Memorex 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

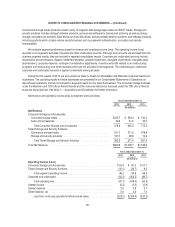

Other Assets and Liabilities

The carrying value of accounts receivable and accounts payable approximate their fair values due to the short-term

duration of these items. Additionally, our borrowings of $20.0 million of outstanding debt under the Amended Credit

Agreement at December 31, 2013, as further described in Note 11 — Debt, approximates fair value due to the short nature of

this debt.

Note 13 — Shareholders’ Equity

Shareholder Rights Plan

Effective February 11, 2013, our Board of Directors amended the Rights Agreement dated as of June 21, 2006 to

change the final expiration date from July 1, 2016 to February 11, 2013, effectively terminating the Rights Agreement. This

amendment had no accounting implications to the Company.

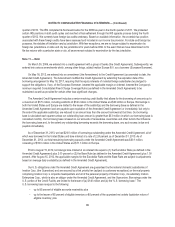

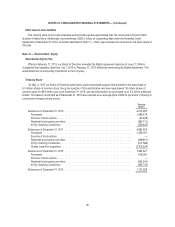

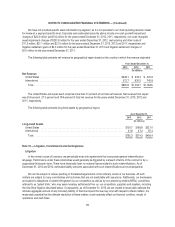

Treasury Stock

On May, 2, 2012 our Board of Directors authorized a share repurchase program that allowed for the repurchase of

5.0 million shares of common stock. Since the inception of this authorization we have repurchased 1.8 million shares of

common stock for $9.0 million and, as of December 31, 2013, we had authorization to repurchase up to 3.2 million additional

shares. The treasury stock held as of December 31, 2013 was acquired at an average price of $24.03 per share. Following is

a summary of treasury share activity:

Treasury

Shares

Balance as of December 31, 2010 ................................................. 4,212,285

Purchases ................................................................. 1,099,219

Exercise of stock options ...................................................... (45,429)

Restricted stock grants and other ................................................ (365,712)

401(k) matching contribution ................................................... (236,440)

Balance as of December 31, 2011 ................................................. 4,663,923

Purchases ................................................................. 1,236,161

Exercise of stock options ...................................................... —

Restricted stock grants and other ................................................ (499,851)

401(k) matching contribution ................................................... (517,588)

Shares issued for acquisition ................................................... (3,319,324)

Balance as of December 31, 2012 ................................................. 1,563,321

Purchases ................................................................. 616,581

Exercise of stock options ...................................................... —

Restricted stock grants and other ................................................ (622,241)

401(k) matching contribution ................................................... (435,735)

Balance as of December 31, 2013 ................................................. 1,121,926

90