Office Depot 2009 Annual Report Download - page 74

Download and view the complete annual report

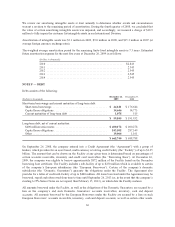

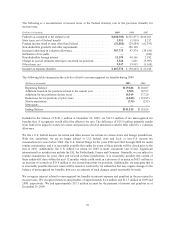

Please find page 74 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Indemnification of Private Label Credit Card Receivables: Office Depot has a private label credit card

program that is managed by a third-party financial services company. We transfer the credit card receivable

balance each business day, with the difference between the transferred amount and the amount received

recognized in store and warehouse operating and selling expense. At December 26, 2009, the outstanding balance

of credit card receivables transferred was approximately $148.3 million. The company’s estimated liability

associated with risk of loss totaled approximately $16 million and $23 million at December 26, 2009 and

December 27, 2008, respectively. This accrual is included in accrued expenses on the Consolidated Balance

Sheets. Following the company’s credit rating downgrade in December 2008, the underlying agreement was

amended to permanently eliminate a provision that allowed both parties to terminate the agreement early in the

event either party suffered a material adverse change, and put in place a letter of credit arrangement supporting

the company’s potential exposure on indemnification of the transferred receivable balance. See Note F for

additional discussion.

Change in Control Features in Certain Employment Contracts: Following shareholder approval of our

Preferred Stock transaction, the vesting of certain employee share-based awards accelerated, resulting in the

recognition of approximately $9 million of compensation expense during the fourth quarter of 2009.

Additionally, change in control features in certain employment contracts could result in additional expenses in

future periods if covered executives are involuntarily, or in certain cases, voluntarily terminated. In February

2010, the employment agreement between the company and its Chief Executive Officer was modified to amend,

among other things, certain change in control provisions. Following this amendment, if all remaining executives

covered by voluntary termination provisions elected to leave, the required cash payment would aggregate to

approximately $8 million.

Legal Matters: We are involved in litigation arising in the normal course of our business. While, from time to

time, claims are asserted that make demands for a large sum of money (including, from time to time, actions

which are asserted to be maintainable as class action suits), we do not believe that contingent liabilities related to

these matters, either individually or in the aggregate, will materially affect our financial position, results of our

operations or cash flows.

As previously disclosed, the company reached a proposed settlement with the staff of the U.S. Securities and

Exchange Commission (“SEC”) to resolve the previously disclosed SEC inquiry that commenced in July of 2007

and the formal investigation disclosed in January of 2008 with respect to contacts and communications with

financial analysts, inventory receipt and reserves, timing of vendor payments, certain intercompany loans, certain

payments to foreign officials, inventory obsolescence and timing and recognition of vendor program funds. The

company and its officers and employees have cooperated with the SEC staff in this investigation. The SEC staff

intends to recommend to the SEC a proposed settlement with respect to the company which would conclude for

the company all matters arising from the SEC investigation. Under the proposed settlement, the company,

without admitting or denying liability, has agreed to pay a civil penalty and to consent to a cease and desist order

from committing or causing violations of Regulation FD and Sections 13(a) and 13(b) of the Securities Exchange

Act of 1934 (and related rules) which require the maintenance of accurate books and records and internal

controls. Regulation FD is a rule regarding communication with analysts and investors. The proposed settlement

is contingent on the review and approval of final documentation by the company and the SEC staff, and is subject

to approval by the SEC Commissioners. There can be no assurance that the SEC Commissioners will approve the

staff’s recommendation. The company has also been informed that the company’s CEO and two former

employees each received “Wells” notices from the staff of the SEC’s Miami Regional Office advising them that

the regional staff has made a preliminary decision to recommend that the SEC bring civil enforcement actions

against them for possible violations of Regulation FD. Under the processes established by the SEC, these

individuals will have an opportunity to present their perspective and to address the issues raised by the SEC staff

prior to any action being taken by the SEC.

72