Office Depot 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

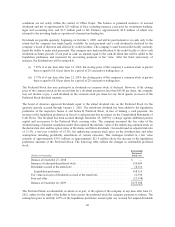

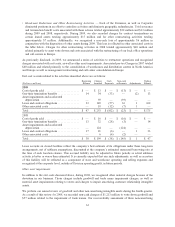

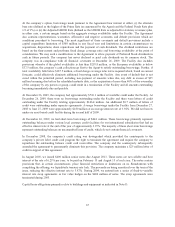

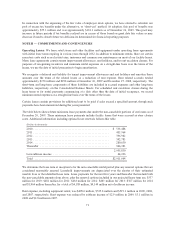

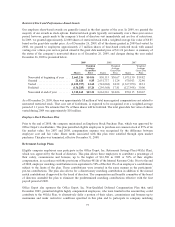

Aggregate annual maturities of long-term debt and capital lease obligations are as follows:

(Dollars in thousands)

2010 .............................................................. $ 77,535

2011 .............................................................. 31,441

2012 .............................................................. 29,430

2013 .............................................................. 429,011

2014 .............................................................. 29,164

Thereafter .......................................................... 279,241

Total .............................................................. 875,822

Less amount representing interest on capital leases .......................... 153,237

Total .............................................................. 722,585

Less current portion .................................................. 59,845

Total long-term debt .................................................. $ 662,740

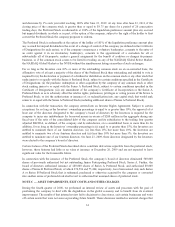

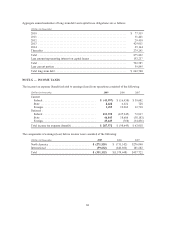

NOTE G — INCOME TAXES

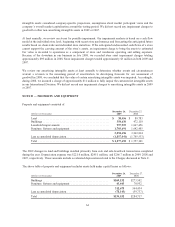

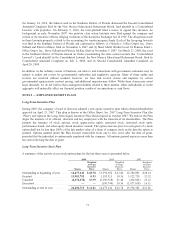

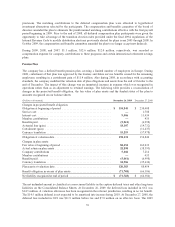

The income tax expense (benefit) related to earnings (loss) from operations consisted of the following:

(Dollars in thousands) 2009 2008 2007

Current:

Federal ..................................... $ (41,997) $ (16,430) $ 50,602

State ....................................... 2,228 6,622 728

Foreign ..................................... 1,455 19,262 12,710

Deferred :

Federal ..................................... 233,398 (125,945) 72,017

State ....................................... 46,845 18,606 (38,183)

Foreign ..................................... 45,643 (760) (34,856)

Total income tax expense (benefit) ................. $ 287,572 $ (98,645) $ 63,018

The components of earnings (loss) before income taxes consisted of the following:

(Dollars in thousands) 2009 2008 2007

North America ............................ $ (271,520) $ (733,342) $276,040

International ............................. (39,632) (846,306) 181,682

Total ................................... $ (311,152) $(1,579,648) $457,722

68