Food Lion 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

CONSOLIDATED BALANCE SHEET CONSOLIDATED INCOME

STATEMENT CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

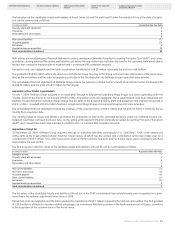

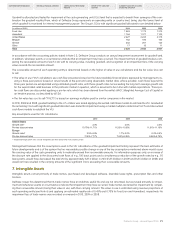

From the date of acquisition, the acquired stores have contributed EUR 3 million to the 2009 revenues of the Group and - mainly due to the

conversion process - EUR (1) million to the net profit of the year. If the combination had taken place at the beginning of the year, the 2009 rev-

enues of the Group would have increased by approximately EUR 26 million.

Koryfi SA applied Greek Generally Accepted Accounting Principles (“Greek GAAP”) before the acquisition by the Group. Consequently, the car-

rying values of assets and liabilities just before the acquisition, as well as the estimated full year impact on Group’s consolidated results, have

not been disclosed here due to the fact that it would be impracticable to establish and / or estimate IFRS compliant amounts.

Acquisitions during 2008

Acquisition of P.L.L.C.

On February 14, 2008, Delhaize Group acquired 100% of the shares and voting rights of P.L.Logistics Center – Dianomes – Apothikefsis - Logistics

(P.L.L.C.) for an amount of EUR 12 million. This company owns mainly land and construction permits at Inofyta, Greece, where a new distribution

center of fresh products is currently under construction. The fair value of the acquired land amounted to EUR 9 million and goodwill of EUR 5 mil-

lion has been recognized. P.L.L.C. has been included in the consolidated financial statements since February 14, 2008.

Acquisition of Plus Hellas

On April 1, 2008, Delhaize Group acquired, through its subsidiary Alfa Beta, 100% of the shares and voting rights of the Greek retailer “Plus

Hellas,” a fully-owned subsidiary of the Tengelmann Group. The initial acquisition price of EUR 70 million was subsequently adjusted to

EUR 65 million based on the terms of the agreement between the two parties. The Plus Hellas network consisted of 34 stores and a distribution

center, whereby 11 stores and the distribution center are owned. During 2008, five Plus Hellas stores have been closed and the remaining 29

have been converted to Alfa Beta banners.

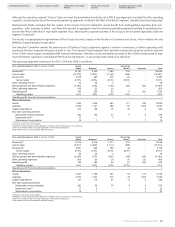

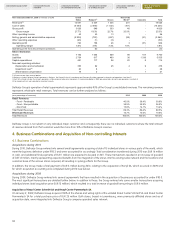

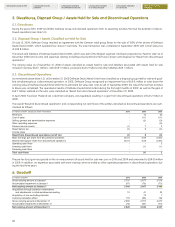

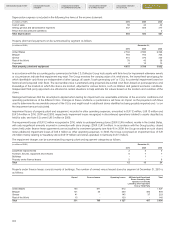

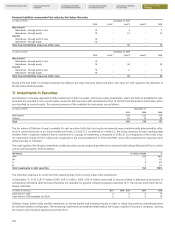

The final acquisition date (April 1, 2008) fair values of the identifiable assets and liabilities of Plus Hellas can be summarized as follows:

(in millions of EUR) Acquisition Date Fair Value

Intangible assets 2

Property, plant and equipment 67

Other non-current assets 3

Inventories 8

Receivables and other assets 2

Cash and cash equivalents 1

83

Non-current liabilities (10)

Accounts payable (18)

Other current liabilities (4)

Net assets 51

Goodwill arising on acquisition 14

Total acquisition cost 65

The total acquisition costs comprised a cash payment and transaction costs of EUR 0.5 million, which were directly attributable to the acquisi-

tion.

(in millions of EUR) Cash outflow on acquisition

Cash paid (net of contractual adjustments and including transaction costs) 65

Net cash acquired with the subsidiary (1)

Net cash outflow 64

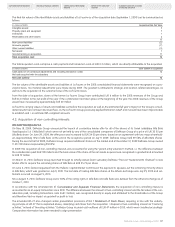

The recognized goodwill is attributed to the expected synergies, acquired customer base and other benefits from combining the assets and

retail activities of Plus Hellas with those of the Group.

From the date of acquisition, Plus Hellas has contributed EUR 36 million to the Group’s 2008 revenues and EUR (6) million to the net profit of the

year. If the combination had taken place at the beginning of the year, the 2008 revenues of the Group would have increased by approximately

EUR 24 million.

Plus Hellas applied “Greek GAAP” before the acquisition by the Group. Consequently, the carrying values of assets and liabilities just before

the acquisition, as well as the estimated full year impact on the Group’s consolidated results, have not been disclosed here due to the fact that

it would be impracticable to establish and / or estimate IFRS compliant amounts.

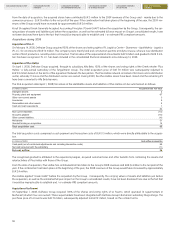

Acquisition of La Fourmi

On September 1, 2008, Delhaize Group acquired 100% of the shares and voting rights of La Fourmi, which operated 14 supermarkets in

Bucharest (of which four are owned). These supermarkets have been integrated with Delhaize Group’s Romanian subsidiary Mega Image. The

purchase price of La Fourmi was EUR 19 million, subsequently adjusted to EUR 12 million, based on the contract terms.