Food Lion 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

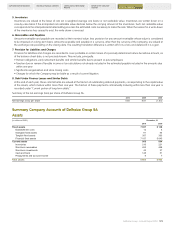

Delhaize Group - Annual Report 2010 139

SUPPLEMENTARY INFORMATION HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS REPORT OF THE STATUTORY

AUDITOR SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

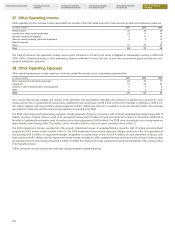

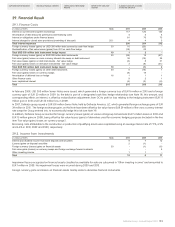

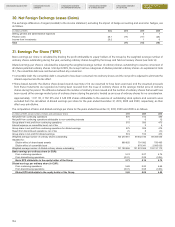

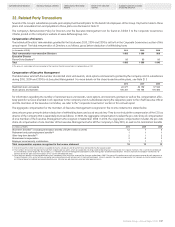

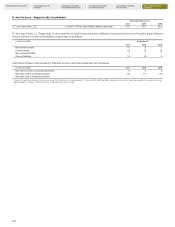

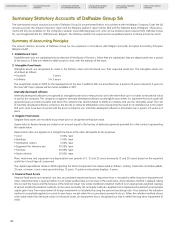

35. Subsequent Events

In February 2011, Delhaize Group has been notified that some former Greek shareholders of Alfa Beta Vassilopoulos S.A., who together held

7% of Alfa Beta shares, have filed a claim in front of the Court of First Instance of Athens challenging the price paid by the Group during the

squeeze-out process that was approved by the Hellenic Capital Markets Commission. Delhaize Group is convinced that the squeeze-out trans-

action has been executed and completed in compliance with all legal and regulatory requirements. The Group is currently in the process of

reviewing the merits and any potential exposure of this claim and will vigorously defend itself. The first hearing has been scheduled in October

2013.

On March 3, 2011, Delhaize Group announced the signing of an agreement to acquire 100% of the registered share capital and voting rights

of Delta Maxi Group, a retail company operating more than 450 stores in five countries in Southeastern Europe. The agreed total purchase

price amounts to EUR 933 million, including net debt of approximately EUR 300 million. The acquisition is subject to mutually agreed upon

and customary conditions, including the approval by the merger control authorities in Serbia, Bulgaria, Montenegro and Albania. Delhaize

Group expects to close the deal in the third quarter of 2011, as from which date Delta Maxi Group will be fully consolidated into the Group’s

consolidated financial statements.