Kodak 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

71

2 0 0 4 S U M M A R Y A N N U A L R E P O R T

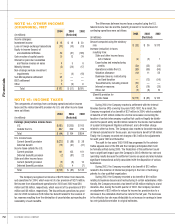

(inmillions)

DeferredrevenueatDecember31,2002 $ 103

Newextendedwarrantyarrangementsin2003 372

Recognitionofextendedwarrantyarrangement

revenuein2003 (355)

Adjustmentsforchangesinestimates (2)

DeferredrevenueatDecember31,2003 $ 118

Newextendedwarrantyarrangementsin2004 411

Recognitionofextendedwarrantyarrangement

revenuein2004 (388)

DeferredrevenueatDecember31,2004 $ 141

NOTE13:FINANCIALINSTRUMENTS

Thefollowingtablepresentsthecarryingamountsoftheassets(liabilities)

andtheestimatedfairvaluesoffinancialinstrumentsatDecember31,

2004and2003:

20042003

Carrying FairCarrying Fair

(inmillions) Amount Value Amount Value

Marketablesecurities:

Current $ 3 $ 3 $ 11 $ 11

Long-term 24 26 24 35

Long-termborrowings (1,852) (2,039) (2,302) (2,450)

Foreigncurrencyforwards 25 25 (1) (1)

Silverforwards — — 1 1

Marketablesecuritiesarevaluedatquotedmarketprices.Thefair

valuesoflong-termborrowingsaredeterminedbyreferencetoquoted

marketpricesorbyobtainingquotesfromdealers.Thefairvaluesforthe

remainingfinancialinstrumentsintheabovetablearebasedondealer

quotesandreflecttheestimatedamountstheCompanywouldpayor

receivetoterminatethecontracts.Thecarryingvaluesofcashandcash

equivalents,receivables,short-termborrowingsandpayablesapproximate

theirfairvalues.

TheCompany,asaresultofitsglobaloperatingandfinancingactivi-

ties,isexposedtochangesinforeigncurrencyexchangerates,commodity

pricesandinterestrateswhichmayadverselyaffectitsresultsofopera-

tionsandfinancialposition.TheCompanymanagessuchexposures,in

part,withderivativefinancialinstruments.Thefairvalueofthesederivative

contractsisreportedinothercurrentassetsoraccountspayableandother

currentliabilitiesintheaccompanyingConsolidatedStatementofFinancial

Position.

Foreigncurrencyforwardcontractsareusedtohedgeexisting

foreigncurrencydenominatedassetsandliabilities,especiallythoseofthe

Company’sInternationalTreasuryCenter,aswellasforecastedforeigncur-

rencydenominatedintercompanysales.Silverforwardcontractsareused

tomitigatetheCompany’srisktofluctuatingsilverprices.TheCompany’s

exposuretochangesininterestratesresultsfromitsinvestingandborrow-

ingactivitiesusedtomeetitsliquidityneeds.Long-termdebtisgenerally

usedtofinancelong-terminvestments,whileshort-termdebtisusedto

meetworkingcapitalrequirements.TheCompanydoesnotutilizefinancial

instrumentsfortradingorotherspeculativepurposes.

TheCompanyperiodicallyentersintoforeigncurrencyforward

contractsthataredesignatedascashflowhedgesofexchangeraterisk

relatedtoforecastedforeigncurrencydenominatedintercompanysales.At

December31,2004,theCompanyhadnoopencashflowhedgesrelated

totheseforeigncurrencyforwardcontracts.During2004,asaresultof

thesaleoftheintercompanyforeigncurrencydenominatedassetsand

liabilitiestothirdparties,apre-taxlossof$16millionwasreclassifiedfrom

accumulatedothercomprehensive(loss)incometocostofgoodssold.

Hedgeineffectivenesswasinsignificant.

TheCompanydoesnotapplyhedgeaccountingtotheforeigncur-

rencyforwardcontractsusedtooffsetcurrency-relatedchangesinthe

fairvalueofforeigncurrencydenominatedassetsandliabilities.These

contractsaremarkedtomarketthroughearningsatthesametimethatthe

exposedassetsandliabilitiesareremeasuredthroughearnings(bothin

otherincome(charges),net).Themajorityofthecontractsofthistypeheld

bytheCompanyaredenominatedineuros,Australiandollars,andCanadian

dollars.AtDecember31,2004,thefairvalueoftheseopencontractswas

anunrealizedgainof$25million(pre-tax).

TheCompanyhasenteredintosilverforwardcontractsthataredes-

ignatedascashflowhedgesofpriceriskrelatedtoforecastedworldwide

silverpurchases.TheCompanyusedsilverforwardcontractstominimize

itsexposuretoincreasesinsilverpricesin2002,2003,and2004.AtDe-

cember31,2004,theCompanyhadopenforwardcontractswithmaturities

throughMarch2005.

AtDecember31,2004,thefairvalueofopensilverforwardcontracts

wasanunrealizedlossoflessthan$1million(pre-tax),whichisincluded

inaccumulatedothercomprehensive(loss)income.Ifthisamountwere

toberealized,allofitwouldbereclassifiedintocostofgoodssoldduring

thenexttwelvemonths.Additionally,realizedgainsof$2million(pre-tax),

relatedtoclosedsilvercontracts,havebeendeferredinaccumulatedother

comprehensive(loss)income.Thesegainswillbereclassifiedintocostof

goodssoldassilver-containingproductsaresold,allwithinthenexttwelve

months.During2004,resultingfromthesaleofsilver-containingproducts,

arealizedgainof$10million(pre-tax)wasrecordedincostofgoodssold.

Hedgeineffectivenesswasinsignificant.

TheCompany’sfinancialinstrumentcounterpartiesarehigh-quality

investmentorcommercialbankswithsignificantexperiencewithsuch

instruments.TheCompanymanagesexposuretocounterpartycreditrisk

byrequiringspecificminimumcreditstandardsanddiversificationofcoun-

terparties.TheCompanyhasprocedurestomonitorthecreditexposure

amounts.ThemaximumcreditexposureatDecember31,2004wasnot

significanttotheCompany.

TheCompanyhasa50percentownershipinterestinKPG,ajoint

ventureaccountedforundertheequitymethod.TheCompany’spropor-

tionateshareofKPG’sothercomprehensiveincomeisthereforeincluded

initspresentationofothercomprehensive(loss)incomedisplayedinthe

ConsolidatedStatementofShareholders’Equity.