Food Lion 2010 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delhaize Group - Annual Report 2010 149

SUPPLEMENTARY INFORMATION HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS REPORT OF THE STATUTORY

AUDITOR

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

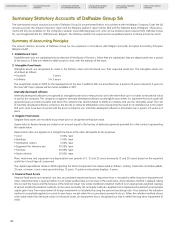

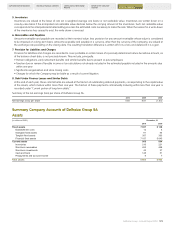

5. Inventories

Inventories are valued at the lower of cost (on a weighted average cost basis) or net realizable value. Inventories are written down on a

case-by-case basis if the anticipated net realizable value declines below the carrying amount of the inventories. Such net realizable value

corresponds to the anticipated estimated selling price less the estimated costs necessary to make the sale. When the reason for a write-down

of the inventories has ceased to exist, the write-down is reversed.

6. Receivables and Payables

Amounts receivable and payable are recorded at their nominal value, less provision for any amount receivable whose value is considered

to be impaired on a long-term basis. Amounts receivable and payable in a currency, other than the currency of the Company, are valued at

the exchange rate prevailing on the closing date. The resulting translation difference is written off if it is a loss and deferred if it is a gain.

7. Provision for Liabilities and Charges

Provision for liabilities and charges are recorded to cover probable or certain losses of a precisely determined nature but whose amount, as

of the balance sheet date, is not precisely known. They include, principally:

•Pensionobligations,earlyretirementbenefitsandsimilarbenefitsduetopresentorpastemployees

•Taxationdueonreviewoftaxableincomeortaxcalculationsnotalreadyincludedintheestimatedpayableincludedintheamountsdue

within one year

•Significantreorganizationandstoreclosingcosts

•ChargesforwhichtheCompanymaybeliableasaresultofcurrentlitigation.

8. Debt Under Finance Leases and Similar Debts

At the end of each year, these commitments are valued at the fraction of outstanding deferred payments, corresponding to the capital value

of the assets, which mature within more than one year. The fraction of these payments contractually maturing within less than one year is

recorded under “Current portion of long-term debts.”

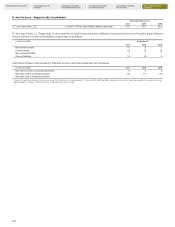

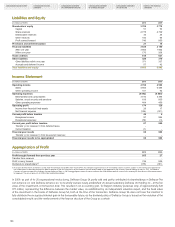

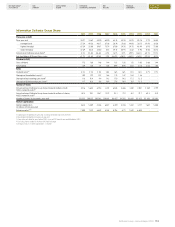

Summary of the net earnings (loss) per share of Delhaize Group SA:

2010 2009 2008

Net earnings (loss) per share 0.65 9.81 (1.53)

Summary Company Accounts of Delhaize Group SA

Assets

(in millions of EUR) December, 31

2010 2009

Fixed assets 7 697 6 138

Establishment costs 12 6

Intangible fixed assets 111 94

Tangible fixed assets 387 393

Financial fixed assets 7 187 5 645

Current assets 908 804

Inventories 216 221

Short-term receivables 493 488

Short-term investments 42 37

Cash and bank 148 51

Prepayments and accrued income 9 7

Total assets 8 605 6 942