Memorex 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Based on the facts that existed in the fourth quarter and as of December 31, 2012, all of our long-lived assets were

evaluated for impairment under the “held and used” impairment model and, while we were in the process of exploring

strategic options (including potential disposition) of our XtremeMac and Memorex brands (pertaining only to the consumer

electronics products), such asset groups did not qualify as being classified as held-for-sale as of December 31, 2012 as the

criteria for such classification were not met as of that date.

We compared the carrying value of our asset groups with their estimated undiscounted future cash flows and

determined that the carrying value of certain asset groups exceeded the undiscounted cash flows expected to be generated

by the asset group. For those asset groups, we then compared the carrying value of the asset group to its estimated fair value

to determine the amount by which our long-lived assets (primarily intangible assets) within the asset group were impaired. As

a result of these analyses, we recorded an impairment charge of $260.5 million in our Consolidated Statements of Operations

for the year ended December 31, 2012. During 2013, the impairment charge of $8.7 million that related to our Memcorp Asset

Group was reclassified to discontinued operations and thus the 2012 impairment charge from continuing operations in our

Consolidated Statement of Operations as of December 31, 2013 is reported as $251.8 million. See Note 4 — Acquisitions and

Divestitures for more information on our discontinued operations.

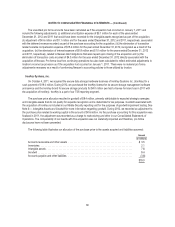

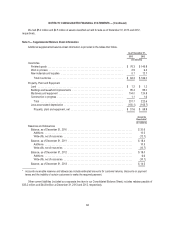

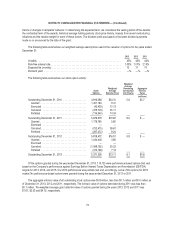

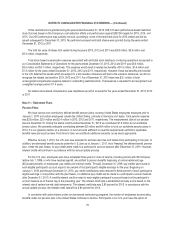

The impairment of these intangible assets was accounted for in accordance with ASC 360-10. The following illustrates

the carrying values, estimated fair values and impairment losses recorded, by asset group, associated with the fourth quarter

2012 impairment charge:

Carrying

Value

Estimated

Fair Value Impairment

(In millions)

Memorex Asset Group ..................................... $164.1 $8.6 $155.5

TDK Asset Group ......................................... 96.7 6.3 90.4

Memcorp Asset Group ..................................... 8.7 — 8.7

Imation Asset Group ....................................... 5.9 — 5.9

Total ................................................... $260.5

The intangible assets included within each of the above asset groups (all of which were impaired) consisted primarily of

trade names, customer lists and intellectual property relating to each brand. The remaining intangible assets within the

Memorex and TDK asset groups as of December 31, 2012 subsequent to the impairment charge consisted of trade names.

In reviewing these asset groups to determine whether a triggering event had occurred which would require an

impairment test, we assessed factors impacting the asset groups including our views associated with changes in the

estimated future cash flows associated with each of our asset groups. Revenues for the Memorex, TDK and Imation asset

groups are derived primarily from sales of optical and magnetic media with each asset group having its own separately

identifiable stream of cash flows. Revenues for the Memcorp asset group are derived primarily from sales of consumer

electronics under the Memorex brand name. During the fourth quarter of 2012, the magnitude of decline in certain of our key

product lines across the aforementioned asset groups widened and, at that time, we determined that we now expected this

rate of decline to continue into the foreseeable future. This determination resulted in our decision in the fourth quarter of 2012

to accelerate our strategic transformation (as further described in Note 1 — Basis of Presentation) and to further focus our

efforts on our growth categories in data storage and data security. As a result of this determination in the fourth quarter of

2012, we revised our revenue forecast and projected cash flows and accordingly, concluded that a triggering event to test our

long-lived assets for impairment had occurred.

As a part of this analysis, we also re-assessed the useful lives of any remaining intangible assets, excluding the

intangible assets acquired in the recent Nexsan acquisition, and adjusted the remaining lives as necessary.

66