Office Depot 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

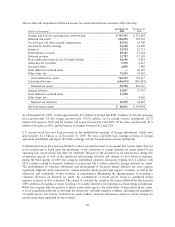

On January 14, 2010, the federal court in the Southern District of Florida dismissed the Second Consolidated

Amended Complaint filed by the New Mexico Educational Retirement Board, lead plaintiff in a Consolidated

Lawsuit, with prejudice. On February 9, 2010, the lead plaintiff filed a notice to appeal this decision. As

background, in early November 2007, two putative class action lawsuits were filed against the company and

certain of its executive officers alleging violations of the Securities Exchange Act of 1934. The allegations made

in these lawsuits primarily related to the accounting for vendor program funds. Each of the foregoing lawsuits

was filed in the Southern District of Florida and captioned as follows: (1) Nichols v. Office Depot, Inc., Steve

Odland and Patricia McKay filed on November 6, 2007 and (2) Sheet Metal Worker Local 28 Pension Fund v.

Office Depot, Inc., Steve Odland and Patricia McKay filed on November 5, 2007. On March 21, 2008, the court

in the Southern District of Florida entered an Order consolidating the class action lawsuits (the “Consolidated

Lawsuit”). Lead plaintiff in the Consolidated Lawsuit, the New Mexico Educational Retirement Board, filed its

Consolidated Amended Complaint on July 2, 2008, and its Second Consolidated Amended Complaint on

April 20, 2009.

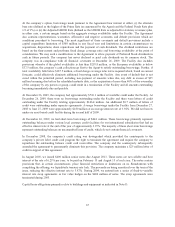

In addition, in the ordinary course of business, our sales to and transactions with government customers may be

subject to audits and review by governmental authorities and regulatory agencies. Many of these audits and

reviews are resolved without incident; however, we have had several claims and inquiries by certain

governmental agencies into contract pricing, and additional inquiries may follow. While these claims may assert

large demands, we do not believe that contingent liabilities related to these matters, either individually or in the

aggregate, will materially affect our financial position, results of our operations or cash flows.

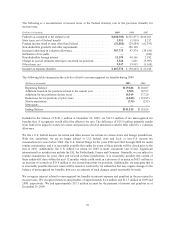

NOTE I — EMPLOYEE BENEFIT PLANS

Long-Term Incentive Plan

During 2007, the company’s board of directors adopted a new equity incentive plan which obtained shareholder

approval on April 25, 2007. This plan is known as the Office Depot, Inc. 2007 Long-Term Incentive Plan (the

“Plan”) and replaces the Long-Term Equity Incentive Plan which expired in October 2007. We believe the Plan

aligns the interests of its officers, directors and key employees with the interests of its shareholders. The Plan

permits the issuance of stock options, stock appreciation rights, restricted stock, restricted stock units,

performance-based, and other equity-based incentive awards. The option exercise price for each grant of a stock

option shall not be less than 100% of the fair market value of a share of common stock on the date the option is

granted. Options granted under the Plan become exercisable from one to five years after the date of grant,

provided that the individual is continuously employed with the company. All options granted expire no more than

ten years following the date of grant.

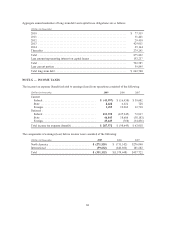

Long-Term Incentive Stock Plan

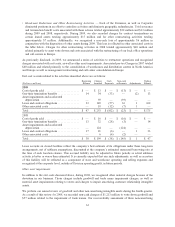

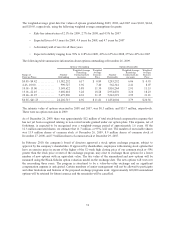

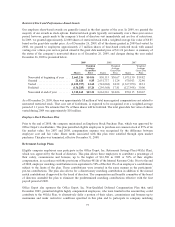

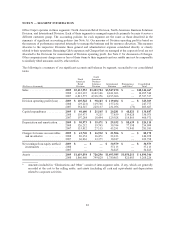

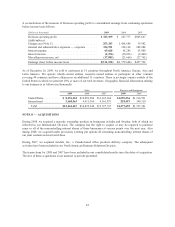

A summary of the activity in our stock option plans for the last three years is presented below.

2009 2008 2007

Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price

Outstanding at beginning of year ..... 14,479,141 $ 22.78 13,594,302 $ 23.86 12,384,083 $ 20.14

Granted ......................... 11,901,752 0.93 3,185,511 10.56 3,522,720 32.52

Canceled ........................ (2,178,178) 15.99 (2,190,928) 21.48 (434,863) 25.12

Exercised ........................ ——(109,744) 10.36 (1,877,638) 16.11

Outstanding at end of year .......... 24,202,715 $ 11.81 14,479,141 $ 22.78 13,594,302 $ 23.86

73