Office Depot 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

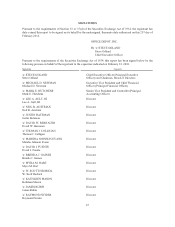

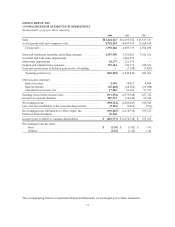

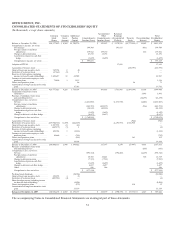

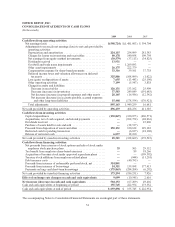

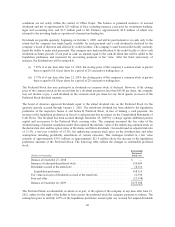

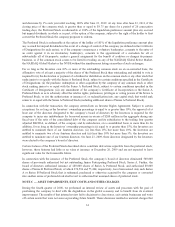

OFFICE DEPOT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

2009 2008 2007

Cash flows from operating activities:

Net earnings (loss) ........................................ $(598,724) $(1,481,003) $ 394,704

Adjustments to reconcile net earnings (loss) to net cash provided by

operating activities:

Depreciation and amortization ............................. 224,115 254,099 281,383

Charges for losses on inventories and receivables .............. 80,178 140,058 109,798

Net earnings from equity method investments ................. (30,579) (37,113) (34,825)

Dividends received ...................................... 13,931 ——

Goodwill and trade name impairments ....................... —1,269,893 —

Other asset impairments .................................. 26,175 222,379 —

Compensation expense for share-based payments .............. 33,316 39,561 37,738

Deferred income taxes and valuation allowances on deferred

tax assets ............................................ 325,886 (108,099) (1,022)

Loss (gain) on disposition of assets ......................... 7,655 (13,443) (25,190)

Other operating activities ................................. 7,199 (5,547) 3,838

Changes in assets and liabilities:

Decrease in receivables ................................. 126,131 133,162 25,909

Decrease (increase) in inventories ........................ 37,583 249,849 (191,685)

Net decrease (increase) in prepaid expenses and other assets . . . 28,165 (16,986) (12,342)

Net increase (decrease) in accounts payable, accrued expenses

and other long-term liabilities .......................... 15,408 (178,554) (176,921)

Total adjustments ....................................... 895,163 1,949,259 16,681

Net cash provided by operating activities ......................... 296,439 468,256 411,385

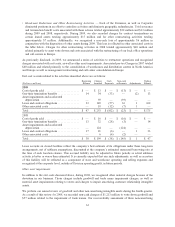

Cash flows from investing activities:

Capital expenditures ....................................... (130,847) (330,075) (460,571)

Acquisitions, net of cash acquired, and related payments .......... —(102,752) (48,036)

Dividends received ........................................ —— 25,000

Purchase of assets held for sale and sold ....................... —(38,537) —

Proceeds from disposition of assets and other ................... 150,131 120,632 129,182

Restricted cash for pending transaction ........................ —(6,037) (18,100)

Release of restricted cash ................................... 6,037 18,100 —

Net cash provided by (used in) investing activities ................. 25,321 (338,669) (372,525)

Cash flows from financing activities:

Net proceeds from exercise of stock options and sale of stock under

employee stock purchase plans ............................. 35 503 29,332

Tax benefit from employee share-based exercises ................ —89 18,266

Acquisition of treasury stock under approved repurchase plans ..... —— (199,592)

Treasury stock additions from employee related plans ............ —(944) (11,201)

Debt issuance costs ........................................ —(40,793) —

Proceeds from issuance of redeemable preferred stock, net ......... 324,801 ——

Proceeds from issuance of borrowings ......................... 24,321 139,098 177,413

Payments on long- and short-term borrowings ................... (175,863) (284,204) (6,292)

Net cash provided by (used in) financing activities ................. 173,294 (186,251) 7,926

Effect of exchange rate changes on cash and cash equivalents ...... 9,099 (10,545) 2,616

Net increase (decrease) in cash and cash equivalents ............. 504,153 (67,209) 49,402

Cash and cash equivalents at beginning of period .................. 155,745 222,954 173,552

Cash and cash equivalents at end of period ....................... $ 659,898 $ 155,745 $ 222,954

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

54