Office Depot 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

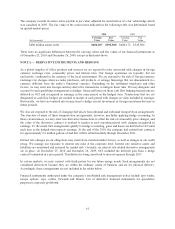

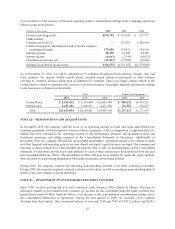

The pension plan was part of an entity acquired in 2003. The purchase and sale agreement included a provision

whereby the seller is required to pay to the company an amount of unfunded benefit obligation as measured

based on certain 2008 data. The company is in the process of resolving this uncertainty with the seller. We

currently cannot predict the outcome of this matter. The after-tax effect of the payment from the seller, if any,

will be recognized as a credit to income when all associated uncertainties are resolved.

The company has been in discussions with the plan trustees on reducing the unfunded balance. It is expected that

the company will contribute amounts received from the seller to the plan and that the contribution will effectively

lower or eliminate other company contribution requirements over the next three years. The amount to be

contributed during 2011 currently cannot be determined but is likely to be no less than the amount contributed

during 2010.

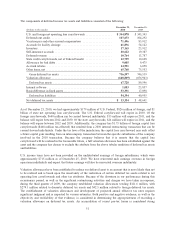

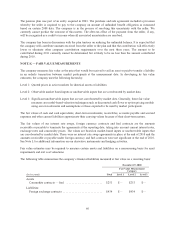

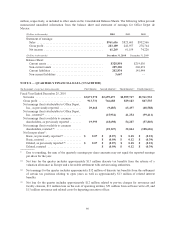

NOTE K — FAIR VALUE MEASUREMENTS

The company measures fair value as the price that would be received to sell an asset or paid to transfer a liability

in an orderly transaction between market participants at the measurement date. In developing its fair value

estimates, the company uses the following hierarchy:

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Observable market based inputs or unobservable inputs that are corroborated by market data.

Level 3: Significant unobservable inputs that are not corroborated by market data. Generally, these fair value

measures are model-based valuation techniques such as discounted cash flows or option pricing models

using our own estimates and assumptions or those expected to be used by market participants.

The fair values of cash and cash equivalents, short-term investments, receivables, accounts payable and accrued

expenses and other current liabilities approximate their carrying values because of their short-term nature.

The fair values of our interest rate swaps, foreign currency contracts and fuel contracts are the amounts

receivable or payable to terminate the agreements at the reporting date, taking into account current interest rates,

exchange rates and commodity prices. The values are based on market-based inputs or unobservable inputs that

are corroborated by market data. There were no interest rate swap agreements in place at the end of 2010 and the

amounts receivable or payable under foreign currency and fuel contracts were not significant at the end of 2010.

See Note L for additional information on our derivative instruments and hedging activities.

Fair value estimates may be required to measure certain assets and liabilities on a nonrecurring basis for asset

impairments and exit cost valuations.

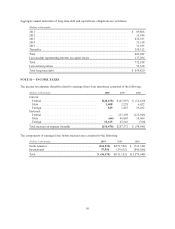

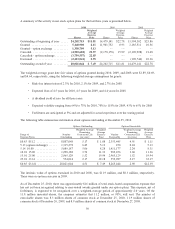

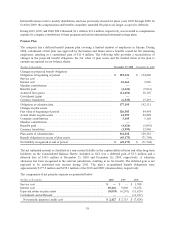

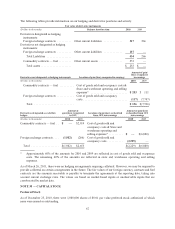

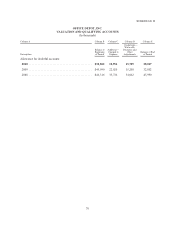

The following table summarizes the company’s financial liabilities measured at fair value on a recurring basis:

December 25, 2010

Total

Fair Value Measurement

Category

(In thousands) Level 1 Level 2 Level 3

Assets

Commodity contracts — fuel ......................... $253 $— $253 $—

Liabilities:

Foreign exchange contracts ........................... $434 $— $434 $—

60