Office Depot 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

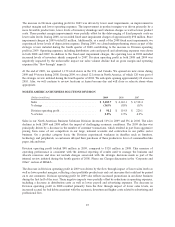

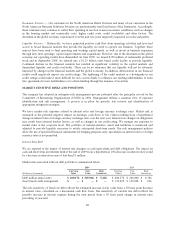

Income Taxes

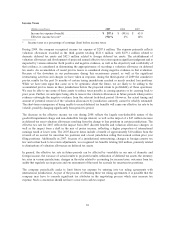

(Dollars in millions) 2009 2008 2007

Income tax expense (benefit) ....................... $ 287.6 $ (98.6) $ 63.0

Effective income tax rate* ......................... (92)% 6% 14%

* Income taxes as a percentage of earnings (loss) before income taxes.

During 2009, the company recognized income tax expense of $287.6 million. The expense primarily reflects

valuation allowances recorded in the third quarter totaling $321.6 million, with $279.1 million related to

domestic deferred tax assets and $42.5 million related to foreign deferred tax assets. The establishment of

valuation allowances and development of projected annual effective tax rates requires significant judgment and is

impacted by various estimates. Both positive and negative evidence, as well as the objectivity and verifiability of

that evidence, is considered in determining the appropriateness of recording a valuation allowance on deferred

tax assets. An accumulation of recent pre-tax losses is considered strong negative evidence in that evaluation.

Because of the downturn in our performance during this recessionary period, as well as the significant

restructuring activities and charges we have taken in response, during the third quarter of 2009 the cumulative

pre-tax results for the past 36 months of certain taxing jurisdictions reached or nearly reached loss positions.

While we have seen signs that cause us to be optimistic about the future, we are likely to be adding to the

accumulated pre-tax losses in these jurisdictions before the projected return to profitability of these operations.

We may be able to use some of these assets to reduce taxes payable in coming quarters or by carrying back to

prior years. Further, we anticipate being able to remove the valuation allowances in future periods when positive

evidence outweighs the negative evidence from the relevant look-back period. However, the actual timing and

amount of potential removal of the valuation allowances by jurisdiction currently cannot be reliably estimated.

The short-term consequence of being unable to record deferred tax benefits will cause our effective tax rate to be

volatile, possibly changing significantly from period to period.

The decrease in the effective income tax rate during 2008 reflects the largely non-deductible nature of the

goodwill impairment charge and non-deductible foreign interest, as well as the impact of a $47 million increase

in deferred tax asset valuation allowances resulting from the change to loss positions in certain jurisdictions. The

effective tax rate for 2007 reflects the impact from 2007 discrete benefits and valuation allowance changes, as

well as the impact from a shift in the mix of pretax income, reflecting a higher proportion of international

earnings taxed at lower rates. The 2007 discrete items include a benefit of approximately $10 million from the

reversal of an accrual for uncertain tax positions and a local jurisdiction ruling that secured certain prior year

filing positions. Additionally in 2007, because of a jurisdictional restructuring, changes in foreign country tax

law and certain book to tax return adjustments, we recognized tax benefits totaling $48 million, primarily related

to eliminations of valuation allowances on deferred tax assets.

In general, the effective tax rate in future periods can be affected by variability in our mix of domestic and

foreign income, the variance of actual results to projected results, utilization of deferred tax assets, the statutory

tax rates in various jurisdictions, changes in the rules related to accounting for income taxes, outcomes from tax

audits that regularly are in process and our assessment of the need for accruals for uncertain tax positions.

The company periodically seeks to limit future tax expense by entering into tax ruling agreements with

international jurisdictions. As part of the process of obtaining these tax ruling agreements, it is possible that the

company may have to concede significant tax attributes in the negotiating process which may increase tax

expense. Such a concession should not have a near-term cash tax impact.

30