Memorex 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Imation is a global data storage and data security company. Our products and solutions help organizations and

individuals store, manage and protect their digital content. Imation’s storage and security portfolio includes Nexsan™ high-

density, archive and solid-state optimized unified hybrid storage solutions; IronKey™ mobile security solutions that address

the needs of professionals for secure data transport and mobile workspaces; and consumer storage solutions, audio products

and accessories sold under the Imation™, Memorex™ and TDK Life on Record™ brands. Imation reaches customers in more

than 100 countries through our global distribution network operating through two business segments, Consumer Storage and

Accessories (CSA) and Tiered Storage and Security Solutions (TSS).

The following discussion is intended to be read in conjunction with Item 1. Business and our Consolidated Financial

Statements and related Notes that appear elsewhere in this Annual Report on Form 10-K. This discussion contains forward-

looking statements that involve risks and uncertainties. Imation’s actual results could differ materially from those anticipated

due to various factors discussed below under “Cautionary Statements Regarding Forward-Looking Statements” in Item 1A.

Risk Factors of this Annual Report on Form 10-K.

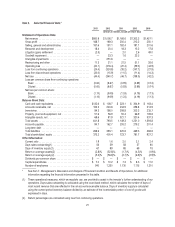

Basis of Presentation

The financial statements in this Annual Report on Form 10-K are presented on a consolidated basis and include the

accounts of the Company and our subsidiaries. See Note 2 — Summary of Significant Accounting Policies in our Notes to

Consolidated Financial Statements for further information regarding consolidation. References to “Imation,” the “Company,”

“we,” “us” and “our” are to Imation Corp, and its subsidiaries and consolidated entities unless the context indicates otherwise.

Our Consolidated Financial Statements are prepared in conformity with accounting principles generally accepted in the United

States of America (GAAP).

The results of operations for our XtremeMac™ and Memorex consumer electronics businesses are presented in our

Consolidated Statements of Operations as discontinued operations for all periods presented.

Overview

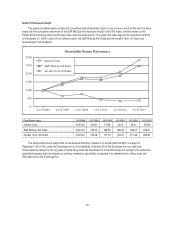

Following is a summary of significant items that impacted our operating results, liquidity and capital structure in 2013:

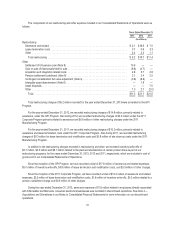

During the fourth quarter of 2012, we announced the acceleration of our strategic transformation, including the

realignment of our global business into two new business units, a cost reduction program and our increased focus on data

storage and data security including exploring strategic options for our consumer electronics brands and businesses. As our

traditional media businesses were declining, we determined that we needed to accelerate our business transformation. During

the first quarter of 2013 we announced our plans to divest our XtremeMac and Memorex consumer electronics businesses.

The divestiture of our Memorex consumer electronics business occurred on October 15, 2013 and the divestiture of our

XtremeMac business occurred on January 31, 2014. The total expected proceeds from the sale of these two businesses is

estimated to be approximately $15 million over time. See Note 4 — Acquisitions and Divestitures in our Notes to Consolidated

Financial Statements for further information on these divestitures. The consumer storage business under the Memorex and

TDK Life on Record brands and the consumer electronics business under the TDK Life on Record brand are being retained.

The realignment of our global business into two new business units better aligns the Company with our key consumer

and commercial channels. The two business units consist of CSA, which focuses mainly on retail channels; and TSS, which

focuses on small and medium business, enterprise and government customers. In the first quarter of 2013, we revised our

segment reporting to reflect these changes into these two new reporting segments. See Note 14 — Business Segment

Information and Geographical Data in our Notes to Consolidated Financial Statements for more information on our business

segments.

In October 2012, the Board of Directors approved our Global Process Improvement Restructuring Program (GPI

Program) in order to realign our business structure and reduce operating expenses in excess of 25 percent over time. This

restructuring program addressed product line rationalization and infrastructure and included a planned reduction in our global

22