Food Lion 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DELHAIZE GROUP ANNUAL REPORT 2004

60

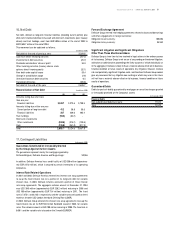

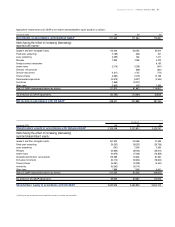

Pensions

The Group sponsors defined benefit pension plans at certain of its subsidiaries.

Such plans have been established in accordance with applicable legal require-

ments and customary practices in each country. Benefits are generally based upon

compensation and years of service. Delhaize Group accounts for pension plans

for its U.S. subsidiaries under the provisions of SFAS 87, Employers’ Accounting

for Pensions (SFAS 87). For all other consolidated entities, pension plan contri-

butions are expensed as contributions are made. Under US GAAP, pension plan

obligations are calculated in accordance w ith the provisions of SFAS 87 for all

the consolidated entities. Additionally, under Belgian GAAP, when Delhaize Group

does follow the provisions of SFAS 87, changes to the minimum pension liability

are recorded in “ Prepayments and accrued income” . Under US GAAP, this amount

is recorded in “ Other comprehensive income” .

Foreign Currency Transactions

Under Belgian GAAP, the Group had deferred foreign currency transaction

exchange rate losses incurred on debts contracted to finance non-monetary

assets. These losses were recognized based on the principle of matching expen-

ses to the income to which they relate. Under US GAAP, the increase or decrease

in expected functional currency cash flow s is a foreign currency trans action gain

or loss that is included in determining net income for the period in w hich the

exchange rate changes. In 2004 and 2003, Delhaize Group has not incurred such

foreign currency transaction exchange rate losses.

Income Taxes

Under Belgian GAAP, Delhaize Group accounts for deferred income tax assets and

liabilities for its U.S. subsidiaries under the provisions of SFAS 109, Accounting

for Income Taxes (SFAS 109). For all other consolidated entities, deferred income

tax assets and liabilities are calculated on certain, but not all, temporary diffe-

rences arising in the accounts of these consolidated entities. Deferred income

tax assets and liabilities are not calculated on tax-exempt reserves and tax loss

carryforw ards. Under US GAAP, all subsidiaries of Delhaize Group are accounted

for under the provisions of SFAS 109.

Dividends and Directors’ Remuneration

Under Belgian GAAP, the proposed annual dividend on ordinary shares to be

approved by the General M eeting of Shareholders, which is held subsequent to

year-end, is accrued at year-end. Under US GAAP, such dividends are not consi-

dered an obligation until approved. Under Belgian GAAP, until 2003, the directors’

remuneration was considered a distribution of profits, similar to a dividend to

shareholders, and w as recorded as a charge to retained earnings. Under US

GAAP, such remuneration is considered compensation expense. Beginning w ith

fiscal year 2004, Delhaize Group’s directors are remunerated for their services

with a fixed compensation w hich is expensed in the income statement under both

Belgian GAAP and US GAAP.

Derivative Instruments

Under US GAAP, Delhaize Group follows the provisions of SFAS 133, Accounting

for Derivative Instruments and Hedging Activities, to account for derivative

instruments such as interest rate swaps or cross currency sw aps. Additionally,

under Belgian GAAP, the loss (net of tax) related to the interest-rate lock agree-

ments that w ere entered into prior to the bond issues related to the acquisition

of Hannaford, w as classified in the balance sheet caption “ Prepayments and

accrued income” . Under US GAAP, this loss w as classified in the balance sheet

caption “ Other comprehensive income” , w hich is part of shareholders’ equity.

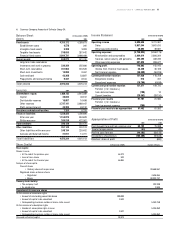

Stock Based Compensation

Under Belgian GAAP, compensation expense related to stock options is not

recorded. Under US GAAP, Delhaize Group has elected to follow the accounting

provisions of Accounting Principles Board Opinion (APBO) N° 25, Accounting for

Stock Issued to Employees, for grant of shares, stock options and other equity

instruments. This resulted in the recording of compensation expense relating

to Delhaize America’s restricted stock plans and Delhaize Group’s stock option

plans. In addition, expenses recorded in Belgian GAAP to recognize the difference

between the market price of a share and its exercise price w hen stock options

are exercised, are reversed for US GAAP. The Delhaize America share exchange

resulted in a new measurement date for the Delhaize America’s stock option and

restricted stock plans. As a result, a one-time, non-cash compensation expense

of EUR 13.1 million pre-tax was recorded in 2001 under US GAAP. Under Belgian

GAAP, tax benefits related to the exercise of stock options are recorded as a

reduction of income tax expense. Under US GAAP, such tax benefits are recorded

in shareholder’s equity. This resulted in an adjustment of EUR 8.5 million to

increase income tax expense under US GAAP.

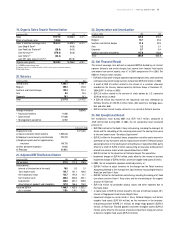

Treasury Shares

Under Belgian GAAP, treasury shares are classified in the balance sheet caption

“ Short-term investments” and are subject to a valuation allow ance w hen the

share price at the reporting date is lower than the acquisition price. Under US

GAAP, treasury shares are deducted from shareholders’ equity in the captions

“ Capital” and “ Additional Paid in Capital” and are maintained at cost.

Inventories

Under Belgian GAAP, amounts received from suppliers for in-store promo-

tions and co-operative advertising are recognized when the activities requi-

red by the supplier are completed. Under US GAAP, Delhaize Group adopted

the Emerging Issues Task Force (EITF) Issue No. 02-16, “ Accounting by a

Reseller for Cash Consideration Received” in 2003. EITF issue No. 02-16

directs that cash consideration received from a vendor should be presumed

to be a reduction of inventory, and recognized in cost of sales w hen the

product is sold, unless it is a reimbursement of specific costs incurred in

advertising the vendor’s products.

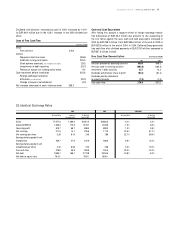

Other Items

Other items include adjustments to record differences betw een Belgian GAAP and

US GAAP for interest cost capitalization, software development cost capitaliza-

tion, accounting for security investments and accounting for a highly inflationary

economy (Romania). Effective January 1, 2004, Romania was no longer conside-

red to have a highly inflationary economy.