Office Depot 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

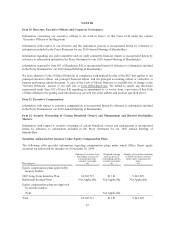

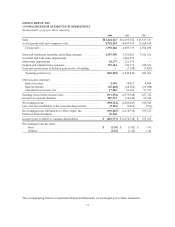

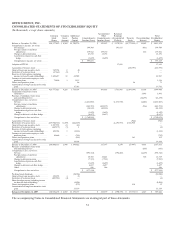

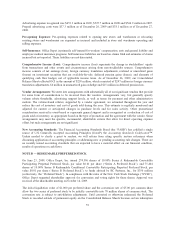

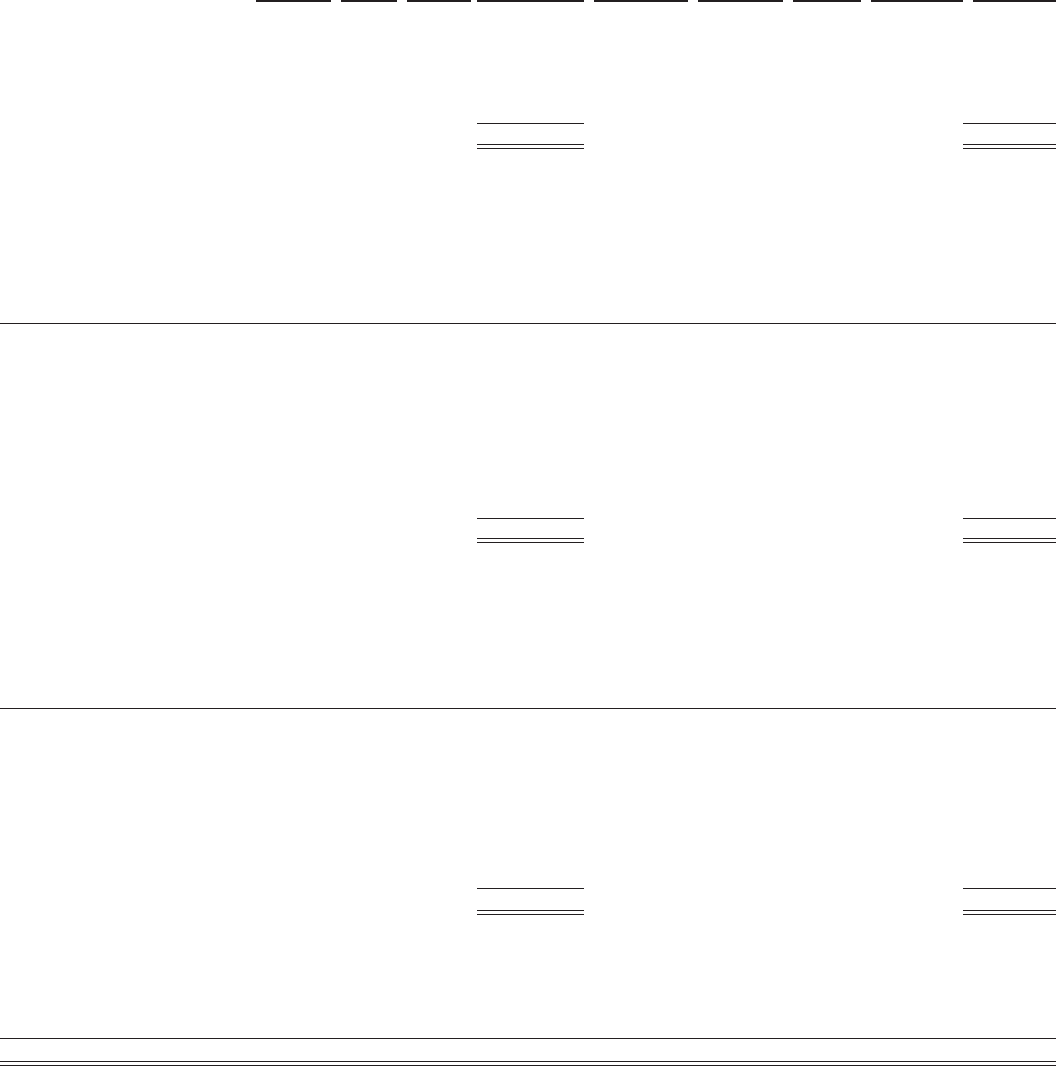

OFFICE DEPOT, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except share amounts)

Common

Stock

Shares

Common

Stock

Amount

Additional

Paid-in

Capital

Comprehensive

Income (Loss)

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

(Accumulated

Deficit)

Treasury

Stock

Noncontrolling

Interest

Total

Stockholders’

Equity

Balance at December 30, 2006 .......... 426,177,619 $ 4,262 $1,700,976 $ 295,253 $ 3,370,538 $(2,773,582) $ 16,023 $ 2,613,470

Comprehensive income, net of tax:

Net earnings ....................... 394,704 395,615 (911) 394,704

Foreign currency translation

adjustments ..................... 179,582 179,130 452 179,582

Change in deferred pension ........... 23,192 23,192 23,192

Amortization of gain on cash flow

hedge .......................... (1,659) (1,659) (1,659)

Comprehensive income, net of tax ..... $ 595,819 $ 595,819

Adoption of FIN 48 ................... 17,652 17,652

Acquisition of treasury stock ............ (210,793) (210,793)

Grant of long-term incentive stock ....... 765,754 8 (8) —

Forfeiture of restricted stock ............ (87,861) (1) 1 —

Exercise of stock options (including

income tax benefits and withholding) . . . 1,849,657 18 43,909 43,927

Issuance of stock under employee stock

purchase plans ..................... 72,456 1 1,515 1,516

Direct stock purchase plans ............. 46 26 72

Amortization of long-term incentive stock

grant ............................. 37,745 37,745

Balance at December 29, 2007 .......... 428,777,625 4,288 1,784,184 495,916 3,783,805 (2,984,349) 15,564 3,099,408

Acquisition of majority-owned

subsidiaries ....................... 5,995 5,995

Purchase of subsidiary shares from

noncontrolling interest ............... (14,295) (14,295)

Comprehensive loss, net of tax:

Net loss .......................... (1,481,003) (1,478,938) (2,065) (1,481,003)

Foreign currency translation

adjustments ..................... (248,591) (248,275) (316) (248,591)

Change in deferred pension ........... (24,128) (24,128) (24,128)

Amortization of gain on cash flow

hedge .......................... (1,659) (1,659) (1,659)

Change in deferred cash flow hedge .... (4,657) (4,657) (4,657)

Comprehensive loss, net of tax ........ $ (1,760,038) $ (1,760,038)

Acquisition of treasury stock ............ (944) (944)

Retirement of treasury stock ............ (149,940,718) (1,499) (626,889) (2,298,597) 2,926,985 —

Grant of long-term incentive stock ....... 2,307,993 23 (23) —

Forfeiture of restricted stock ............ (465,175) (5) 1 (4)

Exercise of stock options (including

income tax benefits and withholding) . . . 109,744 1 (1,222) (1,221)

Issuance of stock under employee stock

purchase plans ..................... 10,666 — (785) (785)

Direct stock purchase plans ............. (228) 361 133

Amortization of long-term incentive stock

grant ............................. 39,584 39,584

Balance at December 27, 2008 .......... 280,800,135 2,808 1,194,622 217,197 6,270 (57,947) 4,883 1,367,833

Purchase of subsidiary shares from

noncontrolling interest ............... (105) (105)

Comprehensive loss, net of tax:

Net loss .......................... (598,724) (596,465) (2,259) (598,724)

Foreign currency translation

adjustments ..................... 25,769 25,461 308 25,769

Change in deferred pension ........... (7,523) (7,523) (7,523)

Amortization of gain on cash flow

hedge .......................... (1,659) (1,659) (1,659)

Change in deferred cash flow hedge .... 4,657 4,657 4,657

Other ............................ 246 246 246

Comprehensive loss, net of tax ........ $ (577,234) $ (577,234)

Preferred stock dividends .............. (30,506) (30,506)

Grant of long-term incentive stock ....... 258,074 3 (3) —

Forfeiture of restricted stock ............ (405,931) (4) — (4)

Share-based payments (including income

tax benefits and withholding) ......... (4,096) (4,096)

Direct stock purchase plans ............. (179) 214 35

Amortization of long-term incentive stock

grant ............................. 33,319 33,319

Balance at December 26, 2009 ......... 280,652,278 $ 2,807 $1,193,157 $ 238,379 $ (590,195) $ (57,733) $ 2,827 $ 789,242

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

53