Memorex 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Commercial storage media products consist mainly of magnetic data storage tape media and RDX®media. Storage and

security solutions includes storage hardware products, services and software for backup and archiving as well as primary

storage; encrypted and biometric flash drives and hard disk drives; secure portable desktop solutions; and software solutions,

including products which contain various security features such as password authentication, encryption and remote

manageability.

We evaluate segment performance based on revenue and operating income (loss). The operating income (loss)

reported in our segments excludes corporate and other unallocated amounts. Although such amounts are excluded from the

business segment results, they are included in reported consolidated results. Corporate and unallocated amounts include

depreciation and amortization, litigation settlement expense, goodwill impairment, intangible impairments, intangible asset

abandonment, corporate expense, contingent consideration adjustments, inventory write-offs related to our restructuring

programs and restructuring and other expenses which are not allocated to the segments. The methodology to determine

corporate and unallocated amounts is applied consistently among all years.

During the first quarter of 2013, we announced our plans to divest our XtremeMac and Memorex consumer electronics

businesses. The operating results for these businesses are presented in our Consolidated Statements of Operations as

discontinued operations and are not included in segment results for any periods presented. The consumer storage business

under the Memorex and TDK Life on Record brands and the consumer electronics business under the TDK Life on Record

brand are being retained. See Note 4 — Acquisitions and Divestitures for further information.

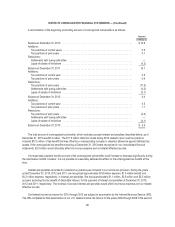

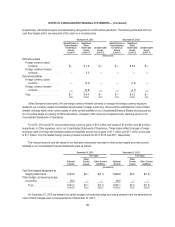

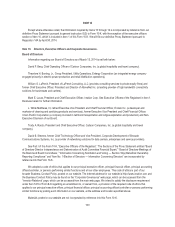

Net revenue and operating income (loss) by segment were as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Net Revenue

Consumer Storage and Accessories

Consumer storage media ..................................... $435.7 $ 594.3 $ 740.2

Audio and accessories ....................................... 42.6 41.0 35.0

Total Consumer Storage and Accessories ....................... 478.3 635.3 775.2

Tiered Storage and Security Solutions

Commercial storage media .................................... 251.0 311.6 378.8

Storage and security solutions ................................. 131.5 59.8 12.6

Total Tiered Storage and Security Solutions ..................... 382.5 371.4 391.4

Total Net Revenue ............................................ $860.8 $1,006.7 $1,166.6

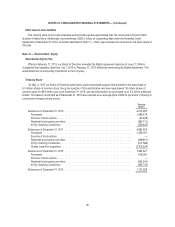

Years Ended December 31,

2013 2012 2011

(In millions)

Operating Income (Loss)

Consumer Storage and Accessories .................................. $52.3 $ 61.5 $ 57.1

Tiered Storage and Security Solutions ................................. (16.1) (26.7) 9.2

Total segment operating income ................................. 36.2 34.8 66.3

Corporate and unallocated ......................................... (56.3) (353.2) (86.7)

Total operating loss .......................................... (20.1) (318.4) (20.4)

Interest income .................................................. (0.2) (0.5) (0.9)

Interest expense ................................................. 2.5 2.9 3.7

Other expense, net ............................................... 0.6 2.6 7.0

Loss from continuing operations before income taxes ................. $(23.0) $(323.4) $(30.2)

92