Food Lion 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

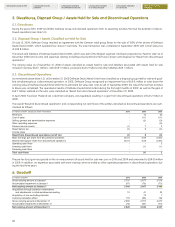

Delhaize Group - Annual Report 2010 91

SUPPLEMENTARY INFORMATION HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS REPORT OF THE STATUTORY

AUDITOR SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

•TheGroupgenerateslimitedrevenuesfromfranchise fees, which are recognized in net sales when the services are provided or franchise

rights used.

•Forcertainproductsorservices,suchasthesaleoflotterytickets,third-partyprepaidphonecards,etc.,DelhaizeGroupactsasanagent

and consequently records the amount of commission income in its net sales.

•Rental income from investment property is recognized in profit or loss on a straight-line basis over the term of the lease and included in

“Other operating income” (Note 27).

•Interest Income is recognized as interest accrues (using the effective interest method) and is included in “Income from investments” (Note

29.2).

•Dividend income is recognized when the Group’s right to receive the payment is established. The income is included in “Income from invest-

ments” (Note 29.2).

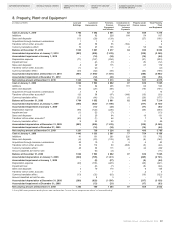

Cost of Sales

Cost of sales includes purchases of products sold and all costs associated with getting the products into the retail stores, including buy-

ing, warehousing and transportation costs. Finally, cost of sales includes appropriate vendor allowances (see also accounting policy for

“Inventories” above).

Selling, General and Administrative Expenses

Selling, general and administrative expenses include store operating expenses, costs incurred for activities which serve securing sales, admin-

istrative and advertising expenses.

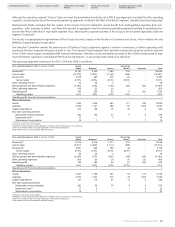

Segment Reporting

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision maker (CODM),

who is responsible for allocating resources and assessing performance of the operating segments. At Delhaize Group the CODM has been

identified to be the Executive Committee (see Note 3).

2.4. Significant Use of Estimates, Assumptions and Judgment

The preparation of financial statements in conformity with IFRS requires Delhaize Group to make judgments, estimates and assumptions that

affect the application of accounting policies and the reported amounts of assets, liabilities and income and expenses, which inherently contain

some degree of uncertainty. These estimates are based on experience and assumptions Delhaize Group believes to be reasonable under the

circumstances. By definition, actual results could and will often differ from these estimates. In the past, the Group’s estimates generally have

not deviated significantly from actual results. Revisions to accounting estimates are recognized in the period in which the estimates are revised

and in any future periods affected.

Information about significant areas of estimation uncertainty and critical judgments in applying accounting policies that have the most signifi-

cant effect on the amounts in the consolidated financial statements is included in, but not limited to, the following notes:

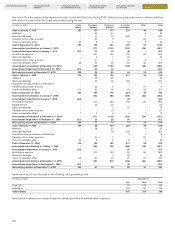

•Note3-Identificationandaggregationofoperatingsegments;

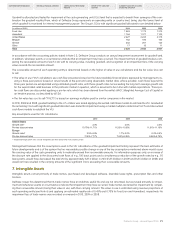

•Notes5.2,5.3-DisposalGroupClassifiedasHeldforSaleandDiscontinuedOperations;

•Notes6,7,8,11,14,19-Assessingassetsforimpairmentandfairvaluesoffinancialinstruments;

•Notes13,25-Accountingforvendorallowances;

•Note18.3-Classificationofleases;

•Note20-Provisions;

•Note21-EmployeeBenefits;

•Note22-IncomeTaxes.

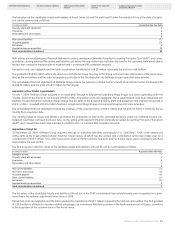

2.5. Standards and Interpretations Issued but not yet Effective

The following standards, amendments to or revisions of existing standards or interpretations have been published and are mandatory for the

Group’s accounting periods beginning on January 1, 2011 or later periods, but Delhaize Group has not early adopted them:

•IFRS9

Financial Instruments

(applicable for annual periods beginning on or after January 1, 2013): On November 12, 2009, the IASB published

the first part of IFRS 9, the accounting standard that will eventually replace IAS 39

Financial Instruments: Recognition and Measurement

. The

revised guidance included in IFRS 9 relates to classification and measurement of financial assets alone and applies a “business model” and

“characteristics of the financial asset” test to assess if, after initial recognition at fair value, a financial asset is subsequently measured at

amortized cost or at fair value. Most significant for the Group, debt instruments may be subsequently measured at amortized cost if the asset

is held within a business model whose objective is to hold the assets to collect the contractual cash flows and the contractual terms of the

financial asset give rise, on specified dates, to cash flows that are solely payments of principal and interest on the principal outstanding. All

other debt instruments are subsequently measured at fair value.

During 2010, Delhaize Group continued to scrutinize the revised guidance in order to assess the full impact IFRS 9 might have on its consoli-

dated financial statements. The Group believes that IFRS 9 will result in a change of the accounting of most of the Group’s available-for-sale

investments (see Note 11), to amortized cost measurement category of IFRS 9, while they are currently measured at fair value through OCI.