Kodak 2004 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2004 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Compensation

44

2 0 0 5 N O T I C E O F A N N U A L M E E T I N G A N D P R O X Y S T A T E M E N T

RETIREMENTPLAN

TheCompanyfundsatax-qualifieddefinedbenefitpensionplanforvirtuallyallU.S.employees.EffectiveJanuary1,2000,theCompanyamendedthe

plantoincludeacashbalancefeature.Mr.Carpistheonlynamedexecutiveofficerwhoparticipatesinthenon-cashbalanceportionoftheplan.Thecash

balancefeaturecoversallnewemployeeshiredafterMarch31,1999,includingMessrs.Perez,Brust,LangleyandMasson.

Retirementincomebenefitsarebaseduponanemployee’saverageparticipatingcompensation(APC).TheplandefinesAPCasone-thirdofthesumofthe

employee’sparticipatingcompensationforthehighestconsecutive39periodsofearningsoverthe10yearsendingimmediatelypriortoretirementorter-

minationofemployment.Participatingcompensation,inthecaseofthenamedexecutiveofficers,isbasesalaryandEXCELawards,includingallowances

inlieuofsalaryforauthorizedperiodsofabsence,suchasillness,vacationorholidays.

Foranemployeewithupto35yearsofaccruedservice,theannualnormalretirementincomebenefitiscalculatedbymultiplyingtheemployee’syearsof

accruedservicebythesumofa)1.3%ofAPC,plusb)0.3%ofAPCinexcessoftheaverageSocialSecuritywagebase.Foranemployeewithmorethan

35yearsofaccruedservice,theamountisincreasedby1%foreachyearinexcessof35years.

TheretirementincomebenefitisnotsubjecttoanydeductionsforSocialSecuritybenefitsorotheroffsets.Thenormalformofbenefitisanannuity,buta

lumpsumpaymentisavailableinlimitedsituations.

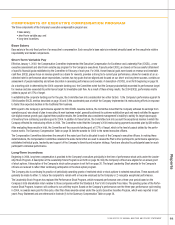

PensionPlanTable

AnnualRetirementIncomeBenefits — StraightLifeAnnuityBeginningatAge65

YearsofService

Remuneration 3 20 25 30 35 40

$ 500,000 $23,190 $ 154,600 $ 193,250 $ 231,900 $ 270,550 $ 284,078

750,000 35,190 234,600 293,250 351,900 410,550 431,078

1,000,000 47,190 314,600 393,250 471,900 550,550 578,078

1,250,000 59,190 394,600 493,250 591,900 690,550 725,078

1,500,000 71,190 474,600 593,250 711,900 830,550 872,078

1,750,000 83,190 554,600 693,250 831,900 970,550 1,019,078

2,000,000 95,190 634,600 793,250 951,900 1,110,550 1,166,078

2,250,000 107,190 714,600 893,250 1,071,900 1,250,550 1,313,078

2,500,000 119,190 794,600 993,250 1,191,900 1,390,550 1,460,078

2,750,000 131,190 874,600 1,093,250 1,311,900 1,530,550 1,607,078

3,000,000 143,190 954,600 1,193,250 1,431,900 1,670,550 1,754,078

3,250,000 155,190 1,034,600 1,293,250 1,551,900 1,810,550 1,901,078

NOTE:Forpurposesofthistable,RemunerationmeansAPC.Totheextentthatanemployee’sannualretirementincomebenefitexceedstheamountpayablefromthe

Company’sfundedplan,itispaidfromoneormoreunfundedsupplementaryplans.