Memorex 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Audio and Accessories

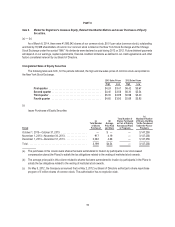

Audio and accessories revenue comprised 4.9 percent, 4.1 percent and 3.0 percent of our total consolidated revenue in

2013, 2012 and 2011, respectively. Our audio and accessories include headphones and speakers sold under the TDK Life on

Record brand. The portfolio continues to evolve as we focus on higher-margin, differentiated accessories products and

respond to customer demand. We design products to meet user needs and source these products from manufacturers

throughout Asia. The divestiture of our Memorex consumer electronics business closed on October 15, 2013 and the

divestiture of our XtremeMac business closed on January 31, 2014.

Commercial Storage Media

Commercial storage media revenue comprised 29.2 percent, 31.0 percent and 32.5 percent of our total consolidated

revenue in 2013, 2012 and 2011, respectively. Our magnetic tape media products are used for back-up, business and

operational continuity planning, disaster recovery, near-line data storage and retrieval and for cost-effective mass and archival

storage. The market for magnetic tape cartridges has been in decline and we expect the declines to continue into 2014, but

we continue to maintain a leading market share. Our magnetic tape products are sold throughout the world under various

brands. In 2011, we consolidated our tape coating operations to the TDK group Yamanashi manufacturing facility under a

strategic agreement with TDK to collaborate on the research and development of future tape formats and jointly develop and

manufacture magnetic tape technologies. At the end of 2013, TDK announced their intent to cease manufacturing of magnetic

tape and therefore we will transition product sourced from alternate magnetic tape suppliers during 2014.

Storage and Security Solutions

Storage and security solutions revenue comprised 15.3 percent, 5.9 percent and 1.1 percent of our total consolidated

revenue in 2013, 2012 and 2011, respectively. Our storage systems include the Nexsan E-Series™ disk arrays with industry-

leading storage density, reliability and power management offering high value block-based storage; the NST™ line of hybrid

storage combining solid state technology with spinning disk to offer high performance and capacity and the Assureon™

secure archive systems for data offload, compliance and secure cloud deployments. We expect to continue to grow revenue

in our storage systems products with the Nexsan acquisition of 2012.

Mobile security products and services include secure storage products, software and portable workspace solutions.

Many of these products are designed to meet the most stringent security standards that protect data at rest with the U.S.

Government Federal Information Processing Standard (FIPS) validation, which includes strong encryption protection with

password and biometric authentication. Flash media products with security features provide margins significantly higher than

traditional flash media without data security. We have consolidated the brands for these products under the IronKey name.

Executive Summary

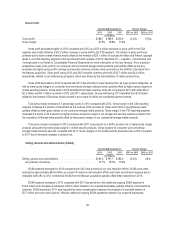

Consolidated Results of Operations for the Twelve Months Ended December 31, 2013

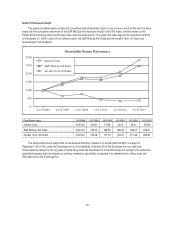

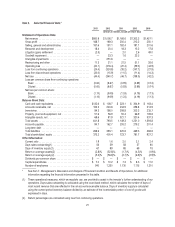

• Revenue of $860.8 million in 2013 was down 14.5 percent compared with revenue of $1,006.7 million in 2012

driven by secular declines in our optical and tape products. Revenue for 2013 compared to 2012 was negatively

impacted by foreign currency translation of four percent.

• Gross margin of 21.9 percent in 2013 was up from 18.8 percent in 2012 and included a benefit of $23.1 million of

accrual reversals associated with European copyright levies as a result of favorable court rulings in Italy and

France. The levy accrual reversals had a 2.7 percent positive impact on gross margin in 2013.

• Selling, general and administrative expense was $181.6 million in 2013, down $9.5 million compared with

$191.1 million in 2012. The addition of SG&A expense from the acquisition of Nexsan was offset by lower SG&A

expense due to cost reduction efforts and lower amortization expense as a result of intangible write-offs in 2012.

• Research and development expense was $18.4 million in 2013, down $2.0 million, compared with $20.4 million in

2012.

24