Food Lion 2010 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

(USD

in millions

except

per share

amounts)

(4)

(EUR in millions

except per

share amounts)

Change vs

Prior Year

2010 2010 2009 2008 2010 2009

Results

Revenues

27 641 20 850 19 938 19 024 4.6% 4.8%

Operating profit

1 358 1 024 942 904 8.7% 4.2%

Net profit from continuing operations

764 576 512 485 12.5% 5.5%

Net profit (Group share)

762 574 514 467 11.7% 10.1%

Free cash flow(1)(5)

882 665 626 162 6.5% 286.2%

Financial position

Total assets

14 453 10 902 9 748 9 700 11.8% 0.5%

Total equity

6 720 5 069 4 409 4 195 15.0% 5.1%

Net debt(1)

2 369 1 787 2 063 2 402 -13.4% -14.1%

Enterprise value(1)(3)

9 810 7 400 7 472 6 849 -1.0% 9.1%

Per share information (in EUR)

Group share in net profit (basic)(2)

7.60 5.73 5.16 4.70 11.2% 9.6%

Group share in net profit (diluted)(2)

7.53 5.68 5.08 4.59 11.7% 10.8%

Free cash flow(1)(2)(5)

8.80 6.64 6.26 1.63 6.0% 284.6%

Net dividend

1.71 1.29 1.20 1.11 7.5% 8.1%

Shareholders’ equity(3)

66.17 49.91 43.54 41.19 14.6% 5.7%

Share price (year-end)

73.27 55.27 53.62 44.20 3.1% 21.3%

Ratios (%)

Operating margin

4.9% 4.7% 4.8% +19bps -3bps

Net margin

2.8% 2.6% 2.5% +18bps 12bps

Net debt to equity(1)

35.3% 46.8% 57.3% -115ppt -105ppt

Currency information

Average EUR per USD rate

0.7543 0.7169 0.6799 5.2% 5.4%

EUR per USD rate at year-end

0.7484 0.6942 0.7185 7.8% -3.4%

Other information

Number of sales outlets

2 800 2 732 2 673 2.5% 2.2%

Capital expenditures

660 520 714 26.8% -27.1%

Number of associates (thousands)

138 138 141 -0.7% -2.0%

Full-time equivalents (thousands)

102 104 106 -1.5% -2.3%

Weighted average number of shares

(thousands)

100 271 99 803 99 385 0.5% 0.4%

(1) These are non-GAAP financial measures.

(2) Calculated using the weighted average number of shares over the year.

(3) Calculated using the total number of shares at the end of the year.

(4) Calculated using an exchange rate of 1 EUR = 1.3257 USD.

(5) Reclassification of cash flows resulting from the acquisition of non-controlling interests

from “Investing” to “Financing” due to a change in IFRS.

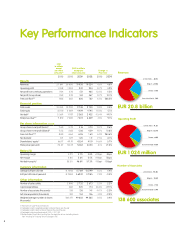

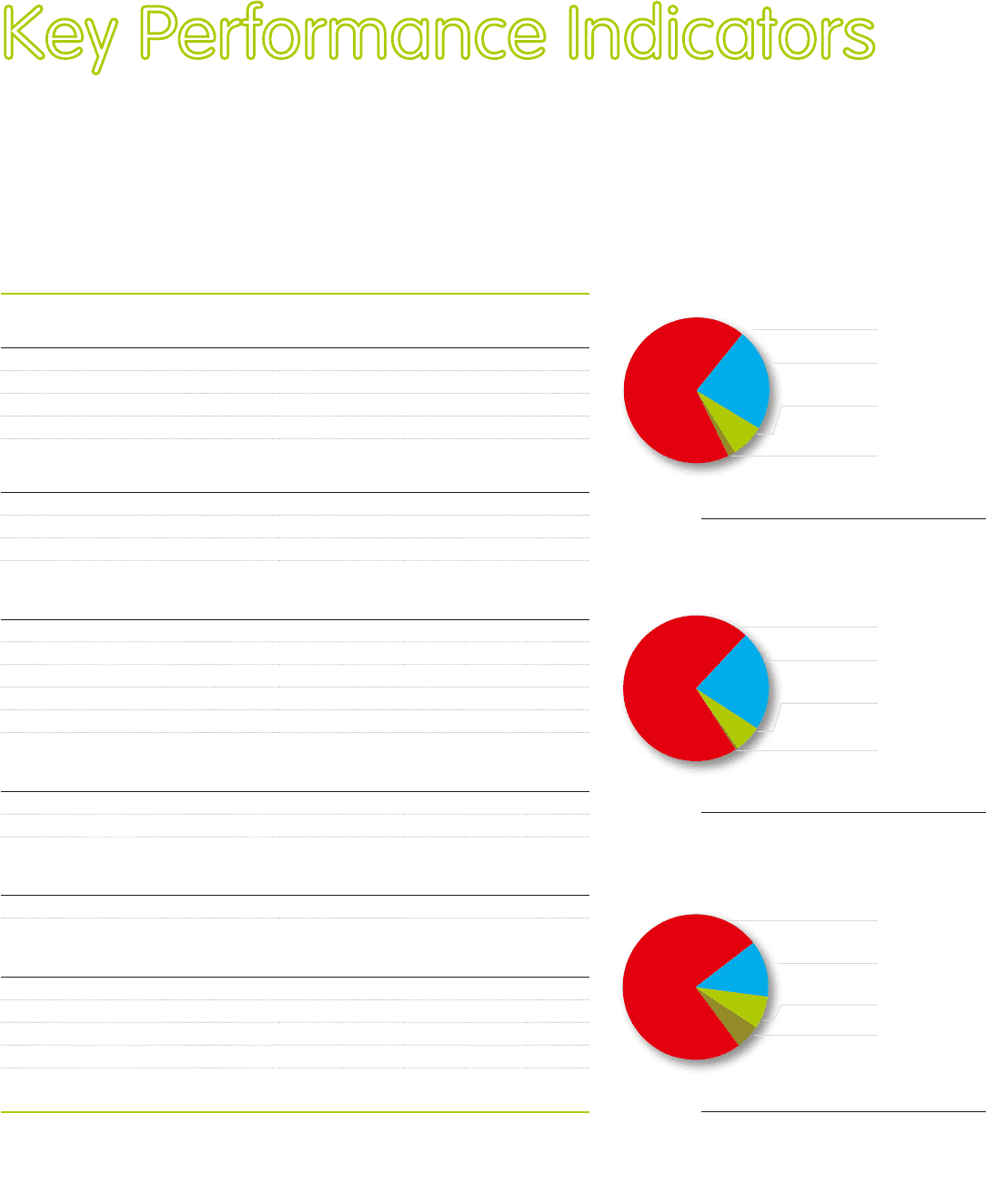

Key Performance Indicators

EUR 20.8 billion

United States - 68.1%

United States - 71.2%

Rest of the World - 1.4%

Rest of the World - 0.5%

Rest of the World - 5.4%

Greece - 7.5%

Greece - 6.0%

Belgium - 23.0%

Belgium - 22.3%

Revenues

EUR 1 024 million

Operating Profit

138 600

associates

United States - 74.8%

Greece - 7.2%

Belgium - 12.6%

Number of Associates