Food Lion 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2004

24

In 2004, sales for Delhaize Group’s operations in

Southern and Central Europe grew by 2.2%. In

Greece, Alfa-Beta faced a mid-year slow down

due to traffi c disruptions during the preparations

for the Olympic Games, but began recovering in

the fourth quarter. Delvita continued to face tough

competition. The European operating margin

increased to 1.5%, mainly due to a better sales

mix and continued cost discipline and in spite of

investments in lower prices in Greece, the Czech

Republic and Romania.

Synergies within Delhaize Europe were extended.

In M ay 2004, Delhaize Group’s European opera-

tions launched “ 365,” a new private-label line of

basic products at low prices. “ 365” offers quality

basic products at prices in line w ith hard discount

competit ion. The combination of purchasing pow er

and the effi ciencies in supply chain and packag-

ing resulted in low er cost. The European support

functions were reinforced further.

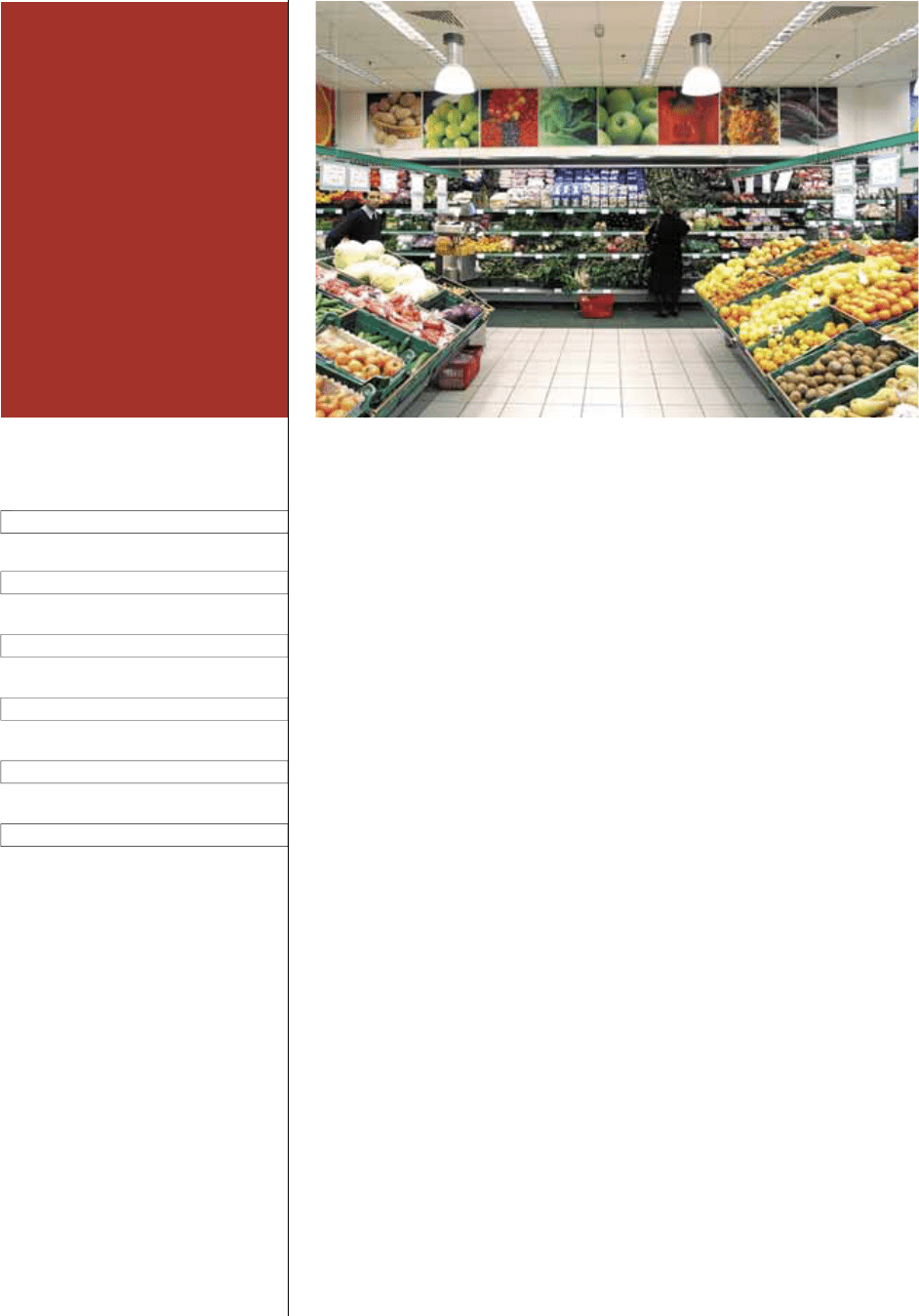

ALFABETA

“ Attracting the Customer”

After strong sales in the fi rst months of the year,

Alfa-Beta’s sales w ere less robust in the sum-

mer months due to the Olympic Games and price

pressure. Sales recovered in the fourth quarter.

Alfa-Beta’s store network w as extended by ten

new stores, including two company-operated

supermarkets and two City stores.

The company focused on expanding its franchis-

ing netw ork, modeled on Delhaize Belgium’s

experience w ith affi liated stores. Six new Trofo

M arket stores w ere added in 2004. The fran-

chised netw ork allows the company to grow sales

and extend its presence to new geographic areas

without major investments.

Alfa-Beta reinforced its customer appeal by

focusing on assortment, price competitiveness

and service. Particular emphasis was placed on

the enlargement of exclusive product lines such

as regional products under the “ Alfa-Beta close

to Greek Nature” brand, premium-quality perish-

ables labeled “ AB Choice” and the organic “ Green

Leaf” non-food range. The “ 365” brand w as intro-

duced with more than 100 items at year-end.

The company enhanced the quality and range

of its bakery and meat departments. In addition,

supply chain, staffi ng and marketing were thor-

oughly evaluated and modifi ed. Customer reac-

SOUTHERN AND

CENTRAL EUROPE

Launched “ 365” basic product

range in all European companies

Focused development in fresh

departments

Implemented new initiatives to

increase effi ciency

Rolled out City store format in all

countries

Reinforced European support

functions

2004

HIGHLIGHTS

C

h

ange

2004

2003

N

umber o

f

stores

+

1

1

2

53

24

2

S

ales

*

+

2.2% 1,

22

5.7 1,1

99

.

0

Operating margin

+

19

bp

s

1

.5

%

1.3

%

Operatin

g

profit*

+

17.5% 17.

8

15.

2

N

et earnings

*

+

90.0

%

(

1.1

)

(10.7

)

*

in millions of EU

R