Office Depot 2009 Annual Report Download - page 63

Download and view the complete annual report

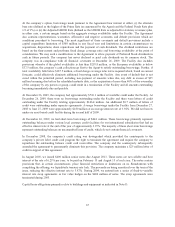

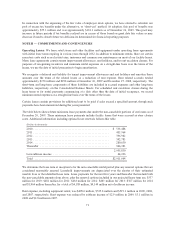

Please find page 63 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and decreases by 1% each year until reaching 100% after June 23, 2019. At any time after June 23, 2011, if the

closing price of the common stock is greater than or equal to $9.75 per share for a period of 20 consecutive

trading days, the Preferred Stock is redeemable at 100% of the liquidation preference amount plus any accrued

but unpaid dividends, in whole or in part, at the option of the company, subject to the right of the holder to first

convert the Preferred Stock the company proposes to redeem.

The Preferred Stock is redeemable at the option of the holder at 101% of the liquidation preference amount plus

any accrued but unpaid dividends in the event of a change of control of the company (as defined in the Certificate

of Designations for each series), or if the company commences a voluntary bankruptcy, consents to the entry of

an order against it in an involuntary bankruptcy, consents to the appointment of a custodian for all or

substantially all of its property, makes a general assignment for the benefit of creditors or changes its primary

business, or if the common stock ceases to be listed for trading on any of the NASDAQ Global Select Market,

the NASDAQ Global Market or the NYSE without the simultaneous listing on another of such exchanges.

For so long as the Investors own 10% or more of the outstanding common stock on an as-converted basis, the

affirmative vote of at least a majority of the shares of the Preferred Stock then outstanding and entitled to vote is

required for (i) the declaration or payment of a dividend or distribution on the common stock or any other stock that

ranks junior to or equally with the Series A Preferred Stock, subject to certain conditions specified in the Certificate

of Designations; (ii) the purchase, redemption or other acquisition by the company of any common stock or other

stock ranking junior to or equal with the Series A Preferred Stock, subject to certain conditions specified in the

Certificate of Designations; (iii) any amendment of the company’s Certificate of Incorporation or the Series A

Preferred Stock so as to adversely affect the relative rights, preferences, privileges or voting powers of the Series A

Preferred Stock; or (iv) the authorization or issuance of, or reclassification into, any capital stock that would rank

senior to or equal with the Series A Preferred Stock (including additional shares of Series A Preferred Stock).

In connection with the transaction, the company entered into an Investor Rights Agreement. Subject to certain

exceptions, for so long as the Investors’ ownership percentage is equal to or greater than 10%, the approval of at

least one of the directors designated to the company’s board of directors by the Investors is required for the

company to incur any indebtedness for borrowed money in excess of $200 million in the aggregate during any

fiscal year if the ratio of the consolidated debt of the company and its subsidiaries to the trailing four quarter

adjusted EBITDA, as defined, of the company and its subsidiaries, on a consolidated basis, is more than 4x. In

addition, for so long as the Investors’ ownership percentage is (i) equal to or greater than 15%, the Investors are

entitled to nominate three of our fourteen directors, (ii) less than 15% but more than 10%, the Investors are

entitled to nominate two of our fourteen directors and (iii) less than 10% but more than 5%, the Investors are

entitled to nominate one of our fourteen directors. On June 23, 2009, three directors designated by the Investors

were elected to the company’s board of directors.

Certain features of the Preferred Stock described above constitute derivatives separable from the preferred stock;

however, those features had little or no value at issuance or December 26, 2009 and are not expected to have

significant value for the foreseeable future.

In connection with the issuance of the Preferred Stock, the company’s board of directors eliminated 500,000

shares of previously authorized but not outstanding Junior Participating Preferred Stock, Series A. Further, the

board of directors authorized issuance of 280,000 shares of Series A Preferred Stock, and authorized 80,000

shares of Series B Preferred Stock, of which 274,596 and 75,404, respectively, have been issued. Any such Series

A or Series B Preferred Stock that is redeemed, purchased or otherwise acquired by the company or converted

into another series of preferred stock shall revert to authorized but unissued shares of preferred stock.

NOTE C — ASSET IMPAIRMENTS, EXIT COSTS AND OTHER CHARGES

During the fourth quarter of 2008, we performed an internal review of assets and processes with the goal of

positioning the company to deal with the degradation in the global economy and to benefit from its eventual

improvement. The results of that internal review led to decisions to close stores, exit certain businesses and write

off certain assets that were not seen as providing future benefit. These decisions resulted in material charges that

61