Food Lion 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delhaize Group - Annual Report 2010 133

SUPPLEMENTARY INFORMATION HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS REPORT OF THE STATUTORY

AUDITOR SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

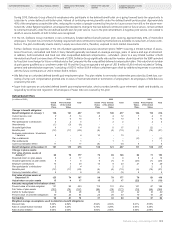

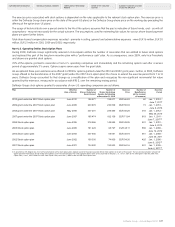

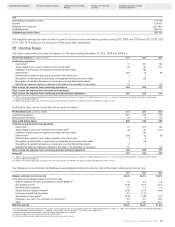

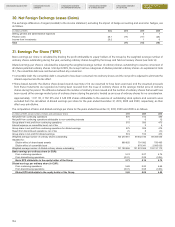

23. Accrued Expenses

(in millions of EUR) December 31,

2010 2009 2008

Accrued payroll and short-term benefits 299 302 286

Accrued interest 37 37 40

Other 57 58 52

Total accrued expenses 393 397 378

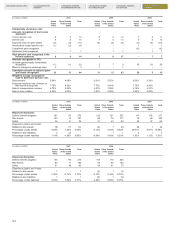

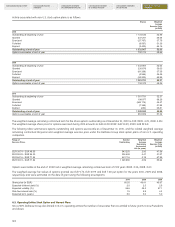

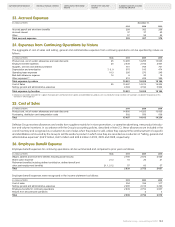

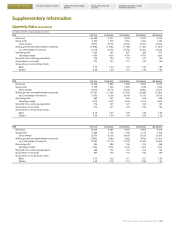

24. Expenses from Continuing Operations by Nature

The aggregate of cost of sales and selling, general and administrative expenses from continuing operations can be specified by nature as

follows:

(in millions of EUR) Note 2010 2009 2008

Product cost, net of vendor allowances and cash discounts 25 14 905 14 255 13 665

Employee benefit expenses 26 2 839 2 752 2 607

Supplies, services and utilities purchased 761 765 761

Depreciation and amortization 7, 8, 9 575 515 474

Operating lease expenses 18.3 295 270 245

Bad debt allowance expense 14 6 20 15

Other expenses(1) 510 428 399

Total expenses by nature 19 891 19 005 18 166

Cost of Sales 25 15 497 14 813 14 204

Selling, general and administrative expenses 4 394 4 192 3 962

Total expenses by function 19 891 19 005 18 166

(1) Allowances and credits received from suppliers that represent a reimbursement of specific and identifiable non-product costs incurred by the Group (see Note 25) have been included for the purposes of this

overview in “Other expenses.”

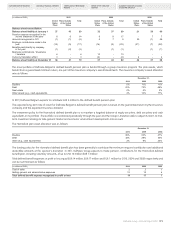

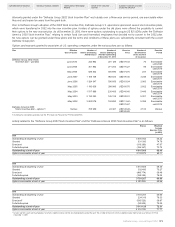

25. Cost of Sales

(in millions of EUR) 2010 2009 2008

Product cost, net of vendor allowances and cash discounts 14 905 14 255 13 665

Purchasing, distribution and transportation costs 592 558 539

Total 15 497 14 813 14 204

Delhaize Group receives allowances and credits from suppliers mainly for in-store promotions, co-operative advertising, new product introduc-

tion and volume incentives. In accordance with the Group’s accounting policies, described in Note 2.3, these allowances are included in the

cost of inventory and recognized as a reduction to cost of sales when the product is sold, unless they represent the reimbursement of a specific

and identifiable cost incurred by the Group to sell the vendor’s product in which case they are recorded as a reduction in “Selling, general and

administrative expenses” (EUR 9 million, EUR 5 million and EUR 4 million in 2010, 2009 and 2008, respectively).

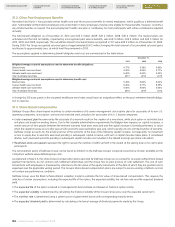

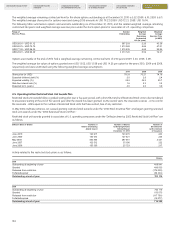

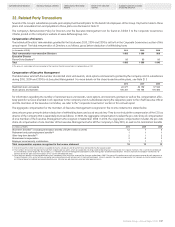

26. Employee Benefit Expense

Employee benefit expenses for continuing operations can be summarized and compared to prior years as follows:

(in millions of EUR) Note 2010 2009 2008

Wages, salaries and short-term benefits including social security 2 766 2 672 2 529

Share option expense 21.3 16 20 21

Retirement benefits (including defined contribution, defined benefit and

other post-employment benefits) 21.1, 21.2 57 60 57

Total 2 839 2 752 2 607

Employee benefit expenses were recognized in the income statement as follows:

(in millions of EUR) 2010 2009 2008

Cost of sales 354 336 317

Selling, general and administrative expenses 2 485 2 416 2 290

Employee benefits for continuing operations 2 839 2 752 2 607

Results from discontinued operations - 2 3

Total 2 839 2 754 2 610