Food Lion 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

CONSOLIDATED BALANCE SHEET CONSOLIDATED INCOME

STATEMENT CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

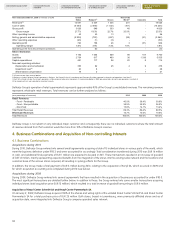

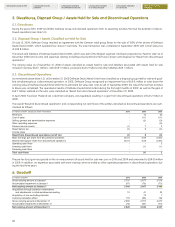

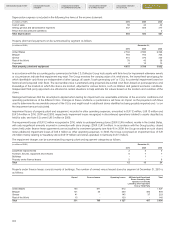

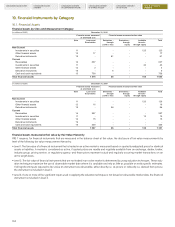

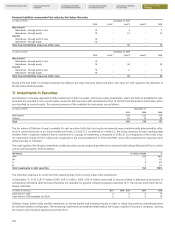

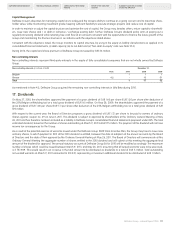

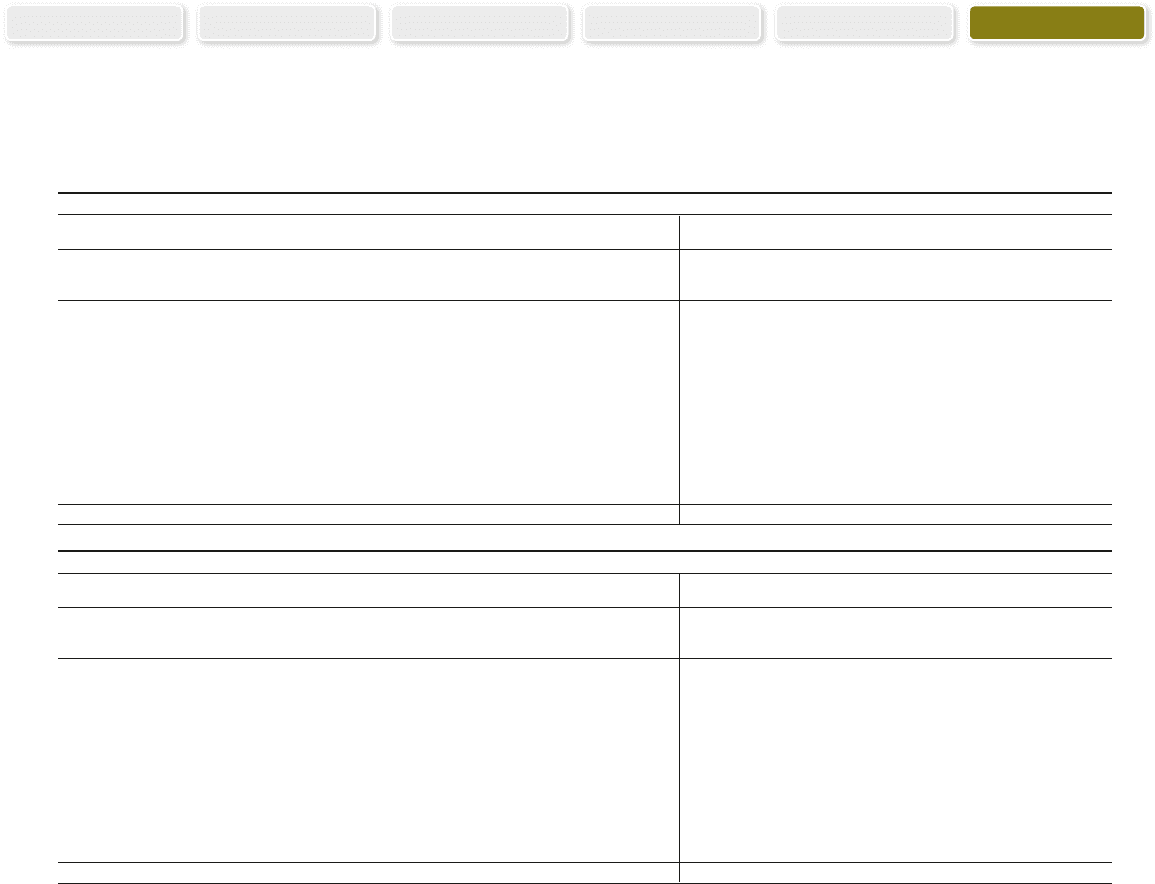

10. Financial Instruments by Category

10.1. Financial Assets

Financial Assets by Class and Measurement Category

(in millions of EUR) December 31, 2010

Financial assets measured Financial assets measured at fair value

at amortized cost

Note Loans and Derivatives - Derivatives - Available Total

Receivables through through for sale -

profit or loss equity through equity

Non-Current

Investments in securities 11 - - - 125 125

Other financial assets 12 17 - - - 17

Derivative instruments 19 - 61 - - 61

Current

Receivables 14 637 - - - 637

Investments in securities 11 - - - 43 43

Other financial assets 12 3 - - - 3

Derivative instruments 19 - 5 - - 5

Cash and cash equivalents 15 758 - - - 758

Total financial assets 1 415 66 - 168 1 649

(in millions of EUR)

December 31, 2009

Financial assets measured Financial assets measured at fair value

at amortized cost

Note Loans and Derivatives - Derivatives - Available Total

Receivables through through for sale -

profit or loss equity through equity

Non-Current

Investments in securities 11 - - - 126 126

Other financial assets 12 16 - - - 16

Derivative instruments 19 - 96 - - 96

Current

Receivables 14 597 - - - 597

Investments in securities 11 - - - 12 12

Other financial assets 12 15 - - - 15

Derivative instruments 19 - - - - -

Cash and cash equivalents 15 439 - - - 439

Total financial assets 1 067 96 - 138 1 301

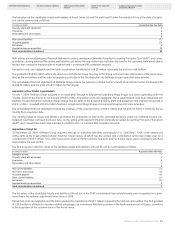

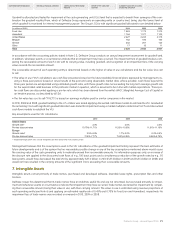

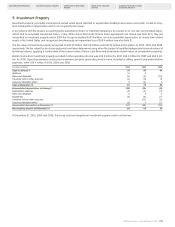

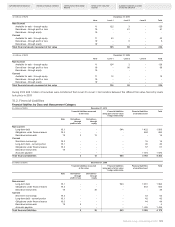

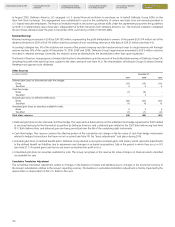

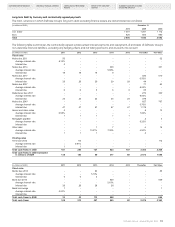

Financial Assets measured at fair value by Fair Value Hierarchy

IFRS 7 requires, for financial instruments that are measured in the balance sheet at fair value, the disclosure of fair value measurements by

level of the following fair value measurement hierarchy:

•Level1:Thefairvalueofafinancialinstrumentthatistradedinanactivemarketismeasuredbasedonquoted(unadjusted)pricesforidentical

assets or liabilities. A market is considered as active, if quoted prizes are readily and regularly available from an exchange, dealer, broker,

industry group, pricing service, or regulatory agency, and those prices represent actual and regularly occurring market transactions on an

arm’s length basis.

•Level2:Thefairvalueoffinancialinstrumentsthatarenottradedinanactivemarketisdeterminedbyusingvaluationtechniques.Thesevalu-

ation techniques maximize the use of observable market date where it is available and rely as little as possible on entity specific estimates.

If all significant inputs required to fair value an instrument are observable, either directly (i.e. as prices) or indirectly (i.e. derived from prices),

the instrument is included in level 2.

•Level3:Ifoneormoreofthesignificantinputsusedinapplyingthevaluationtechniqueisnotbasedonobservablemarketdate,thefinancial

instrument is included in level 3.