Memorex 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

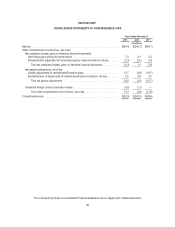

Note 3 — (Loss) Earnings per Common Share

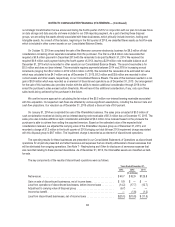

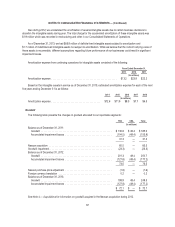

The following table sets forth the computation of the weighted average basic and diluted (loss) earnings per share:

Years Ended December 31,

2013 2012 2011

(In millions, except per share amounts)

Numerator:

Loss from continuing operations .................................. $(24.4) $(324.8) $(35.2)

Loss from discontinued operations ................................ (20.0) (15.9) (11.5)

Net loss .................................................... $(44.4) $(340.7) $(46.7)

Denominator:

Weighted average number of common shares outstanding during the

period ................................................... 40.5 37.5 37.7

Dilutive effect of stock-based compensation plans .................... — — —

Weighted average number of diluted shares outstanding during the period . . 40.5 37.5 37.7

Basic loss per common share:

Continuing operations ......................................... $(0.60) $ (8.67) $(0.93)

Discontinued operations ....................................... (0.49) (0.42) (0.31)

Net loss .................................................... (1.10) (9.09) (1.24)

Diluted loss per common share:

Continuing operations ......................................... $(0.60) $ (8.67) $(0.93)

Discontinued operations ....................................... (0.49) (0.42) (0.31)

Net loss .................................................... (1.10) (9.09) (1.24)

Anti-dilutive shares excluded from calculation .......................... 6.1 6.3 5.4

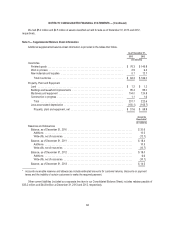

Note 4 — Acquisitions and Divestitures

Acquisitions

Nexsan Corporation

On December 31, 2012, we acquired Nexsan Corporation (Nexsan) which is a provider of disk-based storage systems

and has a portfolio of disk-based and hybrid disk-and-solid-state storage systems with existing customers worldwide. This

acquisition is intended to significantly accelerate our growth in the small and medium-sized business and distributed

enterprise storage markets. The purchase price consisted of a cash payment of $104.6 million (subject to adjustment based

primarily on working capital received) and 3,319,324 shares of our common stock which was the equivalent of $15.5 million

based on the fair value of our stock on the date of acquisition. Nexsan is a part of our TSS reporting segment.

The preliminary purchase price allocation during the fourth quarter of 2012 resulted in goodwill of $65.5 million, primarily

attributable to strategic synergies and intangible assets that do not qualify for separate recognition and is not deductible for

tax purposes. During 2013, we recorded an adjustment to the purchase price related to working capital in the amount of

$1.6 million. This adjustment resulted in a decrease to goodwill and a cash receipt for this amount. Goodwill associated with

the acquisition of Nexsan is included in our Storage Solutions reporting unit, which consists primarily of the Nexsan business,

for the purposes of goodwill impairment testing. See Note 6 — Intangible Assets and Goodwill for more information regarding

goodwill. The purchase accounting for this acquisition was final as of December 31, 2013. The purchase price remained

preliminary prior to December 31, 2013 pending final evaluation of income tax balances of which there were no further

58