Memorex 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

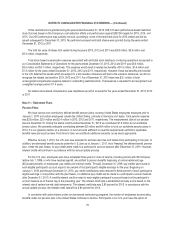

receiving cash lump sum payments when exiting the plan, which a number of participants exiting the plan have elected to

receive. Lump sum payments in 2013, 2012 and 2011 exceeded the service and interest costs associated with those years.

As a result, a partial settlement event occurred in those years and, accordingly, we recognized a settlement loss of

$2.1 million, $2.4 million and $2.5 million during 2013, 2012 and 2011, respectively. These settlement losses are included in

restructuring and other in our Consolidated Statements of Operations.

The U.S. pension plan permits four payment options: a lump-sum option, a life income option, a survivor option or a

period certain option.

We maintained a defined benefit pension plan located in the United Kingdom (UK Plan) for former employees with no

current employees in the plan. During the third quarter of 2013 we settled our UK Plan by way of a transaction with Pension

Insurance Corporation (PIC) whereby PIC fully assumed the projected benefit obligation and underlying plan assets. The net

balance assumed by PIC represented an asset balance of $6.4 million and no cash consideration took place between Imation

and PIC associated with this transaction. As a result of this transaction, we removed this net asset and related unrecognized

net actuarial loss in other comprehensive loss and recorded a loss of $10.6 million in restructuring and other in our

Consolidated Statements of Operations during the year ended December 31, 2013. Additionally, the settlement of the UK

Plan resulted in the removal of a deferred tax liability related to the plan resulting in a $2.3 million credit to income tax

expense for the year ended December 31, 2013. See Note 10 - Income Taxes for further discussion of the impact on the

income tax rate. It is a standard practice in the United Kingdom (UK) for a review process by the UK government, entailing a

review of the plan obligations and participant data, to occur upon a transaction such as this one involving a transfer of a

pension plan. We expect that this government review will be completed within the next twelve months. Upon the conclusion of

this regulatory review, we will record a true-up, if necessary, in the period in which it occurs.

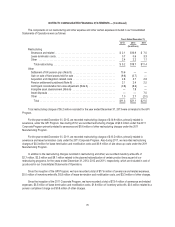

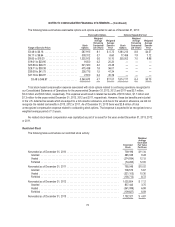

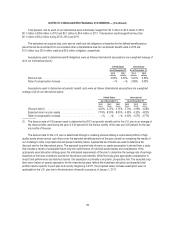

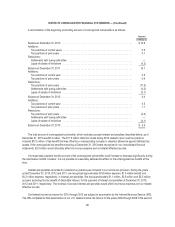

The benefit obligations and plan assets, changes to the benefit obligations and plan assets, and the funded status of the

defined benefit pension plans were as follows:

United States International

As of December 31, As of December 31,

2013 2012 2013 2012

(In millions)

Change in benefit obligation

Benefit obligation, beginning of year ............................ $88.3 $ 92.2 $ 63.4 $55.6

Service cost .............................................. — — 0.5 0.6

Interest cost .............................................. 3.3 3.2 2.0 2.2

Actuarial (gain) loss ........................................ (1.7) 2.2 (4.7) 6.9

Benefits paid .............................................. (2.0) (1.9) (3.5) (2.4)

Settlements .............................................. (9.4) (7.4) (24.8) —

Foreign exchange rate changes ............................... — — (1.5) 0.5

Projected benefit obligation, end of year ....................... $78.5 $ 88.3 $ 31.4 $63.4

Change in plan assets

Fair value of plan assets, beginning of year ....................... $71.7 $ 69.6 $ 58.0 $53.5

Actual return on plan assets .................................. 10.7 8.5 (3.3) 3.7

Foreign exchange rate changes ............................... — — (1.8) 1.0

Company contributions ...................................... — 2.9 1.5 2.2

Benefits paid .............................................. (2.0) (1.9) (3.5) (2.4)

Settlement payments ....................................... (9.4) (7.4) (24.8) —

Fair value of plan assets, end of year ......................... 71.0 71.7 26.1 58.0

Funded status of the plan, end of year ........................... $(7.5) $(16.6) $ (5.3) $ (5.4)

76