Office Depot 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

ÈAnnual Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

For the fiscal year ended December 25, 2010

or

‘Transition Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

For the transition period from to

Commission file number 1-10948

Office Depot, Inc.

(Exact name of registrant as specified in its charter)

Delaware 59-2663954

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

6600 North Military Trail, Boca Raton, Florida 33496

(Address of principal executive offices) (Zip Code)

(561) 438-4800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, par value $0.01 per share New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ÈNo ‘

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ‘No È

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been

subject to such filing requirements for the past 90 days: Yes ÈNo ‘

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months

(or for such shorter period that the registrant was required to submit and post such files): Yes ÈNo ‘

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K. È

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting

company. See the definitions of “large accelerated filer” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

Large accelerated filer ÈAccelerated filer ‘Non-accelerated filer ‘Smaller reporting company ‘

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ‘No È

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 26, 2010 (based on the closing market price on

the Composite Tape on June 25, 2010) was approximately $1,254,039,687 (determined by subtracting from the number of shares outstanding

on that date the number of shares held by affiliates of Office Depot, Inc.).

The number of shares outstanding of the registrant’s common stock, as of the latest practicable date: At March 26, 2011, there were

277,571,087 outstanding shares of Office Depot, Inc. Common Stock, $0.01 par value.

Table of contents

-

Page 1

... the fiscal year ended December 25, 2010 or ' Transition Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 For the transition period from to Commission file number 1-10948 Office Depot, Inc. (Exact name of registrant as specified in its charter) Delaware (State or... -

Page 2

... Depot, Inc. on Form 10-K/A ("Form 10-K/A") amends our annual report on Form 10-K for the year ended December 25, 2010, which was originally filed on February 22, 2011 ("Original Form 10-K"). This amendment is being filed for the purpose of restating certain amounts in the Selected Financial Data... -

Page 3

TABLE OF CONTENTS PART II Item 6. Selected Financial Data ...Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations ...Item 8. Financial Statements and Supplementary Data ...Item 9A. Controls and Procedures ...PART IV Item 15. Exhibits and Financial Statement ... -

Page 4

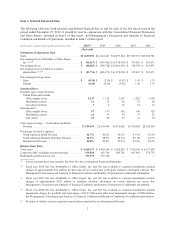

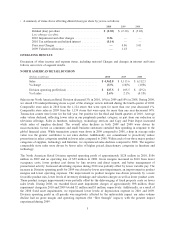

... (loss) per share: Basic ...$ Diluted ...Statistical Data: Facilities open at end of period: United States and Canada: Office supply stores ...Distribution centers ...Crossdock facilities ...International (5): Office supply stores ...Distribution centers ...Call centers ...Total square footage... -

Page 5

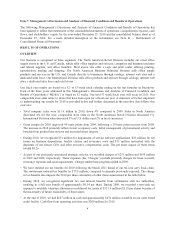

... and office furniture. Most stores also offer a copy and print center offering printing, reproduction, mailing and shipping. The North American Business Solutions Division sells office supply products and services in the U.S. and Canada directly to businesses through catalogs, internet web sites and... -

Page 6

..., technology services and Copy and Print Depot increased while sales of supplies declined. The overall sales declines in both 2009 and 2008 were driven by macroeconomic factors as consumers and small business customers curtailed their spending in response to the global financial crisis. While... -

Page 7

... 10 stores in 2011. Also, we will continue to evaluate locations as leases become due and will close or relocate stores when appropriate. NORTH AMERICAN BUSINESS SOLUTIONS DIVISION (Dollars in millions) 2010 2009 2008 Sales ...% change ...Division operating profit ...% of sales ... $ 3,290... -

Page 8

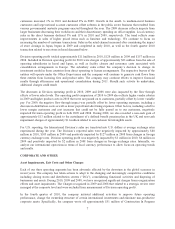

... in the global economy in recent years. The company has taken actions to adapt to the changing and increasingly competitive conditions including closing stores and distribution centers ("DCs"), consolidating functional activities and disposing of businesses and assets. During 2010, 2009 and 2008, we... -

Page 9

... the company's overall market capitalization around the testing period. • Retail Store Initiatives - As part of the strategic review, we closed 126 stores in North America (six of which were closed in the fourth quarter of 2008 and the remainder in 2009) and 27 stores in Japan. The stores closed... -

Page 10

... our back office operations and call centers in Europe. Although we do not expect to recognize new Charges under the 2009 or earlier programs, positive and negative adjustments to previously accrued amounts as well as accretion on discounted long-term accruals such as lease obligations will continue... -

Page 11

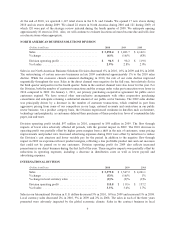

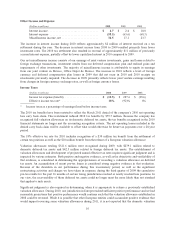

...) 2010 2009 2008 Income tax expense (benefit) ...Effective income tax rate* ...* $ (10.5) 18% $ 287.6 (92)% $ (98.6) 6% Income taxes as a percentage of earnings (loss) before income taxes. The 2010 tax benefits have been restated to reflect the March 2011 denial of the company's 2010 net... -

Page 12

... significantly from period to period. The company experienced significant volatility in its effective tax rate throughout 2010 and 2009, in large part because of valuation allowances recorded during 2009 that limit the impact of deferred tax accounting. The 2008 effective tax rate reflects the... -

Page 13

...the company to pay cash dividends on preferred stock and make share repurchases, in an aggregate amount of $50 million per fiscal year subject to the satisfaction of certain liquidity requirements. The company has never declared or paid cash dividends on its common stock. The Agreement contains cash... -

Page 14

... financial services company for our private label credit cards is scheduled for renewal during 2011. We anticipate successfully renewing or replacing this arrangement. See our discussion under "Off-Balance Sheet Arrangements" for additional information. Redeemable Preferred Stock On June 23, 2009... -

Page 15

... year depending on a variety of factors, including the flow of goods, credit terms, timing of promotions, vendor production planning, new product introductions and working capital management. For our accounting policy on cash management, see Note A of the Notes to Consolidated Financial Statements... -

Page 16

... land sale-leaseback that was treated as a financing transaction as well as approximately $5 million of other short-term borrowings. Off-Balance Sheet Arrangements We maintain a merchant services agreement with a third-party financial services company related to our private label credit card program... -

Page 17

...or by paying a termination fee, we have included the amount of the termination fee or the amount that would be paid over the "notice period." As of December 25, 2010, purchase obligations include television, radio and newspaper advertising, sports sponsorship commitments, telephone services, certain... -

Page 18

... our outlook. We review sales projections and related purchases against vendor program estimates at least quarterly and adjust these balances accordingly. During 2010, the company expanded the number of arrangements that eliminated this tiered purchase rebate mechanism in exchange for a lower price... -

Page 19

...Statements of Operations. Because the 2008 and 2009 facility closures are considered part of a company-wide business review, the accretion of the discounted lease liability and potential future positive and negative adjustments to the recorded amounts from settlements or changes in market conditions... -

Page 20

..., available review periods expire, or additional facts and circumstances cause us to change our assessment of the appropriate accrual amount. Preferred stock paid-in-kind dividends - In June 2009, we issued $350 million of redeemable preferred stock. The preferred stock carries a stated dividend of... -

Page 21

... company paid all Preferred Stock dividends accrued for 2010 in cash. SIGNIFICANT TRENDS, DEVELOPMENTS AND UNCERTAINTIES Competitive Factors - Over the years, we have seen continued development and growth of competitors in all segments of our business. In particular, mass merchandisers and warehouse... -

Page 22

...period from a 50 basis point change in interest rates prevailing at year-end. Foreign Exchange Rate Risk We conduct business in various countries outside the United States where the functional currency of the country is not the U.S. dollar. While our company sells directly or indirectly to customers... -

Page 23

... a portion of the lease payments as financing activities rather than operating activities on the statement of cash flow. These proposed changes in accounting rules would have no direct economic impact to the company. FORWARD-LOOKING STATEMENTS The Private Securities Litigation Reform Act of... -

Page 24

...and uncertainties, as well as management's view of our businesses. Item 8. Financial Statements and Supplementary Data. See Item 15(a) in Part IV of this Annual Report on Form 10-K/A. Item 9A. Controls and Procedures. Disclosure Controls and Procedures The company initially carried out an evaluation... -

Page 25

... of controls in the area of accounting for income taxes, as described below, the CEO and CFO have subsequently concluded that the company's internal control over financial reporting was not effective as of December 25, 2010. A material weakness in internal control over financial reporting is... -

Page 26

...this material weakness in 2011; however, additional measures may be required, which may require additional implementation time. We will continue to assess the effectiveness of our remediation efforts in connection with management's future evaluations of internal control over financial reporting. 25 -

Page 27

... in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our... -

Page 28

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended December 25, 2010 of the Company and our report dated February 22, 2011 (April 6, 2011 as to the effects of the restatement discussed in Note... -

Page 29

.... Exhibits and Financial Statement Schedules. (a) The following documents are filed as a part of this report: 1. The financial statements listed in "Index to Financial Statements." 2. The financial statement schedules listed in "Index to Financial Statement Schedules." 3. The exhibits listed in the... -

Page 30

...the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized on this 6th day of April 2011. OFFICE DEPOT, INC. By /S/ NEIL R. AUSTRIAN Neil R. Austrian Interim Chief... -

Page 31

...of Comprehensive Loss ...Consolidated Statements of Stockholders' Equity ...Consolidated Statements of Cash Flows ...Notes to Consolidated Financial Statements ...Report of Independent Registered Public Accounting Firm on Financial Statement Schedules ...Index to Financial Statement Schedules ... 31... -

Page 32

... in our report) expressed an adverse opinion on the Company's internal control over financial reporting because of a material weakness. /s/ DELOITTE & TOUCHE LLP Certified Public Accountants Boca Raton, Florida February 22, 2011 (April 6, 2011 as to the effects of the restatement discussed in... -

Page 33

OFFICE DEPOT, INC. CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share amounts) December 25, 2010 (Restated) December 26, 2009 ASSETS Current assets: Cash and cash equivalents ...Receivables, net of allowances of $28,047 in 2010 and $32,802 in 2009 ...Inventories ...Prepaid ... -

Page 34

OFFICE DEPOT, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) 2010 (Restated) 2009 2008 Sales ...Cost of goods sold and occupancy costs ...Gross profit ...Store and warehouse operating and selling expenses ...Goodwill and trade name impairments ...Other asset ... -

Page 35

OFFICE DEPOT, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (In thousands, except per share amounts) 2010 (Restated) 2009 2008 Net loss ...$(46,205) $(598,724) $(1,481,003) Other comprehensive income (loss), net of tax: Foreign currency translation adjustments ...(32,224) 25,769 (248,591) ... -

Page 36

...cash flow hedge ...Change in deferred cash flow hedge ...Other ...Comprehensive loss, net of tax ...Preferred stock dividends ...Grant of long-term incentive stock ...Forfeiture of restricted stock ...Share-based payments (including income tax benefits and withholding) ...Direct stock purchase plans... -

Page 37

... flows from financing activities: Net proceeds from exercise of stock options and sale of stock under employee stock purchase plans ...1,011 35 503 Tax benefit from employee share-based exercises ...- - 89 Treasury stock additions from employee related plans ...- - (944) Payment for non-controlling... -

Page 38

... ACCOUNTING POLICIES Nature of Business: Office Depot, Inc. ("Office Depot") is a global supplier of office products and services under the Office Depot® brand and other proprietary brand names. As of December 25, 2010, we sold to customers in 53 countries throughout North America, Europe... -

Page 39

... annually for possible goodwill impairment. Unless conditions warrant earlier action, we perform our test in the fourth quarter of each year using a discounted cash flow analysis that requires that certain assumptions and estimates be made regarding industry economic factors and future profitability... -

Page 40

... commitments under contracts, adjusted for anticipated sublease benefits and discounted at the company's risk-adjusted rate at the time of closing. We recorded charges relating to facilities closed totaling $5 million, $126 million and $10 million in 2010, 2009 and 2008, respectively. Additionally... -

Page 41

... could require adjustments to the provision for returns. We also record reductions to our revenues for customer programs and incentive offerings including special pricing agreements, certain promotions and other volume-based incentives. Revenue from sales of extended warranty service plans is either... -

Page 42

... issued accounting standards that are expected to have a material effect on our financial condition, results of operations or cash flows. NOTE B - RESTATEMENT OF FINANCIAL STATEMENTS The company's 2010 financial statements included in its original Form 10-K that was filed on February 22, 2011 were... -

Page 43

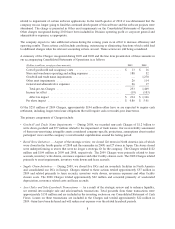

... in the following table: Fiscal Year Ended December 25, 2010 Previously Reported Adjustments Restated (In thousands) Income tax benefit ...Net earnings (loss) ...Net earnings (loss) attributable to Office Depot, Inc...Net loss attributable to common shareholders ...Earnings per common share: Basic... -

Page 44

... closing price of the common stock on the record date for a dividend payment is less than $45.00 per share, the company may not declare or pay a cash dividend on the common stock per share for any fiscal quarter in excess of the Preferred Stock dividend amounts. The board of directors approved cash... -

Page 45

... in the global economy in recent years. The company has taken actions to adapt to the changing and increasingly competitive conditions including closing stores and distribution centers ("DCs"), consolidating functional activities and disposing of businesses and assets. During 2010, 2009 and 2008, we... -

Page 46

...our back office operations and call centers in Europe. Although we do not expect to recognize new Charges under the 2009 and earlier programs, positive and negative adjustments to previously accrued amounts as well as accretion on discounted long-term accruals such as lease obligations will continue... -

Page 47

... participant views and the company's overall market capitalization around the testing period. At least annually, we review our stores for possible impairment. Our impairment analysis is based on a cash flow model at the individual store level, beginning with recent store performance and forecasting... -

Page 48

... the following table: North American Retail Division North American Business Solutions Division (Dollars in thousands) International Division Total Balance as of December 27, 2008 Goodwill ...Accumulated impairment losses ...2009 Changes ...Balance as of December 26, 2009 Goodwill ...Accumulated... -

Page 49

...25% Senior Notes are not repaid, then February 15, 2013), on which date the Facility matures. All amounts borrowed under the Facility, as well as the obligations of the Domestic Guarantors, are secured by a lien on the company's and such Domestic Guarantors' accounts receivables, inventory, cash and... -

Page 50

...facility and certain related security agreements. The company was in compliance with all applicable financial covenants at December 25, 2010. The company has never declared or paid cash dividends on its common stock. All 2010 dividends on its preferred stock were paid in cash as permitted under this... -

Page 51

...,368 $ 659,820 The income tax expense (benefit) related to earnings (loss) from operations consisted of the following: (Dollars in thousands) 2010 2009 2008 Current: Federal ...State ...Foreign ...Deferred : Federal ...State ...Foreign ...Total income tax expense (benefit) ... $(28,278) 1,408 849... -

Page 52

... 25, 2010 December 26, 2009 U.S. and foreign net operating loss carryforwards ...Deferred rent credit ...Vacation pay and other accrued compensation ...Accruals for facility closings ...Inventory ...Self-insurance accruals ...Deferred revenue ...State credit carryforwards, net of Federal benefit... -

Page 53

... positions: (Dollars in thousands) 2010 2009 2008 Beginning Balance ...Additions based on tax positions related to the current year ...Additions for tax positions of prior years ...Reductions for tax positions of prior years ...Statute expirations ...Settlements ...Ending Balance ... $141,125 $119... -

Page 54

... than the date of initial occupancy, we record minimum rental expenses on a straight-line basis over the terms of the leases. Certain leases contain provisions for additional rent to be paid if sales exceed a specified amount, though such payments have been immaterial during the years presented. 53 -

Page 55

...: Office Depot has a private label credit card program that is managed by a third-party financial services company. We transfer the credit card receivable balance each business day, with the difference between the transferred amount and the amount received recognized in store and warehouse operating... -

Page 56

...expired agreement that was in place between January 2, 2006 and January 1, 2011, pursuant to which state, local and non-profit agencies could purchase office supplies. NOTE J - EMPLOYEE BENEFIT PLANS Long-Term Incentive Plan During 2007, the company's board of directors adopted, and the shareholders... -

Page 57

... presented below. 2010 Weighted Average Exercise Price 2009 Weighted Average Exercise Price 2008 Weighted Average Exercise Price Shares Shares Shares Outstanding at beginning of year ...24,202,715 $11.81 Granted ...5,140,900 8.11 Granted - option exchange ...1,350,709 5.13 Canceled ...(4,510,682... -

Page 58

... the grant date market price. In 2008, we granted to employees approximately 2.7 million shares of time-based restricted stock with annual vesting over a three-year service period valued at the grant date market price of $11.24 per share. A summary of the status of the company's nonvested shares as... -

Page 59

... funded status of the plan to amounts recognized on our balance sheets: (Dollars in thousands) December 25, 2010 December 26, 2009 Changes in projected benefit obligation: Obligation at beginning of period ...Service cost ...Interest cost ...Member contributions ...Benefits paid ...Actuarial loss... -

Page 60

Assumptions used in calculating the funded status included: 2010 2009 2008 Long-term rate of return on plan assets ...6.77% 6.89% Discount rate ...5.40% 5.70% Salary increases ...- - Inflation ...3.40% 3.80% 6.62% 5.50% - 3.10% The plan's investment policies and strategies are to ensure assets ... -

Page 61

...payable to terminate the agreements at the reporting date, taking into account current interest rates, exchange rates and commodity prices. The values are based on market-based inputs or unobservable inputs that are corroborated by market data. There were no interest rate swap agreements in place at... -

Page 62

...assets and liabilities are monitored and assessed for market risk. Currently, no interest rate related derivative arrangements are in place. At December 25, 2010 and December 26, 2009, OCI included the deferred gain from a hedge contract terminated in a prior period. This deferral is being amortized... -

Page 63

... to terminate the agreements at the reporting date, taking into account current exchange rates. The values are based on market-based inputs or unobservable inputs that are corroborated by market data. NOTE M - CAPITAL STOCK Preferred Stock As of December 25, 2010, there were 1,000,000 shares of... -

Page 64

...share. In periods of sufficient earnings, this method assumes an allocation of undistributed earnings to both participating stock classes. The 2010 preferred stock dividends were paid in cash. Prior dividends were paid in-kind and a separate determination of fair value above the stated dividend rate... -

Page 65

... related to the Consolidated Statements of Cash Flows is as follows: (Dollars in thousands) 2010 2009 2008 Cash interest paid (net of amounts capitalized) ...Cash taxes paid (refunded) ...Non-cash asset additions under capital leases ...Non-cash paid-in-kind dividends (see Note C) ...NOTE... -

Page 66

...the stock of its operating entities in Israel and Japan and entered into licensing agreements with the respective buyers of those companies. A loss on disposition of approximately $11 million has been reflected in the operating income of the International Division and included in store and warehouse... -

Page 67

... Fiscal Year Ended December 25, 2010 Net sales ...$3,071,970 Gross profit ...913,731 Net earnings (loss) attributable to Office Depot, Inc., as previously reported ...29,468 Net earnings (loss) attributable to Office Depot, Inc., restated (4) ...Net earnings (loss) available to common shareholders... -

Page 68

...amended Forms 10-Q for the second and third quarters of 2010. First Quarter Second Quarter Third Quarter(1) Fourth Quarter(2) Fiscal Year Ended December 26, 2009 Net sales ...Gross profit ...Net loss attributable to Office Depot, Inc...Net loss available to common shareholders ...Net loss per share... -

Page 69

... of Office Depot, Inc. and subsidiaries (the "Company") as of December 25, 2010 and December 26, 2009, and for each of the three fiscal years in the period ended December 25, 2010, and have issued our report thereon dated February 22, 2011, April 6, 2011, as to the effects of the restatement... -

Page 70

INDEX TO FINANCIAL STATEMENT SCHEDULES Page Schedule II - Valuation and Qualifying Accounts and Reserves ... 70 All other schedules have been omitted because they are not applicable, not required or the information is included elsewhere herein. 69 -

Page 71

SCHEDULE II OFFICE DEPOT, INC. VALUATION AND QUALIFYING ACCOUNTS (In thousands) Column A Column B Column C Column D Deductions- Write-offs, Payments and Other Adjustments Column E Description Balance at Beginning of Period Additions- Charged to Expense Balance at End of Period Allowance for ... -

Page 72

...OFFICE DEPOT 10-K/A Exhibit Number Exhibit 23 31.1 31.2 32 (101.INS) (101.SCH) (101.CAL) (101.DEF) (101.LAB) (101.PRE) Consent of Independent Registered Public Accounting Firm Certification of CEO required by Securities and Exchange... XBRL Taxonomy Extension Label Linkbase Document XBRL Taxonomy Extension...