Memorex 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

and stock option awards exercised are issued from our treasury stock. The purchase of treasury stock is discretionary and will

be subject to determination by our Board of Directors each quarter following its review of our financial performance and other

factors.

No further shares are available for grant under the Directors Plan, the 2000 Incentive Plan, the 2005 Incentive Plan or

the 2008 Incentive Plan. Stock-based compensation awards issued under these plans generally have terms of ten years and,

for employees, vest over a four-year period. Awards issued to directors under these plans become fully exercisable on the

first anniversary of the grant date. Stock options granted under these plans are not incentive stock options. Exercise prices of

awards issued under these plans are equal to the fair value of the Company’s stock on the date of grant. As of December 31,

2013, there were 3,332,242 stock-based compensation awards outstanding that were issued under these plans and consist of

stock options and restricted stock.

The 2011 Incentive Plan was approved and adopted by our shareholders on May 4, 2011 and became effective

immediately. The 2011 Incentive Plan was amended and approved by our shareholders on May 8, 2013. The 2011 Incentive

Plan permits the grant of stock options, SARs, restricted stock, restricted stock units, dividend equivalents, performance

awards, stock awards and other stock-based awards. The aggregate number of shares of our common stock that may be

issued under all stock-based awards made under the 2011 Incentive Plan is 6.0 million. The number of shares available for

awards, as well as the terms of outstanding awards, is subject to adjustments as provided in the 2011 Incentive Plan for stock

splits, stock dividends, recapitalization and other similar events. Awards may be granted under the 2011 Incentive Plan until

the earlier to occur of May 3, 2021 or the date on which all shares available for awards under the 2011 Incentive Plan have

been granted; provided, however, that incentive stock options may not be granted after February 10, 2021.

Stock-based compensation awards issued under the 2011 Incentive Plan generally have a term of ten years and, for

employees, vest over a three-year period. Awards issued to directors under this plan become fully exercisable on the first

anniversary of the grant date. Stock options granted under these plans are not incentive stock options. Exercise prices of

awards issued under these plans are equal to the fair value of the Company’s stock on the date of grant.

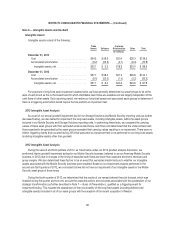

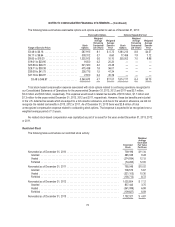

During the year ended December 31, 2013, we granted 3.1 million SARs under the 2011 Incentive Plan to certain

employees associated with our Nexsan and Mobile Security operations. These awards expire in five years and only vest when

both of the market and performance conditions specified by the terms of the SARs are met. For the market conditions, based

on the terms of the awards, 50 percent of the SARs may vest if the 30-day average Imation stock price reaches $10 per share

or more by December 31, 2016 and the remaining 50 percent of the SARs may vest if the 30-day average Imation stock price

reaches $15 per share or more by December 31, 2016. Additionally, for the performance condition, as a condition necessary

for vesting, the net revenue of Nexsan or Mobile Security (depending on the award) must reach certain specified stretch

targets by December 31, 2016. If exercised, the SARs require a cash payment to the holder in an amount based on the

Imation stock price at the date of exercise as compared to the stock priced at the date of grant. As of December 31, 2013 we

have not recorded any compensation expense associated with these SARs based on the applicable accounting rules. We will

continue to assess these SARs each quarter to determine if any expense should be recorded.

As of December 31, 2013 we had 3,231,617 of stock-based compensation awards consisting of stock options, restricted

stock and SARs outstanding under the 2011 Incentive Plan. As of December 31, 2013 there were 2,168,693 shares available

for grant under our 2011 Incentive Plan.

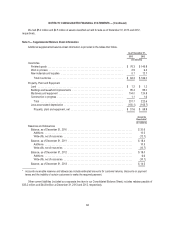

Stock Options

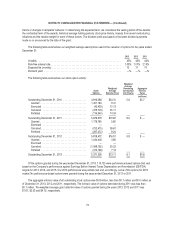

The fair value of each option award is estimated on the date of grant using the Black-Scholes option pricing model. The

assumptions used in the valuation model are supported primarily by historical indicators and current market conditions.

Volatility was calculated using the historical weekly close rate for a period of time equal to the expected term. The risk-free

rate of return was determined by using the U.S. Treasury yield curve in effect at the time of grant. The expected term was

calculated on an aggregated basis and estimated based on an analysis of options already exercised and any foreseeable

72