Office Depot 2009 Annual Report Download - page 61

Download and view the complete annual report

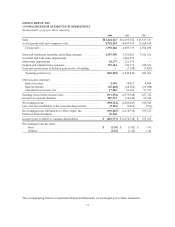

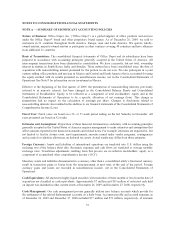

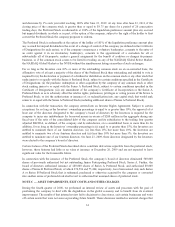

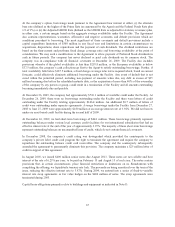

Please find page 61 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Advertising expense recognized was $453.3 million in 2009, $525.7 million in 2008 and $564.9 million in 2007.

Prepaid advertising costs were $37.3 million as of December 26, 2009 and $38.1 million as of December 27,

2008.

Pre-opening Expenses: Pre-opening expenses related to opening new stores and warehouses or relocating

existing stores and warehouses are expensed as incurred and included in store and warehouse operating and

selling expenses.

Self-Insurance: Office Depot is primarily self-insured for workers’ compensation, auto and general liability and

employee medical insurance programs. Self-insurance liabilities are based on claims filed and estimates of claims

incurred but not reported. These liabilities are not discounted.

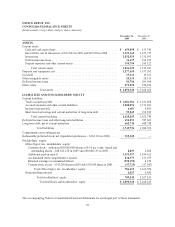

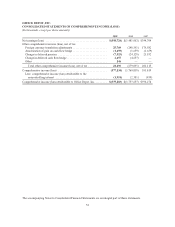

Comprehensive Income (Loss): Comprehensive income (loss) represents the change in stockholders’ equity

from transactions and other events and circumstances arising from non-stockholder sources. Comprehensive

income consists of net earnings (loss), foreign currency translation adjustments, realized or unrealized gains

(losses) on investment securities that are available-for-sale, deferred pension gains (losses), and elements of

qualifying cash flow hedges, net of applicable income taxes. As of December 26, 2009, our Consolidated

Balance Sheet reflected OCI in the amount of $238 million, which consisted of $247 million in foreign currency

translation adjustments, $6 million in unamortized gain on hedge and $15 million in deferred pension loss.

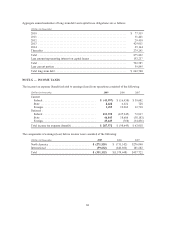

Vendor Arrangements: We enter into arrangements with substantially all of our significant vendors that provide

for some form of consideration to be received from the vendors. Arrangements vary, but generally specify

volume rebate thresholds, advertising support levels, as well as terms for payment and other administrative

matters. The volume-based rebates, supported by a vendor agreement, are estimated throughout the year and

reduce the cost of inventory and cost of goods sold during the year. This estimate is regularly monitored and

adjusted for current or anticipated changes in purchase levels and for sales activity. Other promotional

consideration received is event-based or represents general support and is recognized as a reduction of cost of

goods sold or inventory, as appropriate based on the type of promotion and the agreement with the vendor. Some

arrangements may meet the specific, incremental, identifiable criteria that allow for direct operating expense

offset, but such arrangements are not significant.

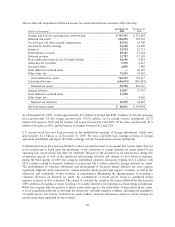

New Accounting Standards: The Financial Accounting Standards Board (the “FASB”) has codified a single

source of U.S. Generally Accepted Accounting Principles (GAAP), the Accounting Standards Codification™.

Unless needed to clarify a point to readers, we will refrain from citing specific section references when

discussing application of accounting principles or addressing new or pending accounting rule changes. There are

no recently issued accounting standards that are expected to have a material effect on our financial condition,

results of operations or cash flows.

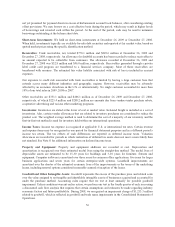

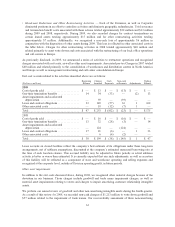

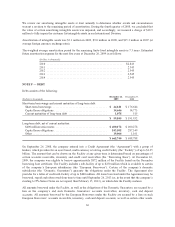

NOTE B — REDEEMABLE PREFERRED STOCK

On June 23, 2009, Office Depot, Inc. issued 274,596 shares of 10.00% Series A Redeemable Convertible

Participating Perpetual Preferred Stock, par value $0.01 per share (“Series A Preferred Stock”), and 75,404

shares of 10.00% Series B Redeemable Conditional Convertible Participating Perpetual Preferred Stock, par

value $0.01 per share (“Series B Preferred Stock”), to funds advised by BC Partners, Inc., for $350 million

(collectively, the “Preferred Stock”). In compliance with the rules of the New York Stock Exchange (“NYSE”),

Office Depot requested shareholder approval for conversion and voting rights for these shares. Approval was

received at the shareholder meeting on October 14, 2009.

The initial liquidation value of $1,000 per preferred share and the conversion rate of $5.00 per common share

allow the two series of preferred stock to be initially convertible into 70 million shares of common stock. The

conversion rate is subject to anti-dilution adjustments. Until converted or otherwise redeemed, the Preferred

Stock is recorded outside of permanent equity on the Consolidated Balance Sheets because certain redemption

59