Food Lion 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delhaize Group - Annual Report 2010 121

SUPPLEMENTARY INFORMATION HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS REPORT OF THE STATUTORY

AUDITOR SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

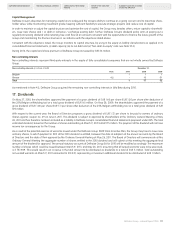

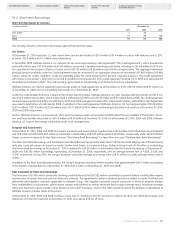

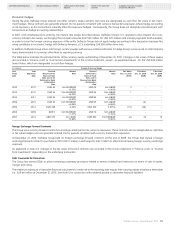

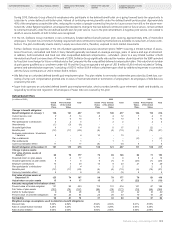

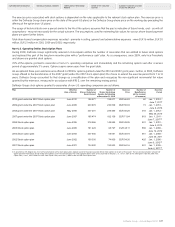

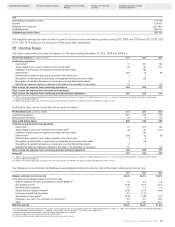

The following table presents a reconciliation of the number of closed stores included in the closed store provision:

Number of

Closed Stores

Balance at January 1, 2008 168

Store closings added 19

Stores sold/lease terminated (38)

Balance at December 31, 2008 149

Store closings added 32

Stores sold/lease terminated (35)

Balance at December 31, 2009 146

Store closings added 7

Stores sold/lease terminated (49)

Balance at December 31, 2010 104

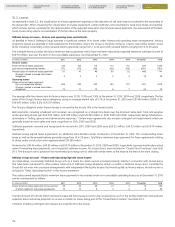

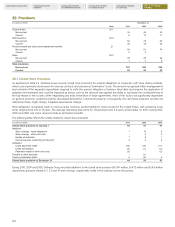

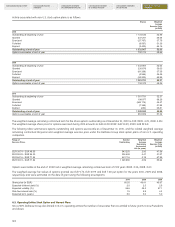

Expenses relating to closed store provisions were recorded in the income statement as follows:

(in millions of EUR) Note 2010 2009 2008

Other operating expenses 28 2 17 9

Interest expense included in “Finance costs” 29.1 4 4 3

Results from discontinued operations 5.3 - - 1

Total 6 21 13

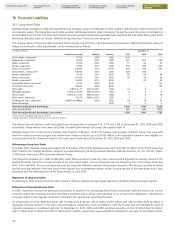

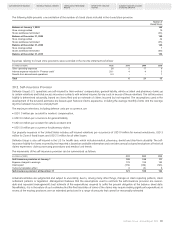

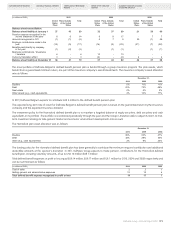

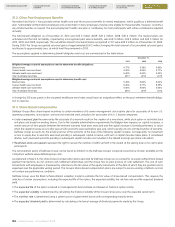

20.2. Self-insurance Provision

Delhaize Group’s U.S. operations are self-insured for their workers’ compensation, general liability, vehicle accident and pharmacy claims up

to certain retentions and holds excess-insurance contracts with external insurers for any costs in excess of these retentions. The self-insurance

liability is determined actuarially, based on claims filed and an estimate of claims incurred but not reported. The assumptions used in the

development of the actuarial estimates are based upon historical claims experience, including the average monthly claims and the average

lag time between incurrence and payment.

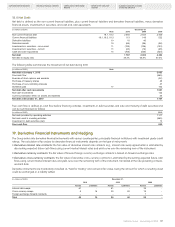

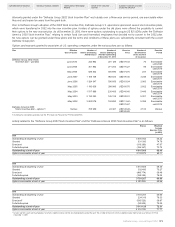

The maximum retentions, including defense costs per occurrence, are:

•USD1.0millionperaccidentforworkers’compensation;

•USD3.0millionperoccurrenceforgeneralliability,

•USD3.0millionperaccidentforvehicleaccident,and

•USD5.0millionperoccurrenceforpharmacyclaims.

Our property insurance in the United States includes self-insured retentions per occurrence of USD 10 million for named windstorms, USD 5

million for Zone A flood losses and USD 2.5 million for all other losses.

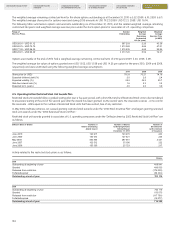

Delhaize Group is also self-insured in the U.S. for health care, which includes medical, pharmacy, dental and short-term disability. The self-

insurance liability for claims incurred but not reported is based on available information and considers annual actuarial evaluations of historical

claims experience, claims processing procedures and medical cost trends.

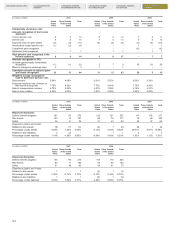

The movements of the self-insurance provision can be summarized as follows:

(in millions of EUR) 2010 2009 2008

Self-insurance provision at January 1 108 122 111

Expense charged to earnings 179 158 153

Claims paid (174) (169) (148)

Currency translation effect 8 (3) 6

Self-insurance provision at December 31 121 108 122

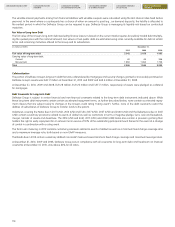

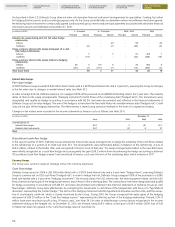

Actuarial estimates are judgmental and subject to uncertainty, due to, among many other things, changes in claim reporting patterns, claim

settlement patterns or legislation. Management believes that the assumptions used to estimate the self-insurance provision are reason-

able and represent management’s best estimate of the expenditures required to settle the present obligation at the balance sheet date.

Nonetheless, it is in the nature of such estimates that the final resolution of some of the claims may require making significant expenditures in

excess of the existing provisions over an extended period and in a range of amounts that cannot be reasonably estimated.