Memorex 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

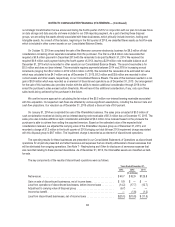

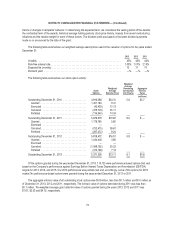

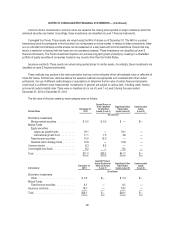

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

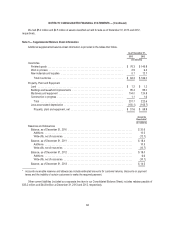

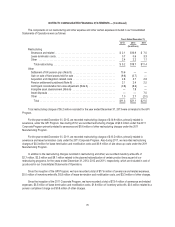

The components of our restructuring and other expense and other certain expenses included in our Consolidated

Statements of Operations were as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Restructuring

Severance and related ............................................ $ 2.1 $16.9 $ 7.0

Lease termination costs ........................................... 0.7 0.6 3.3

Other ........................................................ 2.4 2.2 1.1

Total restructuring ............................................. $ 5.2 $19.7 $11.4

Other

Settlement of UK pension plan (Note 9) ............................... 10.6 — —

Gain on sale of fixed assets held for sale .............................. (9.8) (0.7) —

Acquisition and integration related costs ............................... 2.8 3.7 2.6

Pension settlement/curtailment (Note 9) ............................... 2.1 2.4 2.5

Contingent consideration fair value adjustment (Note 4) ................... (0.6) (8.6) —

Intangible asset abandonment (Note 6) ............................... — 1.9 —

Asset disposals ................................................. — — 7.0

Other ........................................................ 1.0 2.7 (2.0)

Total ....................................................... $11.3 $21.1 $21.5

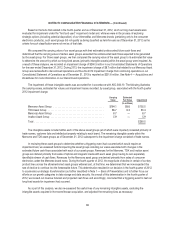

Total restructuring charges of $5.2 million recorded for the year ended December 31, 2013 were all related to the GPI

Program.

For the year ended December 31, 2012, we recorded restructuring charges of $14.9 million, primarily related to

severance, under the GPI Program. Also during 2012, we recorded restructuring charges of $4.2 million under the 2011

Corporate Program primarily related to severance and $0.6 million of other restructuring charges under the 2011

Manufacturing Program.

For the year ended December 31, 2011, we recorded restructuring charges of $10.2 million, primarily related to

severance and lease termination costs under the 2011 Corporate Program. Also during 2011, we recorded restructuring

charges of $0.3 million for lease termination and modification costs and $0.9 million of site clean-up costs under the 2011

Manufacturing Program.

In addition to the restructuring charges recorded in restructuring and other, we recorded inventory write-offs of

$2.7 million, $2.3 million and $9.1 million related to the planned rationalization of certain product lines as part of our

restructuring programs, for the years ended December 31, 2013, 2012 and 2011, respectively, which are included in cost of

goods sold in our Consolidated Statements of Operations.

Since the inception of the GPI Program, we have recorded a total of $17.6 million of severance and related expenses,

$5.0 million of inventory write-offs, $0.8 million of lease termination and modification costs, and $3.3 million of other charges.

Since the inception of the 2011 Corporate Program, we have recorded a total of $13.4 million of severance and related

expenses, $3.5 million of lease termination and modification costs, $1.6 million of inventory write-offs, $0.3 million related to a

pension curtailment charge and $0.9 million of other charges.

70