Office Depot 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

conditions are not solely within the control of Office Depot. The balance is presented inclusive of accrued

dividends and net of approximately $25 million of fees, including issuance costs paid for investment banking,

legal and accounting fees, and $3.5 million paid to BC Partners, approximately $2.8 million of which was

returned to the investing funds as a portion of a transaction funding fee.

Dividends are payable quarterly, beginning on October 1, 2009, and will be paid in-kind or, in cash, only to the

extent that the company has funds legally available for such payment and a cash dividend is declared by the

company’s board of directors and allowed by credit facilities. The company’s asset based credit facility currently

limits the ability to make such payments. The company may seek modification to the credit facility to allow cash

dividends in future periods. If not paid in cash, an amount equal to the cash dividend due will be added to the

liquidation preference and measured for accounting purposes at fair value. After the third anniversary of

issuance, the dividend rate will be reduced to:

(i) 7.87% if at any time after June 23, 2010, the closing price of the company’s common stock is greater

than or equal to $6.62 per share for a period of 20 consecutive trading days, or

(ii) 5.75% if at any time after June 23, 2010, the closing price of the company’s common stock is greater

than or equal to $8.50 per share for a period of 20 consecutive trading days.

The Preferred Stock also may participate in dividends on common stock, if declared. However, if the closing

price of the common stock on the record date for a dividend payment is less than $45.00 per share, the company

may not declare or pay a cash dividend on the common stock per share for any fiscal quarter in excess of the

Preferred Stock dividend amounts.

The board of directors approved dividends equal to the stated dividend rate on the Preferred Stock for the

quarterly periods accrued through January 1, 2010. The stated-rate dividend has been added to the liquidation

preference of the respective Series A and Series B Preferred Stock, in lieu of making a cash payment. An

increase in the liquidation preference in lieu of a cash payment has no impact on the Consolidated Statements of

Cash Flows. The dividend has been accrued through December 26, 2009 by a charge against additional paid-in

capital and an increase to the Preferred Stock carrying value. The company measured the fair value of the

dividend using a binomial simulation model that captured the intrinsic value of the underlying common stock on

the declaration date and the option value of the shares and future dividends. Our model used an adjusted risk rate

of 13.5%, a ten-year volatility of 63.5%, the underlying common stock price on the dividend date and other

assumptions including probability simulations of various outcomes. This technique resulted in a fair value

estimate of approximately $30.5 million, or approximately $12.4 million above the increase in the liquidation

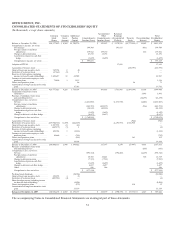

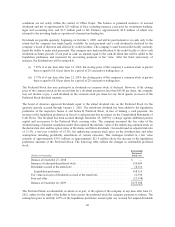

preference amounts of the Preferred Stock. The following table reflects the changes in redeemable preferred

stock.

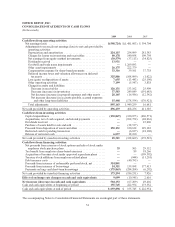

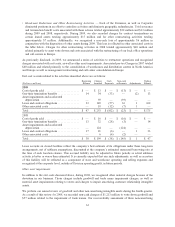

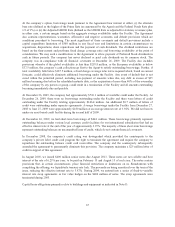

(Dollars in thousands)

Redeemable

Preferred

Stock, net

Balance at December 27, 2008 .......................................... $ —

Issuance of redeemable preferred stock ................................... 350,000

Dividends accrued at the stated rate ...................................... 18,116

Liquidation preference .............................................. 368,116

Fair value in excess of dividends accrued at the stated rate .................... 12,390

Fees and other ....................................................... (25,198)

Balance at December 26, 2009 .......................................... $355,308

The Preferred Stock is redeemable, in whole or in part, at the option of the company at any time after June 23,

2012, subject to the right of the holder to first convert the preferred stock the company proposes to redeem. The

redemption price is initially 107% of the liquidation preference amount plus any accrued but unpaid dividends

60