Office Depot 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

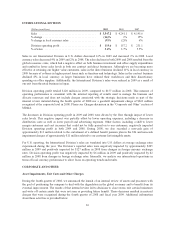

For accounting purposes, the company measured the fair value of the dividend using a binomial simulation

model that captured the intrinsic value of the underlying common stock on the declaration date and the option

value of the shares and future dividends. The dividend resulted in $30.5 million in the aggregate, which includes

the $18.1 million increase in liquidation preference, being charged against additional paid-in capital and added to

the Preferred Stock carrying value as of December 26, 2009.

After the third anniversary of issuance the Preferred Stock is redeemable, in whole or in part, at the option of the

company, subject to the right of the holder to first convert the Preferred Stock the company proposes to redeem.

The redemption price is initially 107% of the liquidation preference amount and decreases by 1% each year until

reaching 100% after June 23, 2019. At any time after June 23, 2011, if the closing price of the common stock is

greater than or equal to $9.75 per share for a period of 20 consecutive trading days, the Preferred Stock is

redeemable at 100% of the liquidation preference amount, in whole or in part, at the option of the company,

subject to the right of the holder to first convert the Preferred Stock the company proposes to redeem. The

Preferred Stock is redeemable at the option of the holder at 101% of the liquidation preference in the event of

certain fundamental change provisions (as defined in the Certificate of Designations for each series), including

sale, bankruptcy, or delisting of our common stock.

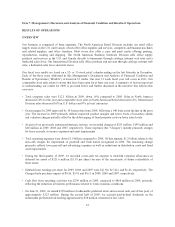

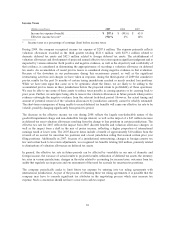

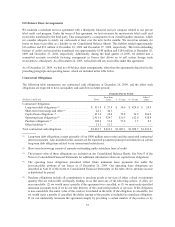

Cash Flows

Cash provided by (used in) our operating, investing and financing activities is summarized as follows:

(Dollars in millions) 2009 2008 2007

Operating activities .............................. $ 296.4 $ 468.3 $ 411.4

Investing activities ............................... 25.3 (338.7) (372.5)

Financing activities .............................. 173.3 (186.3) 7.9

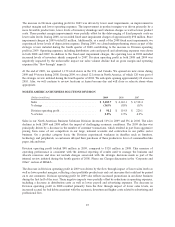

Operating Activities

The decrease in net cash provided by operating activities in 2009 primarily reflects a reduction in business

performance related to weak economic conditions. Depreciation and amortization decreased by approximately

$30 million year over year primarily reflecting the impairment of fixed and intangible assets recorded in the

fourth quarter of 2008. Although we did experience lower levels of bad debt expense, the decrease in charges for

losses on inventories and receivables resulted primarily from lower charges for shrinkage in 2009, compared to

2008. As previously discussed, the company recognized valuation allowances of approximately $322 million

related to deferred tax assets during the third quarter of 2009. This represents a non-cash expense, and therefore,

it has been added back to our net loss in the Consolidated Statements of Cash Flows to arrive at cash provided by

operating activities. Additionally, net cash provided by operating activities includes the impact of non-cash

Charges and increases in accruals for severance and lease obligations. We received dividends from our joint

venture in Mexico of approximately $14 million in 2009. Working capital was a source of cash of approximately

$207 million and $187 million in 2009 and 2008, respectively. The source in 2009 was driven by our continued

focus on collecting accounts receivable balances and controlling our inventory levels. Working capital is

influenced by a number of factors, including the aging of inventory and timing of vendor payments. The timing

of payments is subject to variability during the year depending on a variety of factors, including the flow of

goods, credit terms, timing of promotions, vendor production planning, new product introductions and working

capital management. For our accounting policy on cash management, see Note A of the Notes to Consolidated

Financial Statements. The change in cash flows from operating activities during 2008 reflects improvement in

working capital that was significantly offset by a decrease in business performance.

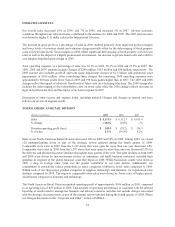

Investing Activities

We invested $131 million, $330 million and $461 million in capital expenditures during 2009, 2008 and 2007,

respectively. The 2009 activity primarily includes investments in information technology and distribution

network infrastructure costs. In 2008, capital expenditures also related to the opening, relocating and remodeling

33