Food Lion 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

CONSOLIDATED BALANCE SHEET CONSOLIDATED INCOME

STATEMENT CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

92 - Delhaize Group - Annual Report 2009

On October 28, 2010, the IASB issued the second part of IFRS 9 dealing with the recognition and measurement of financial liabilities, which

is also applicable for annual periods beginning on or after January 1, 2013. The IASB has retained the existing guidance in IAS 39 regarding

classifying and measuring financial liabilities, except for those liabilities where the fair value option has been elected, which is currently not

the case for any of Delhaize Group’s financial liabilities.

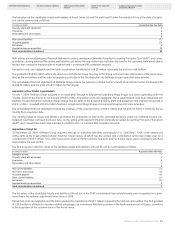

Based on the Group’s current assessment, the following pronouncements are expected to have no significant impact on the 2011 consolidated

financial statements:

• Improvements to IFRS (applicable for annual periods beginning on or after January 1, 2011): In May 2010, the IASB issued an omnibus

amendment to various IFRS pronouncements.

• Revised IAS 24 Related Party Disclosures (applicable for annual periods beginning on or after January 1, 2011): The revised IAS 24 clarifies

and simplifies the definition of a related party.

•AmendmentstoIAS32Classification of Rights Issues (applicable for annual periods beginning on or after February 1, 2010): In October

2009, the IASB amended IAS 32 in a way that foreign currency rights issues are now required to be treated as equity transactions, provided

the offer is made pro-rata to all existing owners of the same class of the entity’s own non-derivative equity instruments.

•AmendmentstoIAS12Income Taxes (applicable for annual periods beginning on or after January 1, 2012): The IASB has added an excep-

tion to the principles in IAS 12, whereby there is now the rebuttable presumption that investment property measured at fair value is recovered

entirely by sale. Delh aize Group is currently measuring its investment property at amortized cost (see Note 9).

•AmendmentstoIFRS7Financial Instruments, Derecognition Disclosure (applicable for annual periods beginning on or after July 1, 2011):

The IASB has amended IFRS 7 requiring additional disclosures in respect of risk exposures arising from transferred financial assets. Additional

disclosures are required for transactions that sell, factor, securitize, lend or otherwise transfer financial assets to other parties.

•AmendmentstoIFRIC14Prepayments of a Minimum Funding Requirement (applicable for annual periods beginning on or after January

1, 2011): The amendment corrects IFRIC 14, an interpretation of IAS 19 Employee Benefits.

•IFRIC19Extinguishing Financial Liabilities with Equity Instruments (applicable for annual periods beginning on or after July 1, 2010): On

November 26, 2009, IFRIC 19 was issued, which clarifies the treatment of financial liabilities that are extinguished with equity instruments.

Delhaize Group generally does not early adopt changes in IFRS pronouncements and therefore expects to implement such changes when

mandatorily effective for the Group.

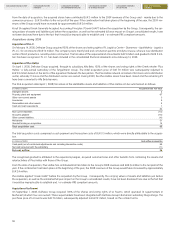

2.6 Financial Risk Management, Objectives and Policies

The Group’s activities expose it to a variety of financial risks: market risk (including currency risk, fair value interest rate risk, cash flow interest

rate risk and price risk), credit risk and liquidity risk. Delhaize Group’s principle financial liabilities, other than derivatives, comprise mainly debts

and borrowings and trade and other payables. These financial liabilities are mainly held in order to raise funds for the Group’s operations.

On the other hand, the Group holds notes receivables, other receivables and cash and cash-equivalents that result directly from the Group’s

activities. The Group also holds several available-for-sale investments. Delhaize Group uses derivative financial instruments to hedge certain

risk exposures.

The risks the Group is exposed to are evaluated by Delhaize Group’s management and Board of Directors and discussed in the section “Risk

Factors” in this annual report.

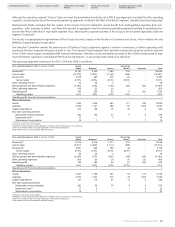

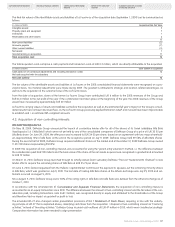

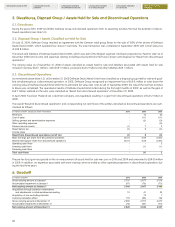

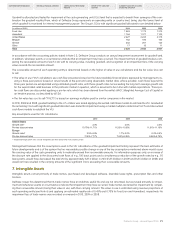

3. Segment Information

IFRS 8 applies the so-called “management approach” to segment reporting and requires the Group to report financial and descriptive infor-

mation about its reportable segments. Such reportable segments are operating segments or aggregations of operating segments that meet

specified criteria.

Operating segments are components of an entity, which engage in business activities from which they may earn revenues and incur expenses,

including revenues and expenses that relate to transactions with any of the Group’s other components, about which discrete financial informa-

tion is available that is evaluated regularly by the chief operating decision maker (CODM) in deciding how to allocate resources and in assess-

ing performance. The Group is required to report separate information about each operating segment that:

(a) has been identified as described above or results from aggregating two or more of those segments if they exhibit similar long-term finan-

cialperformanceandhavesimilareconomiccharacteristics;and

(b) exceeds certain quantitative thresholds.

Delhaize Group identified the Executive Committee as its CODM and defined operating segments based on the information provided to the

Executive Committee. Delhaize Group subsequently reviewed these operating segments to establish, if any of these individual operating

segments can be considered to have similar economic characteristics and exhibit similar long-term financial performance as described by

IFRS 8, which the standard allows to aggregate into one single operating segment. Based on this, the Group’s US operating segments have

been aggregated into one single aggregated operating segment. In a final step, reportable segments have been identified, which represent

operating segments that exceed the quantitative thresholds defined by IFRS 8, requiring individual disclosure, and aggregated those operating

segments that do not pass these thresholds, into the “Rest of World” segment.