Memorex 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The unaudited pro forma amounts have been calculated as if the acquisition had occurred on January 1, 2011 and

include the following adjustments: (i) additional amortization expense of $5.1 million for each of the years ended

December 31, 2012 and 2011 that would have been recorded for the intangible assets recognized as part of the acquisition,

(ii) adjustment of $0.6 million and $1.1 million and for the years ended December 31, 2012 and 2011, respectively, associated

with the deferred revenue recorded as part of the purchase accounting for the acquisition, (iii) the elimination of transaction

related variable compensation expense of $15.4 million for the year ended December 31, 2012, recognized as a result of the

acquisition, (iv) the elimination of interest expense of $0.9 million and $1.0 million for the years ended December 31, 2012

and 2011, respectively, related to Nexsan debt obligations that were repaid upon closing of the acquisition and (v) the

elimination of transaction costs incurred of $4.3 million for the year ended December 31, 2012 directly associated with the

acquisition of Nexsan. Pro forma loss from continuing operations has also been calculated to reflect estimated adjustments to

Imation’s income tax provision as if the acquisition had occurred on January 1, 2011. There were no material pro forma

adjustments necessary as a result of conforming Nexsan’s accounting policies to those utilized by Imation.

IronKey Systems, Inc.

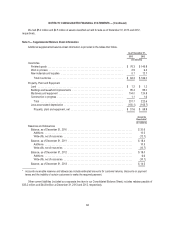

On October 4, 2011, we acquired the secure data storage hardware business of IronKey Systems Inc. (IronKey) for a

cash payment of $19.0 million. During 2012, we purchased the IronKey license for its secure storage management software

and service and the IronKey brand for secure storage products for $4.0 million (we held a license for brand use in 2011 with

the acquisition of IronKey). IronKey is a part of our TSS reporting segment.

The purchase price allocation resulted in goodwill of $9.4 million, primarily attributable to expected strategic synergies

and intangible assets that do not qualify for separate recognition and is deductible for tax purposes. Goodwill associated with

the acquisition of IronKey is included in our Mobile Security reporting unit for the purposes of goodwill impairment testing. See

Note 6 — Intangible Assets and Goodwill for more information regarding goodwill. During 2012, we recorded an adjustment to

the purchase price related to working capital in the amount of $0.6 million. As the purchase accounting for this acquisition was

finalized in 2011, the adjustment was recorded as a charge to restructuring and other in our Consolidated Statements of

Operations. The comparability of our results with this acquisition was not materially impacted and therefore, pro forma

disclosures have not been presented.

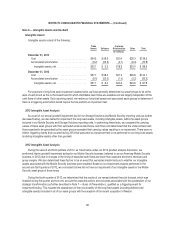

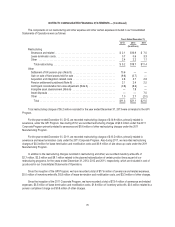

The following table illustrates our allocation of the purchase price to the assets acquired and liabilities assumed:

Amount

(In millions)

Accounts receivable and other assets ............................................... $ 3.5

Inventories ................................................................... 2.1

Intangible assets ............................................................... 7.8

Goodwill ..................................................................... 9.4

Accounts payable and other liabilities ............................................... (3.8)

$19.0

60