Food Lion 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2004 83

Investors and M edia

For all questions regarding Delhaize Group and its stock, please contact:

Delhaize Group

Investor Relations Department

rue Osseghemstraat 53

1080 Brussels

Belgium

Tel. : +32 2 412 21 51

Fax. : +32 2 412 29 76

Questions can be sent to investor@delhaizegroup.com.

Information regarding Delhaize Group (press releases, annual reports,

share price) can be found in three languages (English, French and Dutch)

on Delhaize Group’s website w w w.delhaizegroup.com.

Delhaize Group News, the Company’s quarterly newsletter, provides sha-

reholders with recent information on the Company. You can download the

new sletter at www.delhaizegroup.com.

Delhaize Group’s website also offers the possibility to subscribe to email

alerts on several topics: agendas of the general meetings, press releases,

projects of modifications of Articles of Association, special reports from

the Board of Directors, publication of annual report, statutory accounts,

dividend payment, number of outstanding shares and w arrants, and trans-

parency notifications.

Delhaize Group

Investor Relations Department

P.O. Box 1330

Salisbury, NC 28145-1330

United States

Tel.: +1 704 633 8250, ext. 3398

Fax.: +1 704 645 2050

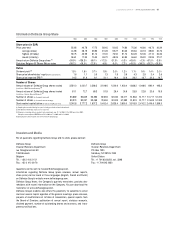

Information Delhaize Group Share

2004 2003 2002 2001 2000 1999 1998 1997 1996 1995

Share price (in EUR)

Price: year-end 55.95 40.78 17.72 58.45 50.65 74.80 75.36 46.60 46.73 30.39

average (close) 44.98 28.15 39.93 61.28 59.27 80.00 65.64 46.18 38.80 30.76

highest (intraday) 59.75 43.99 61.10 72.00 76.50 91.70 84.28 52.06 47.10 34.36

low est (intraday) 36.61 11.90 15.00 48.72 48.05 64.90 46.60 35.20 29.95 27.07

Annual return Delhaize Group share

(1)

+39.9% +136.3% -69.1% +17.2% -31.3% +0.3% +63.6% +1.3% +57.0% -3.9%

Evolution Belgian All Shares Return index +38.2% +16.0% -22.5% -4.9% -5.0% -7.2% +43.5% +36.2% +25.2% +15.9%

Ratios

Dividend yield

(2)

1.5% 1.8% 3.7% 1.9% 2.0% 1.2% 1.1% 1.6% 1.4% 2.0%

Share price/ shareholders’ equity

(after appropriation)

1.6 1.1 0.5 1.3 1.9 3.6 4.3 2.9 3.4 2.6

Share price/ reported EPS

(3)

24.5 21.9 9.1 31.1 16.4 22.9 26.2 19.7 22.3 16.7

Number of Shares

Annual volume of Delhaize Group shares traded 3,581.0 2,020.7 2,568.5 3,198.6 1,520.6 1,930.4 1,688.2 1,048.6 892.4 493.3

(in millions of EUR; Euronext Brussels)

(4)

Annual volume of Delhaize Group shares traded 81.1 72.7 69.3 51.9 26.4 24.6 25.9 22.8 23.6 15.9

(in millions of shares; Euronext Brussels)

(4)

Number of shares

(in thousands; year-end)

93,669 92,625 92,393 92,393 52,032 52,017 51,963 51,717 51,717 51,315

Number of shares

(in thousands; annual average)

93,374 92,097 92,068 79,494 52,023 51,983 51,824 51,717 51,603 51,303

Stock market capitalization

(in millions of EUR; year-end)

5,240.8 3,777.2 1,637.2 5,400.4 2,635.4 3,890.0 3,915.9 2,410.2 2,416.6 1,559.5

(1) Capital gains recorded during the year, including net dividend and reinvestment.

(2) Net dividend divided by share price at year-end.

(3) Share price/ earnings before goodwill and exceptionals w as 12.7 in 2004, 9.7 in 2003 and 4.9 in 2002.

Enterprise value/ adjusted EBITDA w as 5.6 in 2004, 4.7 in 2003 and 3.6 in 2002.

(4) Excluding the shares traded on the New York Stock Exchange.