Food Lion 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2004

64

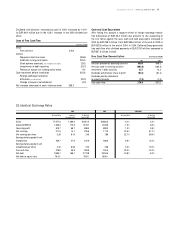

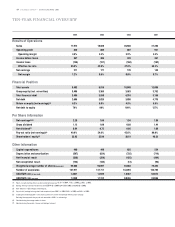

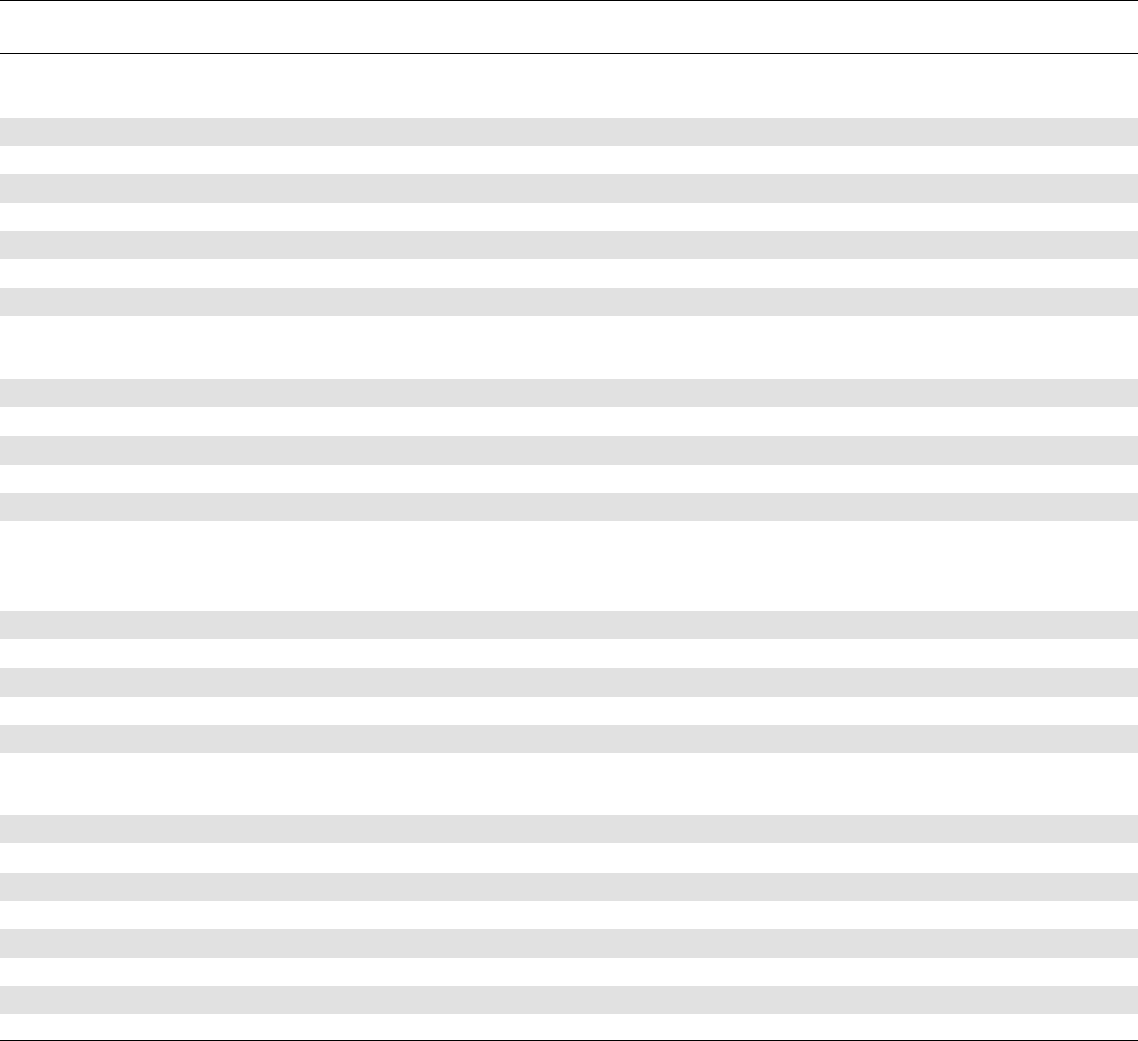

TENYEAR FINANCIAL OVERVIEW

2004 2003 2002 2001

Results of Operations

Sales 17,972 18,820 20,688 21,396

Operating profit 820 809 807 921

Operating margin 4.6% 4.3% 3.9% 4.3%

Income before taxes 367 306 339 361

Income taxes (145) (131) (160) (192)

Effective tax rate 39.5% 42.9% 47.0% 53.2%

Net earnings 211 171 178 149

Net margin 1.2% 0.9% 0.8% 0.7%

Financial Position

Total assets 9,403 9,519 10,840 12,086

Group equity (incl. minorities) 3,406 3,369 3,563 3,752

Total financial debt 3,406 3,550 4,316 5,168

Net debt 2,606 3,025 3,898 4,776

Return on equity (net earnings)

(1)

6.3% 5.0% 4.9% 5.9%

Net debt to equity 76% 90% 109% 127%

Per Share Information

Net earnings

(2)(6)

2.28 1.86 1.94 1.88

Gross dividend 1.12 1.00 0.88 1.44

Net dividend

(3)

0.84 0.75 0.66 1.08

Pay-out ratio (net earnings)

(4)

49.6% 54.6% 45.6% 89.0%

Shareholders’ equity

(7)

35.85 35.99 38.19 40.22

Other Information

Capital expenditures 490 448 635 554

Depreciation and amortization (587) (624) (725) (719)

Net financial result (330) (359) (455) (464)

Net exceptional result (123) (145) (13) (96)

Weighted average number of shares

(thousands)

92,663

92,097

92,068

79,494

Number of associates 137,911 141,711 143,894 146,785

USD/EUR rate

(at year-end)

1.3621 1.2629 1.0487 0.8813

USD/EUR rate

(average)

1.2439 1.1312 0.9456 0.8956

(1) Return on equity (earnings before goodw ill and exceptionals) was 12.2% in 2004, 11.3% in 2003 and 9.3% in 2002.

(2) Earnings before goodwill and exceptionals w ere EUR 4.42 in 2004, EUR 4.20 in 2003 and EUR 3.63 in 2002.

(3) After deduction of 25% Belgian withholding tax.

(

4) Pay-out ratio (earnings before goodw ill and exceptionals) was 25.6% in 2004, 24.2% in 2003 and 24.2% in 2002.

(5) Including the dividend payable to new shares issued in the context of the Delhaize America share exchange.

Excluding these payments, the pay-out ratio amounted to 44.6% on net earnings.

(6) Calculated using the average number of shares.

(7) Calculated using the number of shares outstanding at year-end.