Kodak 2004 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

90

EASTMAN KODAK COMPANY

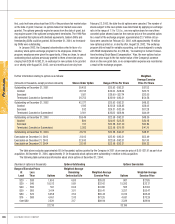

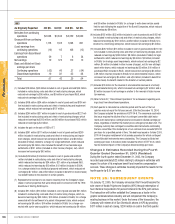

The unaudited pro forma combined historical results, as if Practice-

Works had been acquired at the beginning of 2003 and 2002, respectively,

are estimated to be:

2003 2002

(in millions, except per share data) (Restated)

Net sales $ 13,039 $ 12,636

Earnings from continuing operations $ 185 $ 735

Basic earnings per share from

continuing operations $ .65 $ 2.52

Diluted earnings per share from

continuing operations $ .65 $ 2.52

Number of common shares used in:

Basic earnings per share 286.5 291.5

Diluted earnings per share 290.8 291.7

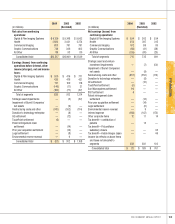

The pro forma results include amortization of the intangible assets

presented above and interest expense on debt assumed to fi nance the

purchase. The interest expense was calculated based on the assumption

that approximately $450 million of the purchase price was fi nanced through

debt with an annual interest rate of approximately 5%. The pro forma

results exclude the write-off of research and development assets that were

acquired from the acquisition. The pro forma results are not necessarily

indicative of what actually would have occurred if the acquisition had been

completed as of the beginning of each fi scal period presented, nor are they

necessarily indicative of future consolidated results.

Laser-Pacific Media Corporation On October 31, 2003, the Company

announced that it had completed the acquisition of Laser-Pacifi c Media

Corporation (Laser-Pacifi c), a leading Hollywood-based post-production

company for approximately $31 million or $4.22 per share. At the time of

the closing, Laser-Pacifi c had approximately $6 million of net debt. The

acquisition will allow the Company to establish a major presence in televi-

sion post-production and further extends Kodak’s current digital services

capabilities in the feature fi lm market. Approximately $2 million of the pur-

chase price was allocated to customer-related intangible assets that have

a useful life of four years. Approximately $10 million of the purchase price

was allocated to goodwill, which is reported in the Company’s Photography

segment. The goodwill is not expected to be deductible for tax purposes.

Earnings from continuing operations for 2003 include the results of Laser-

Pacifi c from the date of acquisition.

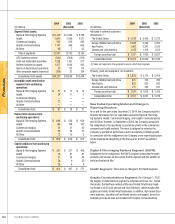

Algotec Systems Ltd. On November 26, 2003, the Company announced

that it had completed the acquisition of Algotec Systems Ltd. (Algotec),

a leading developer of advanced picture-archiving-and-communications

systems (PACS) in Raanana, Israel, for approximately $43 million in cash.

The acquisition improves the Company’s position in the growing mar-

ket for Healthcare Information Systems (HCIS), which enable radiology

departments worldwide to digitally manage and store medical images and

information.

Kodak Wuxi China Limited On December 26, 2003, an unaffi liated in-

vestor in Kodak Wuxi China Limited (KWCL) exercised its rights under a put

option arrangement, which required Kodak to repurchase a 30% outstand-

ing minority equity interest in this subsidiary for approximately $15 million

in cash. The purchase price allocation was completed in 2004, at which

time the approximately $3 million excess purchase price was allocated to

goodwill and other identifi able assets.

Kodak China Company Limited On December 31, 2003, an unaffi liated

investor in Kodak China Company Limited (KCCL) exercised its rights under

a put option arrangement, which required Kodak to repurchase a 10%

outstanding minority equity interest in this subsidiary for approximately

$42 million in cash. The purchase price allocation was completed in the

third quarter of 2004, at which time the approximately $3 million excess

purchase price was allocated to goodwill and other identifi able assets.

Other During the fi rst quarter, the Company paid approximately $21 mil-

lion for the rights to certain technology. As this technology was still in the

development phase and not yet ready for commercialization, it qualifi ed as

in-process research and development. Additionally, management deter-

mined that there are no alternative future uses for this technology beyond

its initial intended application. Accordingly, the entire purchase price was

expensed in the year ended December 31, 2003 as research and develop-

ment costs in the accompanying Consolidated Statement of Earnings.

During 2003, the Company completed a number of additional acquisi-

tions with an aggregate purchase price of approximately $3 million, which

were individually immaterial to the Company’s fi nancial position, results of

operations or cash fl ows.

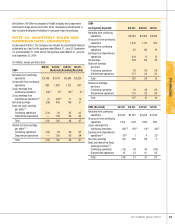

2002

ENCAD, Inc. On January 24, 2002, the Company completed the acquisi-

tion of 100% of the voting common stock of ENCAD, Inc., (ENCAD) for a

total purchase price of approximately $25 million. The purchase price was

paid almost entirely in Kodak common stock. The purchase price in excess

of the fair value of the net assets acquired of approximately $6 million has

been allocated to goodwill. Earnings from continuing operations for 2002

include the results of ENCAD from the date of acquisition.

Kodak India Limited On September 11, 2002, the Company initiated an

offer to acquire all of the outstanding minority equity interests in Kodak

India Limited (Kodak India), a majority owned subsidiary of the Company.

The voluntary offer to the minority equity interest holders of Kodak India

was for the acquisition of approximately 2.8 million shares representing

the full 25.24% minority ownership in the subsidiary. In the fourth quarter

of 2002, the Company purchased 2.1 million shares for approximately $16

million in cash. Upon completion of the purchase price allocation in 2003,

the Company recorded essentially all of the excess purchase price of $8

million as goodwill. In December 2002, the Company also made an offer to

purchase the remaining 6.04% outstanding minority interest in Kodak India

for approximately $4.9 million. This additional repurchase was completed

during 2004. Kodak India operates in each of the Company’s reportable

segments and is engaged in the manufacture, trading and marketing of

cameras, fi lms, photo chemicals and other imaging products.

Kodak China Company Limited On December 31, 2002, an unaffi liated

investor in KCCL exercised its rights under a put option arrangement, which

required Kodak to repurchase a 10% outstanding minority equity interest