Office Depot 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

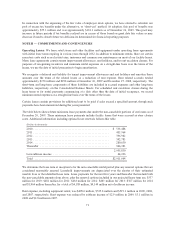

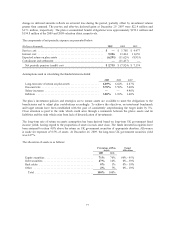

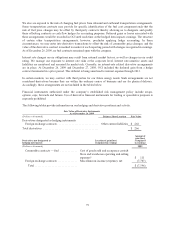

In connection with the expensing of the fair value of employee stock options, we have elected to calculate our

pool of excess tax benefits under the alternative, or “short-cut” method. At adoption, this pool of benefits was

approximately $55.3 million and was approximately $101.1 million as of December 26, 2009. This pool may

increase in future periods if tax benefits realized are in excess of those based on grant date fair values or may

decrease if used to absorb future tax deficiencies determined for financial reporting purposes.

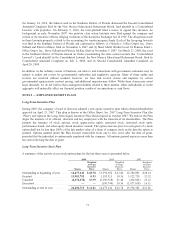

NOTE H — COMMITMENTS AND CONTINGENCIES

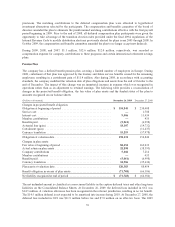

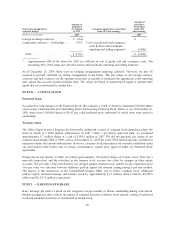

Operating Leases: We lease retail stores and other facilities and equipment under operating lease agreements

with initial lease terms expiring in various years through 2032. In addition to minimum rentals, there are certain

executory costs such as real estate taxes, insurance and common area maintenance on most of our facility leases.

Many lease agreements contain tenant improvement allowances, rent holidays, and/or rent escalation clauses. For

purposes of recognizing incentives and minimum rental expenses on a straight-line basis over the terms of the

leases, we use the date of initial possession to begin amortization.

We recognize a deferred rent liability for tenant improvement allowances and rent holidays and amortize these

amounts over the terms of the related leases as a reduction of rent expense. Rent related accruals totaled

approximately $270 million and $298 million at December 26, 2009 and December 27, 2008, respectively. The

short-term and long-term components of these liabilities are included in accrued expenses and other long-term

liabilities, respectively, on the Consolidated Balance Sheets. For scheduled rent escalation clauses during the

lease terms or for rental payments commencing at a date other than the date of initial occupancy, we record

minimum rental expenses on a straight-line basis over the terms of the leases.

Certain leases contain provisions for additional rent to be paid if sales exceed a specified amount, though such

payments have been immaterial during the years presented.

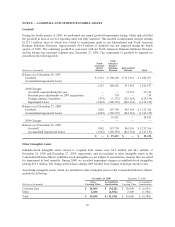

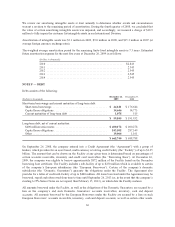

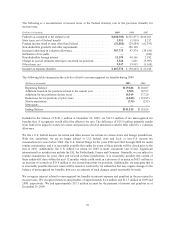

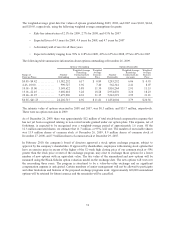

The table below shows future minimum lease payments due under the non-cancelable portions of our leases as of

December 26, 2009. These minimum lease payments include facility leases that were accrued as store closure

costs. Additional information including optional lease renewals follows this table.

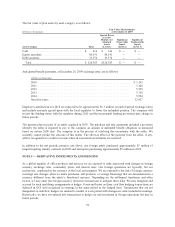

(Dollars in thousands)

2010 ..................................................... $ 533,488

2011 ..................................................... 455,564

2012 ..................................................... 396,982

2013 ..................................................... 342,783

2014 ..................................................... 280,630

Thereafter ................................................ 946,383

2,955,830

Less sublease income ....................................... 44,226

Total .................................................... $2,911,604

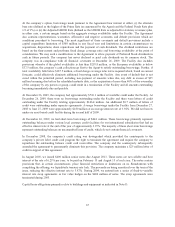

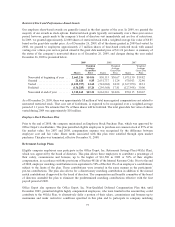

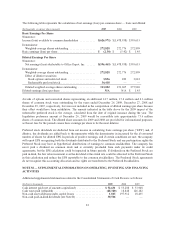

We determine the lease term at inception to be the non-cancelable rental period plus any renewal options that are

considered reasonably assured. Leasehold improvements are depreciated over the shorter of their estimated

useable lives or the identified lease term. Lease payments for the next five years and thereafter that include both

the non-cancelable amounts from above, plus the renewal options included in our projected lease term are, $537

million for 2010; $481 million for 2011; $438 million for 2012; $401 million for 2013; $367 million for 2014

and $1,964 million thereafter, for a total of $4,188 million, $4,144 million net of sublease income.

Rent expense, including equipment rental, was $498.6 million, $525.8 million and $519.1 million in 2009, 2008,

and 2007, respectively. Rent expense was reduced by sublease income of $2.9 million in 2009, $3.1 million in

2008 and $2.8 million in 2007.

71