Food Lion 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

CONSOLIDATED BALANCE SHEET CONSOLIDATED INCOME

STATEMENT CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

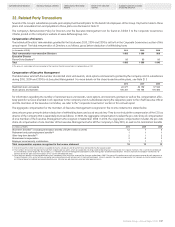

TheweightedaverageremainingcontractualtermfortheshareoptionsoutstandingasatDecember31,2010is5.52(2009:6.18;2008:6.67).

Theweightedaveragesharepriceforoptionsexercisedduring2010amountstoUSD79.22(2009:USD72.21;2008:USD76.14).

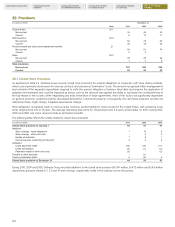

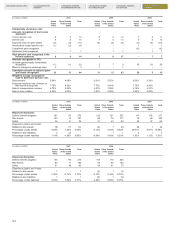

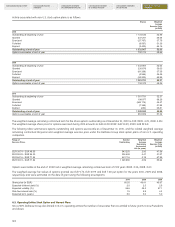

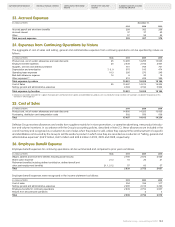

The following table summarizes options and warrants outstanding as of December 31, 2010, and the related weighted average remaining

contractual life (years) and weighted average exercise price under the stock option plans for associates of U.S. operating companies:

Range of Number Weighted Weighted

Exercise Prices Outstanding Average Average

Remaining Exercise Price

Contractual (in USD)

Life (in years)

USD 28.91 - USD 51.12 587 203 2.26 43.39

USD 60.76 - USD 74.76 1 510 088 5.84 67.01

USD 77.92 - USD 96.30 1 215 835 6.68 92.86

USD 28.91 - USD 96.30 3 313 126 5.52 72.31

Optionsexercisableattheendof2010hadaweightedaverageremainingcontractualtermof4.90years(2009:5.40;2008:5.49).

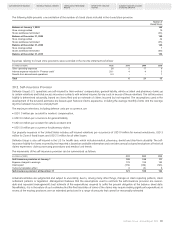

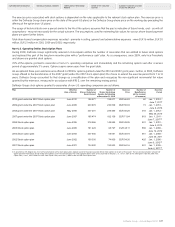

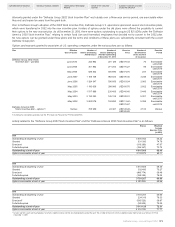

The weighted average fair values of options granted were USD 13.03, USD 12.88 and USD 14.35 per option for the years 2010, 2009 and 2008,

respectively and were estimated using the following weighted average assumptions:

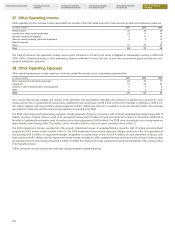

2010 2009 2008

Share price (in USD) 78.33 70.27 74.76

Expected dividend yield (%) 2.5 2.6 2.4

Expected volatility (%) 25.2 26.3 25.7

Risk-free interest rate (%) 1.6 2.3 3.2

Expected term (years) 4.0 4.0 3.9

U.S. Operating Entities Restricted Stock Unit Awards Plan

Restricted stock unit awards follow a graded vesting plan over a five-year period, with a first 25% tranche of Restricted Stock Units to be transferred

to associates starting at the end of the second year after the award has been granted. As the award vests, the associate receives - at no cost for

the associate - ADRs equal to the number of Restricted Stock Units that have vested, free of any restriction.

In May 2002, Delhaize America, LLC ceased granting restricted stock awards under the "2000 Stock Incentive Plan" and began granting restricted

stock unit awards under the "2002 Restricted Stock Unit Plan."

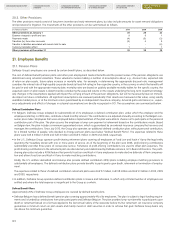

Restricted stock unit awards granted to associates of U.S. operating companies under the “Delhaize America 2002 Restricted Stock Unit Plan” are

as follows:

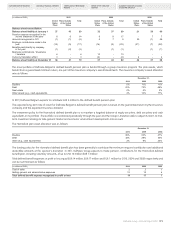

Effective Date of Grants Number of Number of Shares Number of

Shares Underlying Underlying Awards Beneficiaries

Award Issued Outstanding at (at the moment

December 31, 2010 of issuance)

June 2010 123 917 120 270 243

June 2009 150 073 127 821 245

May 2008 466 503 287 661 3 421

June 2007 102 512 35 636 222

June 2006 155 305 25 723 217

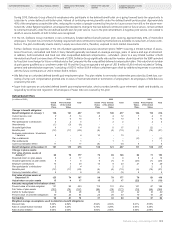

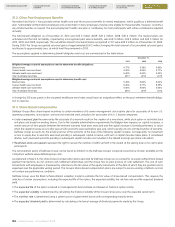

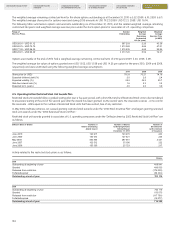

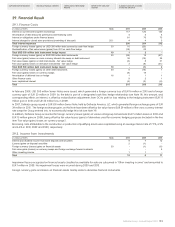

Activity related to the restricted stock plans is as follows:

Shares

2008

Outstanding at beginning of year 468 941

Granted 466 503

Released from restriction (174 000)

Forfeited/expired (58 334)

Outstanding at end of year 703 110

2009

Outstanding at beginning of year 703 110

Granted 150 073

Released from restriction (117 756)

Forfeited/expired (19 077)

Outstanding at end of year 716 350