Office Depot 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

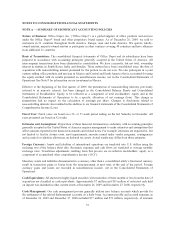

were recognized during the fourth quarter of 2008 and fiscal year 2009. We also recognized material goodwill

and trade name impairment charges during the fourth quarter of 2008. During 2007, we recognized charges

associated with the remaining activities from a previously-disclosed business review. We manage the related

costs and programs associated with these activities (collectively, the “Charges”) at a corporate level, and

accordingly, these amounts are not included in determining Division operating profit.

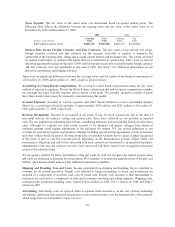

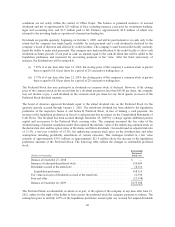

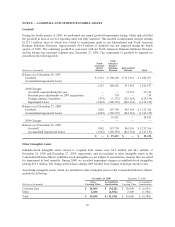

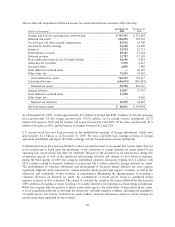

A summary of the Charges and the line item presentation of these amounts in our accompanying Consolidated

Statements of Operations is as follows.

(Dollars in million) 2009 2008 2007

Cost of goods sold and occupancy costs ................................. $13 $16$—

Store and warehouse operating and selling expenses ....................... 188 52 25

Goodwill and trade name impairments .................................. —1,270 —

Other asset impairments .............................................. 26 114 —

General and administrative expenses .................................... 26 17 15

Total pre-tax Charges .............................................. $253 $1,469 $40

Exit costs

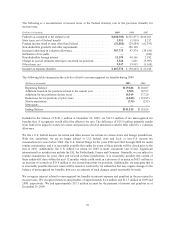

The primary components of Charges associated with exit activities during 2008 and 2009 include:

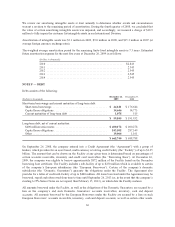

•Retail Store Initiatives — As a result of the strategic review, we closed certain stores in North America and

exited our retail operations in Japan. Additionally, we reduced the planned number of North American retail

store openings for 2009. In total, we closed 126 stores in North America and 27 stores in Japan. Six of the

North American locations were closed during the fourth quarter of 2008 and the remaining stores were closed

during 2009. The stores closed under this program were underperforming stores or stores that were no longer a

strategic fit for the company. The charges associated with the initiatives related to our retail stores totaled $122

million and $104 million in 2009 and 2008, respectively. The 2009 charges were primarily related to lease

accruals, inventory write downs, severance expenses and other facility closure costs. Included in the 2009

charges is the impact of a reclassification to the accrued lease liability of previously accrued lease related costs

such as tenant improvement allowances and various rent credits associated with facilities closed during 2009.

The net effect of this reclassification was to lower the lease-related charges recognized in 2009 by

approximately $32 million. The 2008 charges related primarily to asset impairments, inventory write downs

and lease accruals.

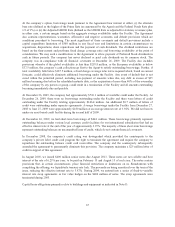

•Supply Chain Initiatives — As a result of the strategic review of our supply chain operations, we consolidated

certain facilities in North America and Europe. During 2009, we closed five distribution centers and six

crossdock facilities in North America and completed the consolidation of our distribution centers in Europe.

Charges related to these actions totaled approximately $57 million in 2009 and related primarily to lease

accruals, inventory write downs, severance expenses and other facility closure costs. The 2008 charges under

these initiatives totaled approximately $22 million and consisted primarily of accelerated depreciation,

severance related costs and lease accruals.

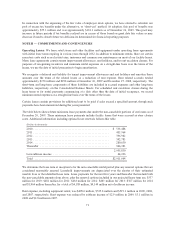

•Asset Sales and Sale-Leaseback Transactions — As a result of the strategic review and to enhance liquidity,

we entered into multiple sale and sale-leaseback transactions. Total proceeds from these transactions were

approximately $150 million and are included in the investing section on our Consolidated Statement of Cash

Flows. Losses on these transactions are included in the Charges and totaled approximately $22 million in

2009. Gains have been deferred and will reduce rent expense over the related leaseback periods. One

transaction was the sale of an asset previously classified as a capital lease. Payments to satisfy the existing

capital lease obligation are included in the financing section of the Consolidated Statement of Cash Flows. An

additional sale-leaseback arrangement associated with operating properties included provisions that resulted in

the transaction being accounted for as a financing. Accordingly, approximately $19 million has been included

in long-term debt on the Consolidated Balance Sheet at December 26, 2009.

62