Office Depot 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We amortize the cost of other intangible assets over their estimated useful lives. Amortizable intangible assets

are reviewed at least annually to determine whether events and circumstances warrant a revision to the remaining

period of amortization. During 2008, we concluded that the value of certain amortizing intangible assets was

impaired, and we recognized a charge of $10.9 million to fully impair the customer list intangible assets in our

International Division. This impairment charge is included in other asset impairments in the Consolidated

Statements of Operations.

See Note D for information related to goodwill and other intangible asset impairment charges recognized in

2008.

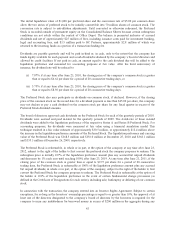

Impairment of Long-Lived Assets: Long-lived assets with identifiable cash flows are reviewed for possible

impairment annually or whenever events or changes in circumstances indicate that the carrying amount of such

assets may not be recoverable. Impairment is assessed at the lowest level of identifiable cash flows, considering

the estimated undiscounted cash flows over the asset’s remaining life. If estimated cash flows are insufficient to

recover the investment, an impairment loss is recognized equal to the estimated fair value of the asset less its

carrying value and any costs of disposition.Impairment losses of $2.3 million, $3.5 million and $97.7 million

were recognized in 2010, 2009 and 2008, respectively, relating to certain under-performing retail stores. For

additional discussion of material asset impairment charges recognized in 2008, see Note D.

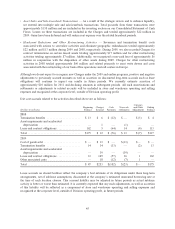

Facility Closure Costs: We regularly review store performance against expectations and close stores not

meeting our performance requirements. Costs associated with store or other facility closures, principally lease

cancellation costs, are recognized when the facility is no longer used in an operating capacity or when a liability

has been incurred. Store assets are also reviewed for possible impairment, or reduction of estimated useful lives.

Accruals for facility closure costs are based on the future commitments under contracts, adjusted for anticipated

sublease benefits and discounted at the company’s risk-adjusted rate at the time of closing. We recorded charges

relating to facilities closed totaling $5 million, $126 million and $10 million in 2010, 2009 and 2008,

respectively. Additionally, we recognized charges to terminate existing commitments and to adjust remaining

commitments to current market values. These charges totaled $5 million and $9 million in 2009 and 2008,

respectively. The accrued balance relating to our future commitments under operating leases for our closed

facilities was $133 million and $181 million at December 25, 2010 and December 26, 2009, respectively. The

short-term and long-term components of this liability are included in accrued expenses and other long-term

liabilities, respectively, on the Consolidated Balance Sheets.

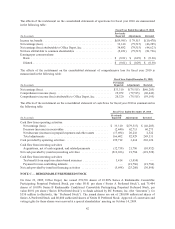

Fair Value of Financial Instruments: The estimated fair values of financial instruments recognized in the

Consolidated Balance Sheets or disclosed within these Notes to Consolidated Financial Statements have been

determined using available market information, information from unrelated third-party financial institutions and

appropriate valuation methodologies, primarily discounted projected cash flows. However, considerable

judgment is required when interpreting market information and other data to develop estimates of fair value. See

Note K for additional information on fair value.

Accounting for Stock-Based Compensation: We account for stock-based compensation using the fair value

method of expense recognition. We use the Black-Scholes valuation model and recognize compensation expense

on a straight-line basis over the requisite service period of the grant. We consider alternative models if grants

have characteristics that cannot be reasonably estimated using this model.

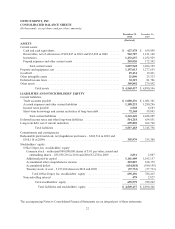

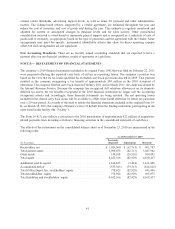

Accrued Expenses: Included in accrued expenses and other current liabilities in our Consolidated Balance

Sheets are accrued payroll-related amounts of approximately $273 million and $294 million at December 25,

2010 and December 26, 2009, respectively.

Revenue Recognition: Revenue is recognized at the point of sale for retail transactions and at the time of

successful delivery for contract, catalog and internet sales. Sales taxes collected are not included in reported

39