Food Lion 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Cash Flow Statement

In 2010, net cash provided by operating

activities amounted to EUR 1 317 million,

an increase of 12.1% at actual exchange

rates (8.6% at identical exchange rates)

compared to 2009 as a result of lower

taxes paid in 2010 mainly due to the positive

impact of the debt exchange completed

in 2010 and tax optimization opportunities

in the U.S., partly offset by unfavorable

changes in operating assets and liabilities

resulting from higher receivables from

affiliated stores at Delhaize Belgium and

major improvements in working capital

realized in 2009.

Net cash used in investing activities

amounted to EUR 665 million, an increase

of 19.6% compared to 2009. This is mainly

due to capital expenditures that were

EUR 140 million higher than in prior year as

a result of intentionally delayed spending

in 2009 on store renewals in the U.S., partly

offset by less business acquisitions than in

2009.

Capital expenditures increased by 26.8%

to EUR 660 million, or 3.2% of revenues.

At identical exchange rates, capital

expenditures increased by 22.7%, mainly

due to higher store remodeling activity in

the U.S. and in Greece. In 2010, 62.0% of

total capital expenditures were invested in

the U.S. activities of the Group, 19.5% in the

Belgian operations, 11.4% in Greece; 5.8% in

the Rest of the World segment and 1.3% in

Corporate activities.

Investments in new store openings

amounted to EUR 196 million (29.7% of total

capital expenditures), an increase of 9.7%

compared to EUR 179 in 2009. Delhaize

Group invested EUR 167 million (25.3% of

capital expenditures) in store remodeling

and expansions (EUR 112 million in 2009).

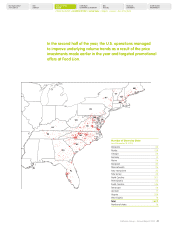

In 2010, Delhaize Group remodeled or

expanded 72 supermarkets in the U.S.,

including 31 stores in the markets of

Richmond, Virginia and Greenville, North

Carolina. In addition, 18 supermarkets were

remodeled in Belgium in 2010.

Capital spending in information

technologies, logistics and distribution,

and miscellaneous categories amounted

to EUR 297 million (45.0% of total capital

expenditures), compared to EUR 229 million

in 2009.

Net cash used in financing activities

amounted to EUR 343 million, a decrease

of EUR 153 million compared to the prior

year mainly due to the higher number of

Alfa Beta shares purchased in 2009 than in

2010 (EUR 108 million in 2009 compared to

EUR 47 million in 2010). The Group

decreased its short-term borrowings by

EUR 42 million in 2010 as a result of lower

cash needs thanks to higher free cash flow

generation during the year.

In 2010, Delhaize Group generated free

cash flow of EUR 665 million or 3.2% of

revenues, an increase of EUR 39 million

compared to last year despite higher

capital expenditures, as a result of higher

cash provided by operating activities.

Balance Sheet

At the end of 2010, Delhaize Group’s total

assets amounted to EUR 10.9 billion, 11.8%

higher than at the end of 2009, mainly as a

result of the strengthening of the US dollar

by 7.8% compared to the euro between the

two balance sheet dates.

At the end of 2010, Delhaize Group’s sales

network consisted of 2 800 stores, an

increase of 68 stores compared to 2009.

Of these stores, 331 were owned by the

Company. Delhaize Group also owned

12 warehousing facilities in the U.S., 7 in

Belgium, 4 in Greece and 2 in the Rest of

the World segment.

Capital Expenditures (in millions of EUR)

Free Cash Flow (in millions of EUR)

Net Debt (in billions of EUR)

Net Debt to Equity (in %)

2008

2008

2008

2008

2009

2009

2009

2009

2010

2010

2010

2010

714

162

2.4

57.3

660

665

1.8

35.3

520

626

2.1

46.8