Memorex 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

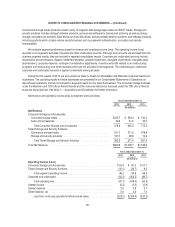

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

In 2013, 2012 and 2011 the net cash paid for income taxes, relating to both continuing and discontinued operations, was

$4.6 million, $4.4 million and $4.9 million, respectively.

Tax laws require certain items to be included in our tax returns at different times than the items are reflected in our

results of operations. Some of these items are temporary differences that will reverse over time. We record the tax effect of

temporary differences as deferred tax assets and deferred tax liabilities in our Consolidated Balance Sheets.

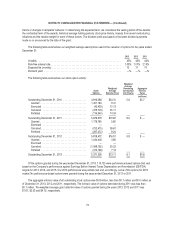

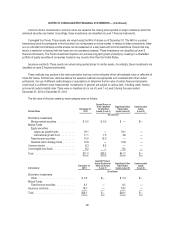

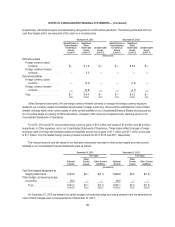

The components of net deferred tax assets and liabilities were as follows:

As of December 31,

2013 2012

(In millions)

Accounts receivable allowances ............................................ $ 3.0 $ 6.9

Inventories ............................................................ 9.1 12.9

Compensation and employee benefits ........................................ 8.0 11.2

Tax credit carryforwards .................................................. 35.8 39.2

Net operating loss carryforwards ............................................ 115.2 83.5

Accrued liabilities and other reserves ........................................ 9.0 9.3

Pension .............................................................. 6.0 9.4

Property, plant and equipment ............................................. 8.9 —

Intangible assets, net .................................................... 55.3 76.9

Other, net ............................................................. 1.8 2.7

Gross deferred tax assets ................................................. 252.1 252.0

Valuation allowance ..................................................... (239.4) (239.1)

Deferred tax assets ...................................................... 12.7 12.9

Property, plant and equipment ............................................. — (1.3)

Deferred tax liabilities .................................................... — (1.3)

Net deferred tax assets ................................................... $ 12.7 $ 11.6

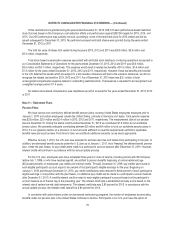

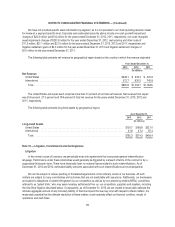

We regularly assess the likelihood that our deferred tax assets will be recovered in the future. A valuation allowance is

recorded to the extent we conclude a deferred tax asset is not considered to be more-likely-than-not to be realized. We

consider all positive and negative evidence related to the realization of the deferred tax assets in assessing the need for a

valuation allowance.

Our accounting for deferred tax consequences represents our best estimate of future events. A valuation allowance

established or revised as a result of our assessment is recorded through income tax provision (benefit) in our Consolidated

Statements of Operations. Changes in our current estimates due to unanticipated events, or other factors, could have a

material effect on our financial condition and results of operations.

We maintain a valuation allowance related to our U.S. deferred tax assets and certain foreign net operating losses. The

valuation allowance was $239.4 million, $239.1 million and $141.1 million as of December 31, 2013, 2012 and 2011,

respectively. The valuation allowance change in 2013 compared to 2012 was not significant. The valuation change in 2012

compared to 2011 was due primarily to operating losses and the impact of intangible asset impairments charges in 2012.

83