Memorex 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Note 6 — Intangible Assets and Goodwill

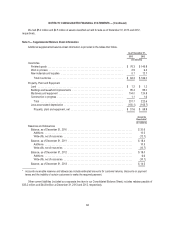

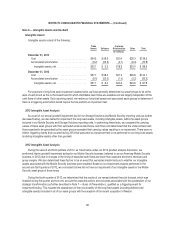

Intangible Assets

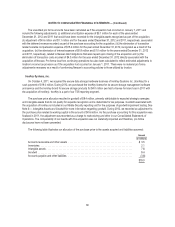

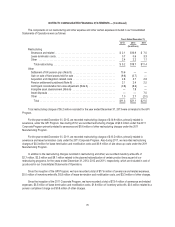

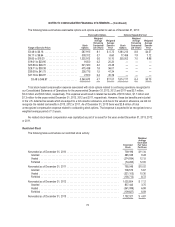

Intangible assets consist of the following:

Trade

Names Software

Customer

Relationships Other Total

(In millions)

December 31, 2013

Cost .................................... $34.3 $ 58.5 $20.4 $26.3 $139.5

Accumulated amortization .................... (9.2) (53.3) (2.1) (6.3) (70.9)

Intangible assets, net ...................... $25.1 $ 5.2 $18.3 $20.0 $ 68.6

December 31, 2012

Cost .................................... $37.7 $ 58.4 $21.2 $26.8 $144.1

Accumulated amortization .................... (6.0) (52.0) (1.0) (3.2) (62.2)

Intangible assets, net ...................... $31.7 $ 6.4 $20.2 $23.6 $ 81.9

For purposes of long-lived asset impairment assessments, we have generally determined our asset groups to be at the

level of each brand as this is the lowest level for which identifiable cash flows are available and are largely independent of the

cash flows of other assets. Each reporting period, we review our long-lived assets and associated asset groups to determine if

there is a triggering event which would require that we perform an impairment test.

2013 Intangible Asset Analysis

As a part of our annual goodwill impairment test for our Storage Solutions and Mobile Security reporting units (as further

discussed below), we also tested for impairment the long-lived assets, including intangible assets, within the asset groups

included in our Mobile Security and Storage Solutions reporting units. In performing these tests, we compared the carrying

values of these asset groups with their estimated undiscounted future cash flows and determined that the undiscounted cash

flows expected to be generated by the asset groups exceeded their carrying values resulting in no impairment. There were no

interim triggering events that occurred during 2013 that warranted an impairment test to be performed on our long-lived assets

(including intangible assets) other than goodwill.

2012 Intangible Asset Analysis

During the second and third quarters of 2012, as noted below under our 2012 goodwill analysis discussion, we

performed interim goodwill impairment testing for our Mobile Security business (referred to as our Americas-Mobile Security

business in 2012) due to changes in the timing of expected cash flows and lower than expected short-term revenues and

gross margins. We also determined these factors to be an event that warranted interim tests as to whether our intangible

assets associated with the Mobile Security business were impaired. Based on our impairment analysis performed in the

second and third quarters of 2012, we concluded that we did not have an impairment of our intangible assets in the Mobile

Security asset group at those times.

During the fourth quarter of 2012, we determined that the results of our revised internal financial forecast, which was

finalized during the quarter and took into account the expected actions and outcomes associated with the acceleration of our

strategic transformation (as further described in Note 1 — Basis of Presentation.), qualified as a triggering event for

impairment testing. This required the assessment of the recoverability of the long-lived assets (including definite-lived

intangible assets) included in all of our asset groups with the exception of the recent acquisition of Nexsan.

65