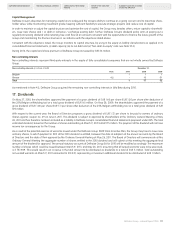

Food Lion 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

CONSOLIDATED BALANCE SHEET CONSOLIDATED INCOME

STATEMENT CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

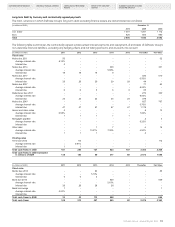

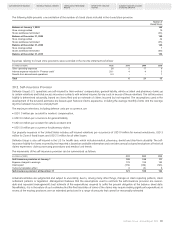

As described in Note 2.3, Delhaize Group does not enter into derivative financial instrument arrangements for speculative / trading, but rather

for hedging (both economic and accounting) purposes only. As the Group currently holds no derivatives where net settlement has been agreed,

the following table indicates the contractually agreed (undiscounted) gross interest and principal payments associated with derivative financial

instruments (assets and liabilities) at December 31, 2010:

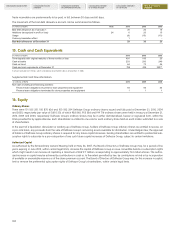

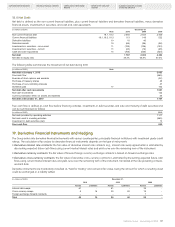

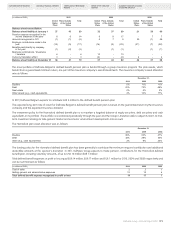

(in millions of EUR) 1 - 3 months 4 - 12 months 2012 - 2013 2014

Principal Interest Principal Interest Principal Interest Principal Interest

Interest rate swaps being part of a fair value hedge

relationship

Inflows - - - 29 - 58 - 29

Outflows - (2) - (7) - (20) - (5)

Cross-currency interest rate swaps being part of a cash

flow hedge relationship

Inflows - 7 - 7 - 27 225 7

Outflows - (15) - - - (30) (228) (15)

Cross-currency interest rate swaps without a hedging

relationship

Inflows 26 4 119 9 - 20 500 5

Outflows (26) (3) (116) (7) - (13) (502) (3)

Total Cash flows - (9) 3 31 - 42 (5) 18

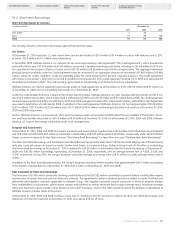

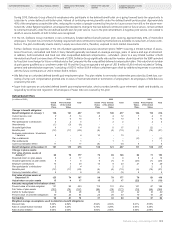

Interest Rate Swaps

Fair value hedge:

In 2007 Delhaize Group issued EUR 500 million Senior Notes with a 5.625% fixed interest rate and a 7 year term, exposing the Group to changes

in the fair value due to changes in market interest rates (see Note 18.1).

In order to hedge that risk, Delhaize America, LLC swapped 100% of the proceeds to a EURIBOR 3m floating rate for the 7 year term. The maturity

dates of interest rate swap arrangements (“hedging instrument”) match those of the underlying debt (“hedged item”). The transactions were

designated and qualify for hedge accounting in accordance with IAS 39, and were documented and reflected in the financial statements of

Delhaize Group as fair value hedges. The aim of the hedge is to transform the fixed rate Notes into variable interest debt (“hedged risk”). Credit

risks are not part of the hedging relationship. The effectiveness is tested using statistical methods in the form of a regression analysis.

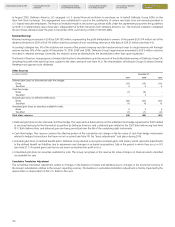

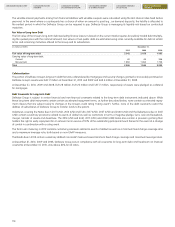

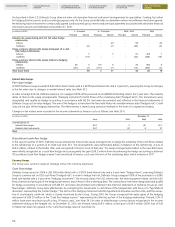

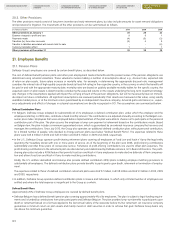

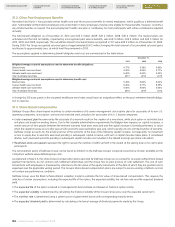

Changes in fair values were recorded in the income statement as finance costs as follows (see Note 29.1):

(in millions of EUR) December 31,

Note 2010 2009 2008

Losses (gains) on

Interest rate swaps 29.1 3 (8) (31)

Related debt instruments 29.1 (3) 8 31

Total - - -

Discontinued cash flow hedge:

In the second quarter of 2007, Delhaize Group entered into interest rate swap arrangements to hedge the variability of the cash flows related

to the refinancing of a portion of its debt (see Note 18.1). The arrangements were terminated before completion of the refinancing. A loss of

EUR 4 million, related to the tender offer, was recognized in finance costs of that year. The swap arrangements related to the new debt issue

were initially designated as a cash flow hedge and consequently the gain (EUR 2 million) from discontinuing the hedge accounting is deferred

(“Discontinued cash flow hedge reserve”) and amortized to finance costs over the term of the underlying debt, which matures in 2017.

Currency Swaps

The Group uses currency swaps to manage some of its currency exposures.

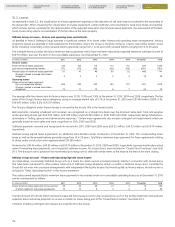

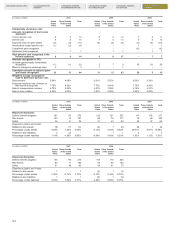

Cash flow hedge:

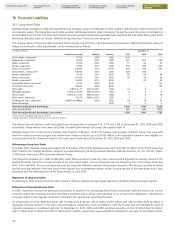

Delhaize Group issued in 2009 a USD 300 million Bond with a 5.875% fixed interest rate and a 5 year term (“hedged item”), exposing Delhaize

Group to currency risk on USD cash flows (“hedged risk”). In order to hedge that risk, Delhaize Group swapped 100% of the proceeds to a EURO

fixed rate liability with a 5 year term (“hedging instrument”). The maturity dates, the USD interest rate, the interest payment dates, and the USD

flows (interest and principal) of the hedging instrument, match those of the underlying debt. The transactions have been designated and qualify

for hedge accounting in accordance with IAS 39, and were documented and reflected in the financial statements of Delhaize Group as cash

flow hedges. Delhaize Group tests effectiveness by comparing the movements in cash flows of the hedged item with those of a “hypothetical

derivative” representing the “perfect hedge.” The terms of the hedging instrument and the hypothetical derivative are the same, with the excep-

tion of counterparty credit risk, which is closely monitored by the Group. During 2010, the Group recognized fair value gains of the hedging

instrument of EUR 23 million in the “Cash flow hedge reserve,” representing the effective portion of the hedging relationship. Thereof, EUR 15

million have been recycled to profit or loss (“Finance costs,” see Note 29.1) in order to offset foreign currency losses recognized in the income

statement relating to the hedged risk. At December 31, 2010, net of taxes, being EUR 3 million, a total gain of EUR 5 million (2009: loss of EUR

6 million) has been recognized in the “Cash flow hedge reserve” (see Note 16).