Office Depot 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

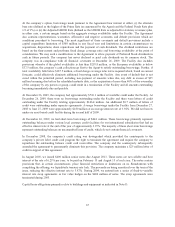

•Headcount Reductions and Other Restructuring Activities — Each of the Divisions, as well as Corporate

eliminated positions in an effort to centralize activities and eliminate geographic redundancies. Total severance

and termination benefit costs associated with these actions totaled approximately $22 million and $13 million

during 2009 and 2008, respectively. During 2009, we also recorded charges for contract terminations on

certain leased assets totaling approximately $17 million and for other restructuring activities totaling

approximately $7 million. Additionally, we recognized a non-cash loss of approximately $6 million in

conjunction with the disposition of other assets during 2009. This loss is reflected in other associated costs in

the table below. Charges for other restructuring activities in 2008 totaled approximately $60 million and

related primarily to asset write downs and costs associated with the restructuring of our back office operations

and call centers in Europe.

As previously disclosed, in 2005, we announced a series of activities to restructure operations and recognized

charges associated with exit costs, as well as other asset impairments. Associated pre-tax Charges in 2007 totaled

$40 million and related primarily to the consolidation of warehouses and distribution centers in North America

and Europe as well as management restructuring and call center consolidation in Europe.

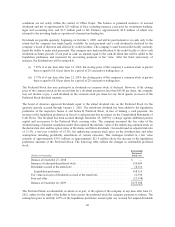

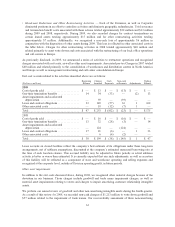

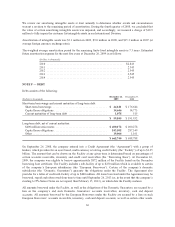

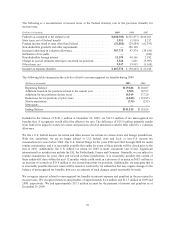

Exit cost accruals related to the activities described above are as follows:

(Dollars in millions)

Beginning

Balance

Charges

Incurred

Cash

Payments

Non-cash

settlements Adjustments

Ending

Balance

2009

Cost of goods sold ........................ $ — $ 13 $ — $ (13) $ — $ —

One-time termination benefits ............... 14 34 (33) — (2) 13

Asset impairments and accelerated

depreciation ........................... — 39 — (39) — —

Lease and contract obligations ............... 33 149 (57) 36 1 162

Other associated costs ..................... — 18 (12) (7) 1 —

Total ................................... $ 47 $253 $ (102) $ (23) $ — $ 175

2008

Cost of goods sold ........................ $ — $ 16 $ — $ (16) $ — $ —

One-time termination benefits ............... 13 32 (28) (3) — 14

Asset impairments and accelerated

depreciation ........................... — 124 — (124) — —

Lease and contract obligations ............... 17 21 (6) — 1 33

Other associated costs ..................... — 6 (4) (2) — —

Total ................................... $ 30 $199 $ (38) $ (145) $ 1 $ 47

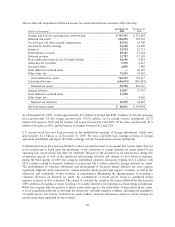

Lease accruals on closed facilities reflect the company’s best estimate of its obligations under these long-term

arrangements, net of sublease assumptions, discounted at the company’s estimated unsecured borrowing rate at

the time of each location closure. This accrued liability may be adjusted in future periods as actual sublease

activity is better or worse than estimated. It is currently expected that any such adjustments, as well as accretion

of this liability will be reflected as a component of store and warehouse operating and selling expenses and

recognized at the corporate level, outside of Division operating profit, in future periods.

Other asset impairments

In addition to the exit costs discussed above, during 2008, we recognized other material charges because of the

downturn in our business. Those charges include goodwill and trade name impairment charges, as well as

material asset impairments relating to stores and charges to impair amortizing customer relationship intangible

assets.

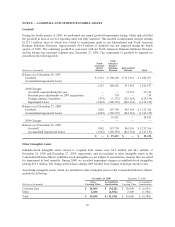

We perform our annual review of goodwill and other non-amortizing intangible assets during the fourth quarter.

As a result of this review for 2008, we recorded non-cash charges of $1,213 million to write down goodwill and

$57 million related to the impairment of trade names. Our recoverability assessment of these non-amortizing

63