Food Lion 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delhaize Group - Annual Report 2010 37

At the end of 2010, total equity had

increased by 15.0% to EUR 5.1 billion

as a result of the net profit and other

comprehensive income of the year and

favorable impact of stock option activity

offset partly by the payment of dividends

of EUR 162 million and the purchase of

non controlling interests (EUR 47 million).

The number of Delhaize Group shares,

including treasury shares, increased in 2010

by 684 655 newly issued shares to 102

million. Delhaize Group owned 988 860

treasury shares at the end of 2010.

At the end of 2010, Delhaize Group’s

net debt amounted to EUR 1.8 billion, a

decrease of EUR 276 million compared

to EUR 2.1 billion at the end of December

2009, mainly as a result of strong free cash

flow generation.

At the end of 2010, Delhaize Group had

total annual minimum operating lease

commitments for 2011 of EUR 269 million,

including EUR 13 million related to closed

stores. These leases generally have terms

that range between 1 and 40 years with

renewal options ranging from 3 to 36 years.

Events after Balance Sheet Date

In February 2011, Delhaize Group has

been notified that some Greek former

shareholders of Alfa Beta Vassilopoulos

S.A. have filed a claim in front of the Court

of First Instance of Athens challenging the

price paid by Delhaize Group during the

squeeze-out process that was approved by

the Hellenic Capital Markets Commission.

Please refer to Note 35 for more information

related to this matter.

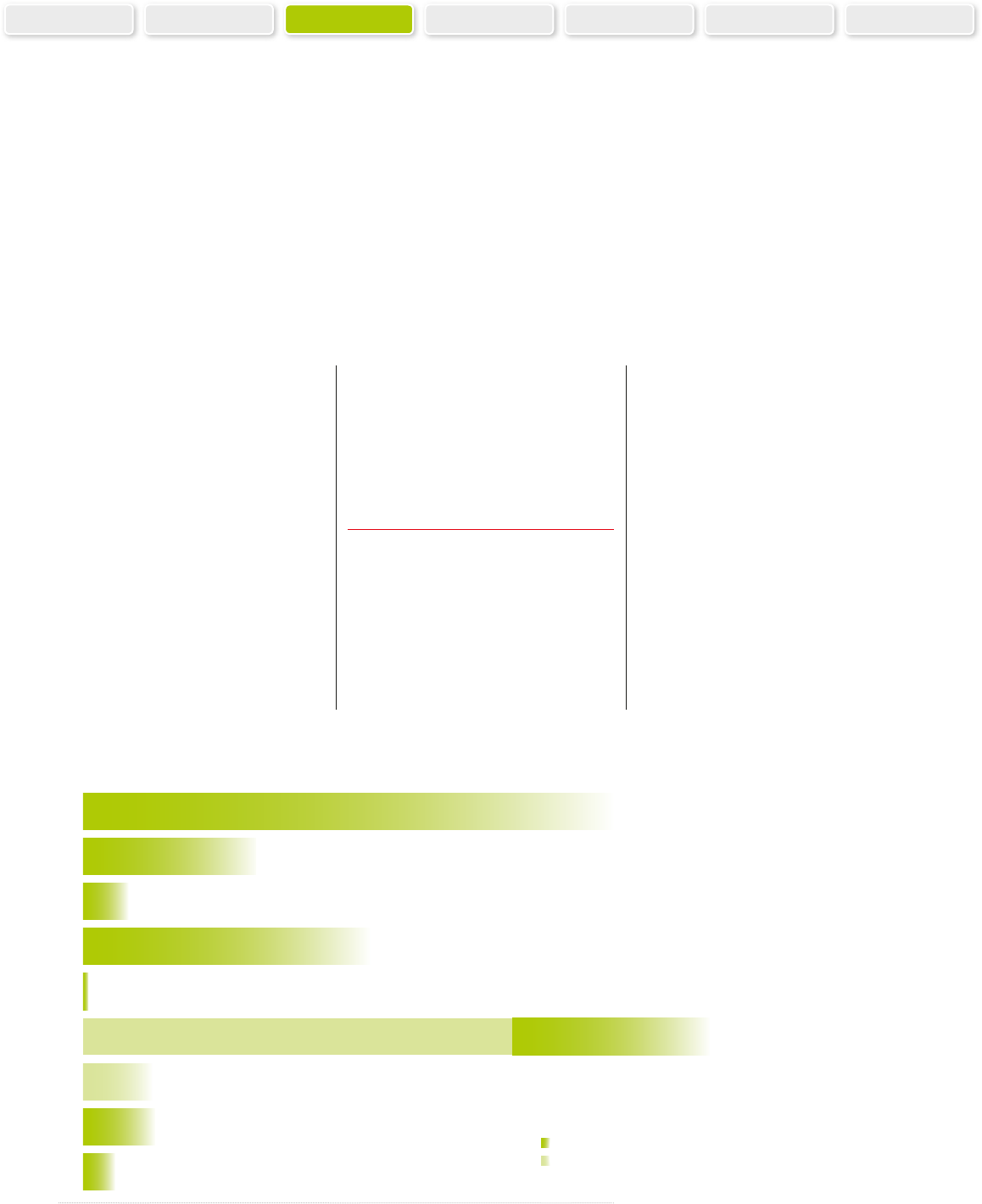

(1) Excluding finance leases; principal payments (related premiums and discounts not taken into account) after effect of cross-currency interest rate swaps.

Debt Maturity Profile Delhaize Group(1) as of December 31, 2010 (in millions of EUR)

2013

2011

2014

2012

2016

2017

2027

2031

2040

619

203

53

337

7

502

80

85

39

229

USD Denominated Long Term Debt

EUR Denominated Long Term Debt

On March 3, 2011, Delhaize Group

announced to have reached an agreement

to acquire 100% of the Serbian retailer

Delta Maxi Group, an acquisition that will

make Delhaize Group a leading retailer in

Southeastern Europe. Through combining

Delta Maxi Group with its existing network

in Greece and Romania, Delhaize Group

expects to generate approximately

EUR 3.4 billion in annual sales through 800

stores at the end of 2011. The transaction is

expected to be closed in the third quarter

of 2011.

DELHAIZE GROUP

AT A GLANCE OUR

STRATEGY OUR ACTIVITIES

IN 2010 CORPORATE

GOVERNANCE STATEMENT RISK

FACTORS FINANCIAL

STATEMENTS SHAREHOLDER

INFORMATION

> FINANCIAL REVIEW > BUSINESS REVIEW > United States > Belgium > Greece > Rest of the World