Kodak 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

67

2 0 0 4 S U M M A R Y A N N U A L R E P O R T

144AundertheSecuritiesActof1933.InterestontheConvertibleSecuri-

tieswillaccrueattherateof3.375%perannumandispayablesemian-

nually.TheConvertibleSecuritiesareunsecuredandrankequallywithall

oftheCompany’sotherunsecuredandunsubordinatedindebtedness.Asa

conditionoftheprivateplacement,onJanuary6,2004theCompanyfiled

ashelfregistrationstatementundertheSecuritiesActof1933relatingto

theresaleoftheConvertibleSecuritiesandthecommonstocktobeissued

uponconversionoftheConvertibleSecuritiespursuanttoaregistration

rightsagreement,andmadethisshelfregistrationstatementeffectiveon

February6,2004.

TheConvertibleSecuritiescontainanumberofconversionfeatures

thatincludesubstantivecontingencies.TheConvertibleSecuritiesare

convertiblebytheholdersataninitialconversionrateof32.2373shares

oftheCompany’scommonstockforeach$1,000principalamountof

theConvertibleSecurities,whichisequaltoaninitialconversionprice

of$31.02pershare.Theinitialconversionrateof32.2373issubjectto

adjustmentfor:(1)stockdividends,(2)subdivisionsorcombinationsofthe

Company’scommonstock,(3)issuancetoallholdersoftheCompany’s

commonstockofcertainrightsorwarrantstopurchasesharesofthe

Company’scommonstockatlessthanthemarketprice,(4)distributions

toallholdersoftheCompany’scommonstockofsharesoftheCompany’s

capitalstockortheCompany’sassetsorevidencesofindebtedness,(5)

cashdividendsinexcessoftheCompany’scurrentcashdividendsor(6)

certainpaymentsmadebytheCompanyinconnectionwithtenderoffers

andexchangeoffers.

TheholdersmayconverttheirConvertibleSecurities,inwholeor

inpart,intosharesoftheCompany’scommonstockunderanyofthe

followingcircumstances:(1)duringanycalendarquarter,ifthepriceofthe

Company’scommonstockisgreaterthanorequalto120%oftheappli-

cableconversionpriceforatleast20tradingdaysduringa30consecutive

tradingdayperiodendingonthelasttradingdayofthepreviouscalendar

quarter;(2)duringanyfiveconsecutivetradingdayperiodfollowingany10

consecutivetradingdayperiodinwhichthetradingpriceoftheConvertible

Securitiesforeachdayofsuchperiodislessthan105%oftheconver-

sionvalue,andtheconversionvalueforeachdayofsuchperiodwasless

than95%oftheprincipalamountoftheConvertibleSecurities(theParity

Clause);(3)iftheCompanyhascalledtheConvertibleSecuritiesforre-

demption;(4)upontheoccurrenceofspecifiedcorporatetransactionssuch

asaconsolidation,mergerorbindingshareexchangepursuanttowhich

theCompany’scommonstockwouldbeconvertedintocash,propertyor

securities;and(5)ifthecreditratingassignedtotheConvertibleSecuri-

tiesbyeitherMoody’sorS&PislowerthanBa2orBB,respectively,which

representsathreenotchdowngradefromtheCompany’scurrentstanding,

oriftheConvertibleSecuritiesarenolongerratedbyatleastoneofthese

servicesortheirsuccessors(theCreditRatingClause).

TheCompanymayredeemsomeoralloftheConvertibleSecuritiesat

anytimeonorafterOctober15,2010atapurchasepriceequalto100%

oftheprincipalamountoftheConvertibleSecuritiesplusanyaccruedand

unpaidinterest.UponacallforredemptionbytheCompany,aconversion

triggerismetwherebytheholderofeach$1,000ConvertibleSeniorNote

mayconvertsuchnotetosharesoftheCompany’scommonstock.

TheholdershavetherighttorequiretheCompanytopurchasetheir

ConvertibleSecuritiesforcashatapurchasepriceequalto100%of

theprincipalamountoftheConvertibleSecuritiesplusanyaccruedand

unpaidinterestonOctober15,2010,October15,2013,October15,2018,

October15,2023andOctober15,2028,oruponafundamentalchangeas

describedintheofferingmemorandumfiledunderRule144Ainconjunction

withtheprivateplacementoftheConvertibleSecurities.AsofDecember

31,2004,theCompanyhasreserved18,536,447sharesintreasurystock

tocoverpotentialfutureconversionsoftheseConvertibleSecuritiesinto

commonstock.

CertainoftheconversionfeaturescontainedintheConvertibleSecuri-

tiesaredeemedtobeembeddedderivativesasdefinedunderSFASNo.

133,“AccountingforDerivativeInstrumentsandHedgingActivities.”These

embeddedderivativesincludetheParityClause,theCreditRatingClause,

andanyspecifiedcorporatetransactionoutsideoftheCompany’scontrol

suchasahostiletakeover.Basedonanexternalvaluation,theseembedded

derivativeswerenotmaterialtotheCompany’sfinancialposition,resultsof

operationsorcashflows.

InNovember2004,theEmergingIssuesTaskForcefinalizedthecon-

sensusinIssueNo.04-8,“TheEffectofContingentlyConvertibleDebton

DilutedEarningsperShare”(EITF04-8).EITF04-8requiresthatcontingent

convertibleinstrumentsbeincludedindilutedearningspershareregard-

lessofwhetheramarketpricetriggerorothercontingentfeaturehasbeen

met.EITF04-8iseffectiveforreportingperiodsendingafterDecember15,

2004andrequiresrestatementofpriorperiods.SeeNote1,“Significant

AccountingPolicies,”“EarningsPerShare”forfurtherdiscussion.

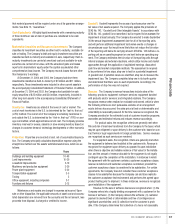

NOTE10:OTHERLONG-TERM

LIABILITIES

20042003

(inmillions) (Restated)

Deferredcompensation $176 $ 164

Environmentalliabilities 153 141

Deferredincometaxes67 89

MinorityinterestinKodakcompanies 25 45

Other 325 223

Total $746 $ 662

Theothercomponentaboveconsistsofothermiscellaneouslong-

termliabilitiesthat,individually,arelessthan5%ofthetotalliabilitiescom-

ponentintheaccompanyingConsolidatedStatementofFinancialPosition,

andtherefore,havebeenaggregatedinaccordancewithRegulationS-X.

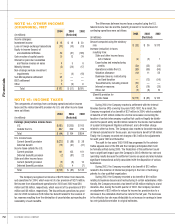

NOTE11:COMMITMENTSAND

CONTINGENCIES

EnvironmentalCashexpendituresforpollutionpreventionandwaste

treatmentfortheCompany’scurrentfacilitieswereasfollows:

(inmillions) 2004 2003 2002

Recurringcostsforpollution

preventionandwastetreatment $ 75 $ 74 $ 67

Capitalexpendituresforpollution

preventionandwastetreatment 7 8 12

Siteremediationcosts 3 2 3

Total $ 85 $ 84 $ 82