Office Depot 2009 Annual Report Download - page 33

Download and view the complete annual report

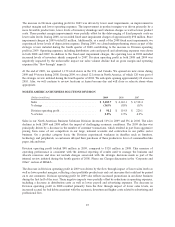

Please find page 33 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LIQUIDITY AND CAPITAL RESOURCES

Liquidity

At December 26, 2009, we had approximately $660 million in cash and equivalents and another $726 million

available under our asset based credit facility based on the December borrowing base certificate. We consider our

resources adequate to satisfy our cash needs at least over the next twelve months. We anticipate that market

conditions will continue to be challenging through 2010, and in response, we are focused on maximizing cash

flow. We have made strong progress towards reducing inventory levels and remain focused on accelerating the

collection of our accounts receivable balances. During the first half of 2009, we entered into sale-leaseback

transactions and sales of certain assets, and during the third quarter of 2009, we entered into a committed

factoring arrangement in France that allows us to sell certain foreign trade receivables to a third party which

provides up to approximately $85 million additional liquidity, depending on the level of eligible receivables and

currency exchange rates. As of December 26, 2009, we had not sold any receivables under this agreement.

We hold cash throughout our service areas, but we principally manage our cash through regional headquarters in

North America and Europe. We may move cash between those regions from time to time through short-term

transactions and have used these cash transfers at the end of fiscal quarterly periods to pay down borrowings

outstanding under our credit facilities. Although such transfers and debt repayments took place during the first

three quarters of 2007, we completed a non-taxable distribution to the U.S. in the amount of $220 million during

the fourth quarter of 2007, thereby permanently repatriating this cash. Additional distributions, including

distributions of foreign earnings or changes in long-term arrangements could result in significant additional U.S.

tax payments and income tax expense. Currently, there are no plans to change our expectation of foreign earnings

reinvestment or the long-term nature of our intercompany arrangements, though accounting impacts of any

change in these classifications would be recognized in the period of the change.

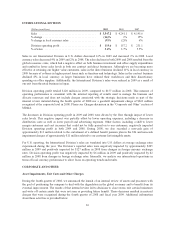

On September 26, 2008, the company entered into a Credit Agreement (the “Agreement”) with a group of

lenders, which provides for an asset based, multi-currency revolving credit facility (the “Facility”) of up to $1.25

billion. The amount that can be drawn on the Facility at any given time is determined based on percentages of

certain accounts receivable, inventory and credit card receivables (the “Borrowing Base”). At December 26,

2009, the company was eligible to borrow approximately $872 million of the Facility. The Facility includes a

sub-facility of up to $250 million which is available to certain of the company’s European subsidiaries (the

“European Borrowers”). Certain of the company’s domestic subsidiaries (the “Domestic Guarantors”) guaranty

the obligations under the Facility. The Agreement also provides for a letter of credit sub-facility of up to $400

million. All loans borrowed under the Agreement may be borrowed, repaid and reborrowed from time to time

until September 26, 2013 (or, in the event that the company’s existing 6.25% Senior Notes are not repaid, then

February 15, 2013), on which date the Facility matures.

All amounts borrowed under the Facility, as well as the obligations of the Domestic Guarantors, are secured by a

lien on the company’s and such Domestic Guarantors’ accounts receivables, inventory, cash and deposit accounts.

All amounts borrowed by the European Borrowers under the Facility are secured by a lien on such European

Borrowers’ accounts receivable, inventory, cash and deposit accounts, as well as certain other assets. At the

company’s option, borrowings made pursuant to the Agreement bear interest at either, (i) the alternate base rate

(defined as the higher of the Prime Rate (as announced by the Agent) and the Federal Funds Rate plus 1/2 of 1%) or

(ii) the Adjusted LIBOR Rate (defined as the LIBOR Rate as adjusted for statutory revenues) plus, in either case, a

certain margin based on the aggregate average availability under the Facility. The Agreement also contains

representations, warranties, affirmative and negative covenants, and default provisions which are conditions

precedent to borrowing. The most significant of these covenants and default provisions include a capital expenditure

limitation of $500 million in any fiscal year and limitations in certain circumstances on acquisitions, dispositions,

share repurchases and the payment of cash dividends. The cash dividend restrictions are based on the then-current

and proforma fixed charge coverage ratio and borrowing availability at the point of consideration. The company has

never declared or paid cash dividends on its common stock. The company was in compliance with all financial

covenants at December 26, 2009. The Facility also includes provisions whereby if the global availability is less than

31